Alberta’s passage of Bill 48, the iGaming Alberta Act, signals a major shift: opening the market to private operators and aiming for a launch in early 2026. The details are still being worked out, but the precedent is clear: Alberta looks closely modeled on Ontario’s regulatory framework, offering both opportunity and challenge to operators preparing for entry.

Building on Ontario’s framework, with local twists

Alberta is adopting Ontario’s playbook, housing regulatory oversight in the AGLC and creating a new Alberta iGaming Corporation to manage licensing and operations. This “two-tier” model mirrors Ontario’s AGCO/iGO structure, introducing common elements like province-wide self-exclusion and responsible gaming tools. However, Alberta has opted not to cap the number of licenses, and details around taxation, advertising, and revenue-sharing remain undecided.

Stakeholder voices are clear: “This is about bringing order to a growing market, collecting revenue, and giving Albertans a safer, more responsible way to play,” said Minister Dale Nally. Similarly, the Canadian Gaming Association praised the move, citing Alberta’s readiness to “combat unlicensed operators” and improve player protections.

Emerging regulatory requirements

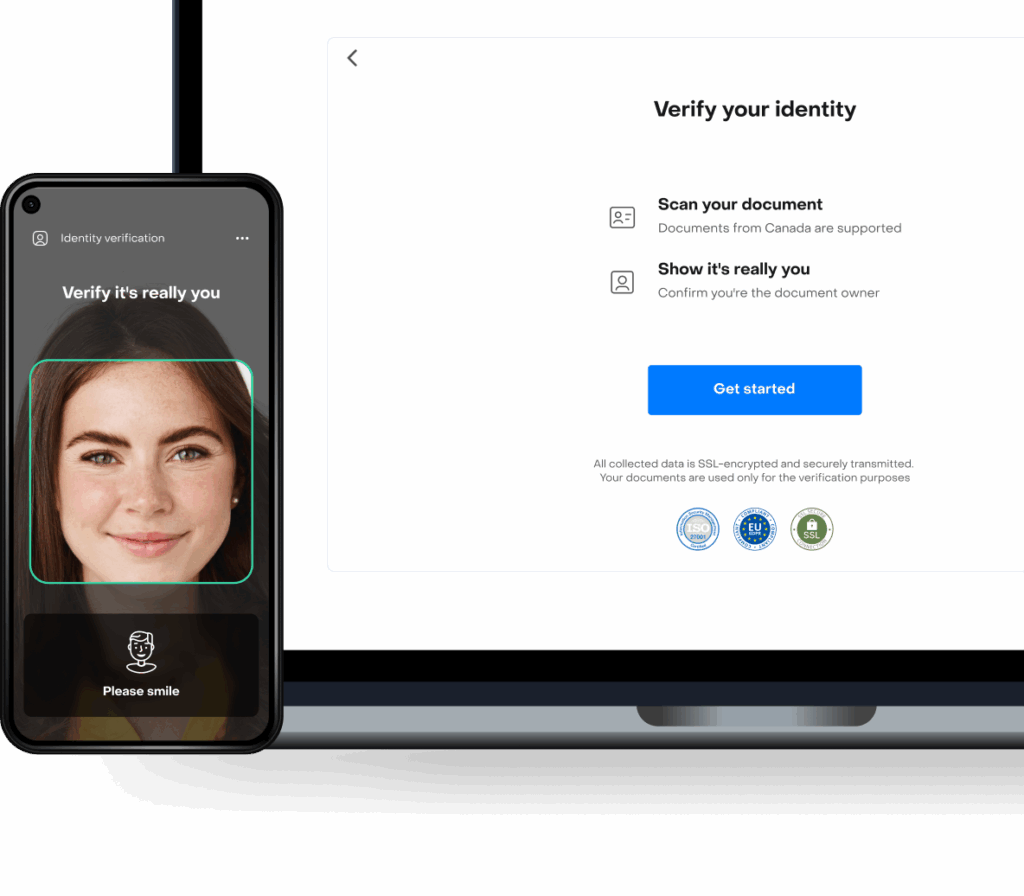

Alberta still needs to finalize critical elements of its regime, responsible gaming mechanisms, identity and age verification rules, and self-exclusion processes. Ontario’s model already requires operators to verify identity using two independent data points, conduct continual AML/PEP screening, and integrate biometric liveness tools. That gives Alberta a clear benchmark, but also raises expectations for consistency at sign-up and throughout the customer journey.

For operators, this means keeping a close eye on regulations as they take shape. As some experts warn, misjudging periods that require operator input, such as consumer-protection frameworks, could lead to costly adjustments down the line, mirroring early Ontario delays in self-exclusion implementation.

What operators can prepare now

Looking ahead, operators planning to launch in Alberta should consider:

- Integrating age and ID verification into onboarding flows, with minimal friction.

- Ensuring readiness for self-exclusion databases and province-specific geo-restrictions.

- Automating PEP, sanctions, and ongoing AML screening to meet Canadian expectations.

This is where experience from other provinces pays off. At Checkin.com, we've already helped operators in Ontario build user-friendly onboarding flows that meet strict compliance requirements, without hurting conversion. With Alberta following a similar trajectory, many of these tools and integrations are ready to deploy on day one.

Operators using Checkin.com benefit from secure and fast ID verification, biometric authentication, localized compliance logic, and a customizable backoffice built for audit-readiness across markets like Canada. That means no need to patch together point solutions or rebuild from scratch as the rules evolve.

Bottom Line

Alberta’s market opening is a clear signal that Canada is steadily maturing into a multi-provincial iGaming ecosystem. The operators who succeed will be those who treat compliance as a customer experience challenge, not merely a legal one.

With the right identity infrastructure in place, they’ll be positioned not just to launch in Alberta, but to win it.

Reach out now to learn more!