Expanding into a new market means dealing with complex KYC (Know Your Customer) and AML (Anti-Money Laundering) laws and implementing localised onboarding workflows, which can quickly become complicated.

9 out of 10 hard-earned users in the financial services industry never complete the registration process because of tedious flows. In fact, according to a Thomson Reuters report, onboarding takes 30 days on average for US financial institutions, during which clients were contacted four times for their onboarding information.

There is a jungle of third party solutions, ranging from browser prefills to data lookups and open banking, which can help solve part of the onboarding puzzle in parts of the world. But integrating and maintaining these solutions are time-consuming and expensive, and increase friction in the customer journey.

That is why we built Checkin.com: an all-encompassing customer onboarding software not just for KYC requirements but also for seamless onboarding experiences that lead to higher conversions.

Checkin.com: the world’s first holistic KYC lifecycle and onboarding

Checkin.com combines the best third party integrations and KYC identity verification solutions to create a seamless experience, out of the box and across the globe.

As of 2023, we are the only software in the market that offers an end-to-end automation flow for your entire client onboarding process. You can quit patching together different vendor solutions, or pour in massive time and resources to build your own KYC process. We’ve spent years doing KYC checks across dozens of countries. Having learned what the optimal KYC process flow looks like for each market, we’ve baked it into the Checkin.com framework. This means you get a perfect signup flow out of the box that is already optimised to consistently improve your conversion rates in target markets. With Checkin.com, you can activate the solution through one simple front-end integration code and you’re good to go.

Streamline your KYC and customer signup with the Checkin.com Framework

Our three-step Checkin.com framework takes care of your entire client onboarding tech stack so you can focus on delivering the best customer experiences and launch products at speed in any market.

Here are three use cases:

- Grow faster with optimised data collection and signups.

- Securely identify the user behind the screen.

- Let existing customers log in with ease.

1. Grow faster with optimised data collection and signups across the full KYC lifecycle

Most companies invest in customer acquisition, but what about customer onboarding and conversion? Today’s customers demand and expect an individualised and easy onboarding experience. From the order you ask for customer information to optimising data collection, these are essential considerations to remove friction for your users to reduce drop-off and maximise conversions while achieving 100% regulatory compliance.By improving the way customers sign up to your software, we can guarantee conversions based on five years of behavioural data from millions of sessions working across 223+ countries. Your workflows are configured with instant access to the optimal local solutions for each market.

"We have grown fast by giving our users a great experience in every part of our product. Partnering up with Checkin.com was a no-brainer, we loved the flow and already from day one 12% more users signed up.”- Tobias Carlsson, CEO of Wunderino

Due to regulatory requirements, a range of information needs to be collected and verified before a visitor can become a customer. When the number of steps increase, so does the risk of the visitor failing to complete the process.

Based on specialised technology and millions of data points, we develop UX modules to optimise the whole registration journey for users to stay on and complete data collection. You will no longer lose customers from complex sign-up flows.

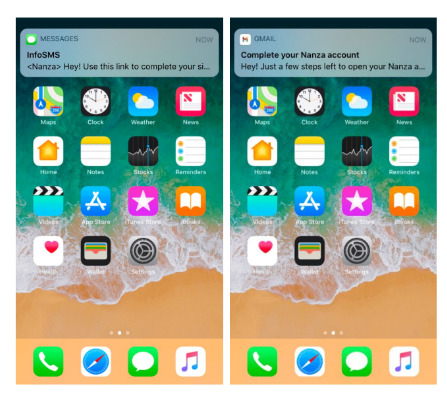

Even if a user abandons their sign-up journey midway, you can send them reactivation links as SMS or email that lead them back to where they left off. Reactivation is one of our strategies to help increase the overall conversion rate by making it easier for customers to log back into their account.

2. Securely identify the user behind the screen

We speed up and secure your onboarding process by letting your customers take selfies and scan documents. Our proprietary KYC and ID verification software, GetID covers 11,000+ ID types from over 223 countries and 80+ global languages. It’s a one-stop shop for every solution you need to streamline your onboarding process, ensure full compliance, and reduce fraud.

✔️ Document verification: Scanning ID cards, passports, driver’s licence, residence permits, etc and comparing them with a database of known valid documents to determine if the document is genuine or fraudulent. GetID also collects specific KYC data from documents and approves or rejects sign ups according to your own verification rules.

✔️ Face matching & liveness: Allowing users to take selfies or perform live actions with the camera to instantly verify it’s a real person that matches their ID.

✔️ AML & KYC compliance checks: Checking customers against all global law enforcement databases, sanctions lists and PEP lists, and other sources.

✔️ Proof of address: Confirming the user’s place of permanent residence in accordance with KYC/AML requirements.

✔️ Age verification: Making sure that customers meet the age requirement to use a particular service according to national regulations.

“Checkin.com’s ID Scan solution has been seamlessly integrated into our customer onboarding process. The extensive capabilities of the API integration allowed us to solve several tasks more efficiently.”Valērijs Bikovs, Head of Internal Automation Department at DECTA

3. Let existing customers log in with ease

The client onboarding process doesn’t end at signup and KYC identification. When customers come back to your platform, we have technologies in place to facilitate an easy login process, including:

- Biometric authentication via face matching

- Document scanning

- SMS OTP

- 2-factor authentication

- Magic links via email

You might also like: 4 reasons why you should use an end-to-end signup solution for onboarding

The best KYC signup for competitive advantage

An integrated client onboarding KYC software like Checkin.com nails your competitive advantage in three main ways:

Open up new markets in days, not months

Figuring out KYC/AML compliance in different markets is complex and expensive. With Checkin.com, you can expand into your target market tomorrow with a suite of client onboarding KYC tools built for 165+ countries.

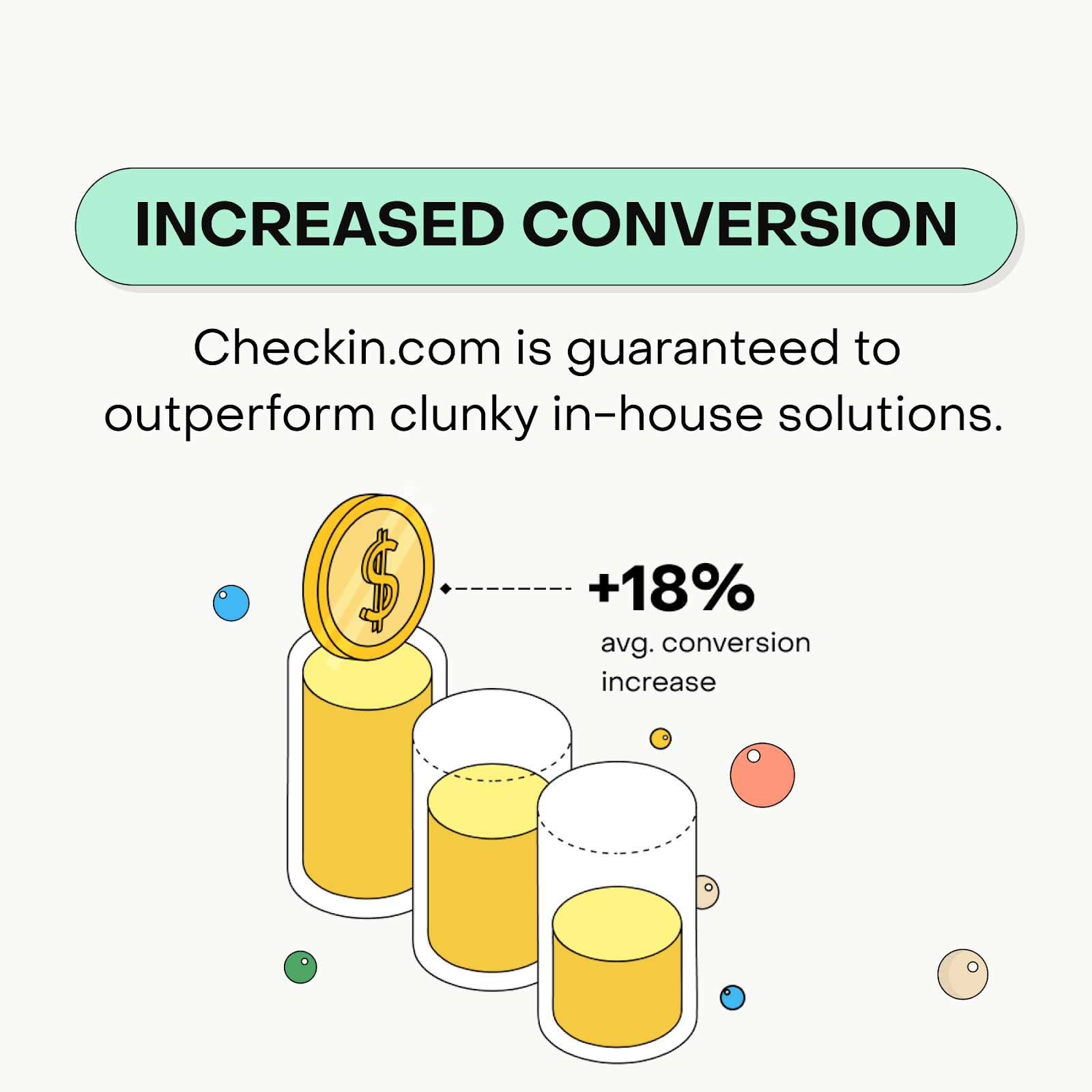

Killer onboarding flows means more revenue

Signup, identity and login are often overlooked as part of the onboarding process. This results in slower growth and lost revenue, which competitors are happy to scoop up.

For optimal conversion, onboarding needs to be adapted to end-users and their preferences on a multitude of devices and languages. Testing, supplying and serving these versions without sufficient data and the right technology is simply not possible.

Checkin.com generates the best possible experience for your users to ensure high conversion and a truly localised experience in every market you target.

Save time with a done-for-you solution

We take onboarding to the next level for the top companies by upgrading your team capabilities with a complete solution that works right out of the box. Free up time for your engineers and product designers to focus on innovation, and save time and energy for C-Levels on sourcing and negotiating different vendors. Today, global companies are choosing Checkin.com as their KYC onboarding solution to drive conversions, save time, and deliver personalised on-brand customer experiences in different markets.

From newcomer to leader: How BetCity.nl grew to 200,000+ users in a new market

When BetCity.nl wanted to launch from scratch in a new market, the Netherlands, they needed a stable third-party solution with a proven technology that would help them safely verify their new customers’ identity and therefore mitigate compliance risks.

Since the Netherlands is a regulated market for gambling, KYC and identity verification are required to be a part of the customer registration process. At the time when Betcity was getting its licence, they needed a third-party tool to perform and automate the KYC & ID Verification checks.

Eventually, after evaluating a range of the leading solutions in this area, they decided to partner with Checkin.com because of our extensive experience in the iGaming field and in-depth knowledge of KYC/AML regulations and the client onboarding process.

"One of the main things that I value about Checkin.com is that they understand the iGaming world, and the needs that iGaming operators have. Checkin.com has provided us with a stable, quality, and flexible service that enables us to smoothly verify our new customers, and this adds up to our conversion numbers,” says Leon Voogt, Head of Product at BetCity.nl.

BetCity is now one of the top 3 iGaming platforms in the Netherlands with over 200,000+ active customers.

How DECTA cut down ID verification time by 20%

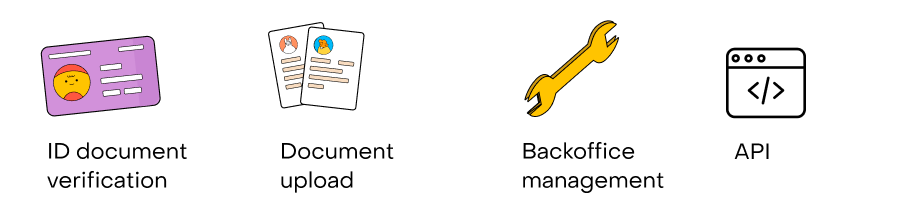

DECTA, a global payment processing company serves over 2000 companies from 32 countries. They needed to automate their ID verification process to reduce the number of involved employees and the time spent on manual data entry.

They also received a recommendation to add a third party provider to carry out the KYC verification process. The company began searching for a supplier and ultimately chose Checkin.com.

DECTA used Checkin.com’s ID Verification, Document upload, back office management, and API features. With the help of Checkin.com, DECTA was able to speed up complex ID document checks by 20%.“Checkin.com’s ID Scan solution has been seamlessly integrated into our customer onboarding process. The extensive capabilities of the API integration allowed us to solve several tasks more efficiently,” says Valērijs Bikovs, Head of Internal Automation Department at DECTA.

Want more examples of client onboarding flows that just work? Check out more case studies here.

Supercharge your KYC and onboarding with Checkin.com

To expand into a new market at full throttle and comply with local regulations, you need an end-to-end onboarding solution that addresses the entire KYC lifecycle–from signups to logins.

In this article, we talked about how:

- Integrating and maintaining different KYC solutions is complicated and time consuming

- Checkin.com is the world’s first end-to-end onboarding flow that boosts conversions by 18% and cuts down verification time

- The Checkin.com framework helps you grow faster with optimised data collection, localised UX, and state-of-the-art KYC verification

- Companies like BetCity.nl use Checkin.com to quickly and easily expand their businesses globallyIf you are ready to get started with Checkin.com, book a 1-on-1 call with our team and we’ll get back to you with a customised workflow for your use case.