The wrong Know Your Customer (KYC) solution costs your business more than money. It risks compliance, reduces customer trust, and impacts operational efficiency.

The issue is that as AI and automation develop, there are more digital KYC solutions than ever before. It can be tempting to settle for the cheapest on the market or the one with the flashiest marketing.

But if it doesn’t align with your unique needs, you’ll suffer from clunky processes, poor user experiences, and high customer dropout rates.

A well-matched KYC solution streamlines your workflows. It meets compliance demands and grows with your business. Not only will you enhance security and fraud detection, you’ll deliver a far better user experience.

In this article, we’ll outline the must-have features and key considerations for choosing KYC solutions that suit your business. We’ll dive into what you need to look for, why, and how this will help you deliver future-forward KYC experiences.

Types of KYC solutions

KYC is your gateway to AML compliance and fraud prevention. Solutions are evolving to simplify the process and improve accuracy.

But not all KYC practices offer the same benefits.

Let’s explore the different ways companies approach KYC.

Manual KYC practices

Despite the rise in KYC technology, 75% of financial institutions still check more than 25% of customer applications manually.

This old-school approach often involves physical document checks, face-to-face interactions, and manual data entry.

Not only is it slow. It’s labor-intensive and error-prone. This makes your KYC operations costly.

And while human oversight is helpful in complex cases, you can’t scale easily if an agent has to review every KYC case.

There’s also the issue of subjectivity.

Application approvals rely on human opinion, so decisions aren’t always consistent. Plus, humans often overlook subtle inconsistencies that point to forgery or fraud.

Technology-enabled KYC solutions

This is where KYC technology shines. It’s faster, smarter, and scalable.

A technological approach to KYC automates identity verification and risk profiling.

And it’s not just at the onboarding stage. KYC solutions automatically monitor transactions and customer profiles to flag suspicious behavior and keep risk profiles up-to-date.

Here’s how the tech fits together.

1. Digital document verification

AI-powered tools analyze identity documents like driver’s licenses and passports.

- AI algorithms analyze the documents and flag any forgery or tampering

- Optical character recognition (OCR) extracts important data, so there’s no need for manual data entry

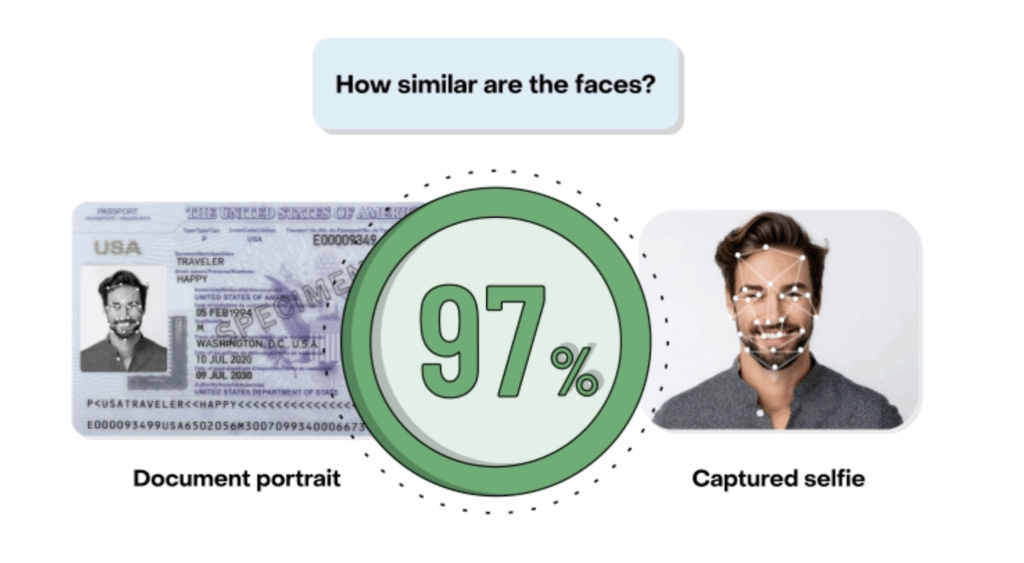

2. Biometric verification

Biometric authentication prevents fraud by analyzing unique biological traits.

- Face matching technology matches a live image of the user to the picture in their document

- Facial recognition checks the image against official databases to verify their identity

- Age estimation technology compares the live image to the document image and data to verify their date of birth

- Liveness detection ensures the person applying is present through selfies or live video

3. Automated watchlist screening

This component automates screening to help build risk profiles. The system continuously checks against official databases to search for criminal histories or risky behaviors.

- It performs PEP (politically exposed persons) and sanctions lists screening.

- It carries out adverse media checks.

- It automatically flags any change in status to update risk profiles.

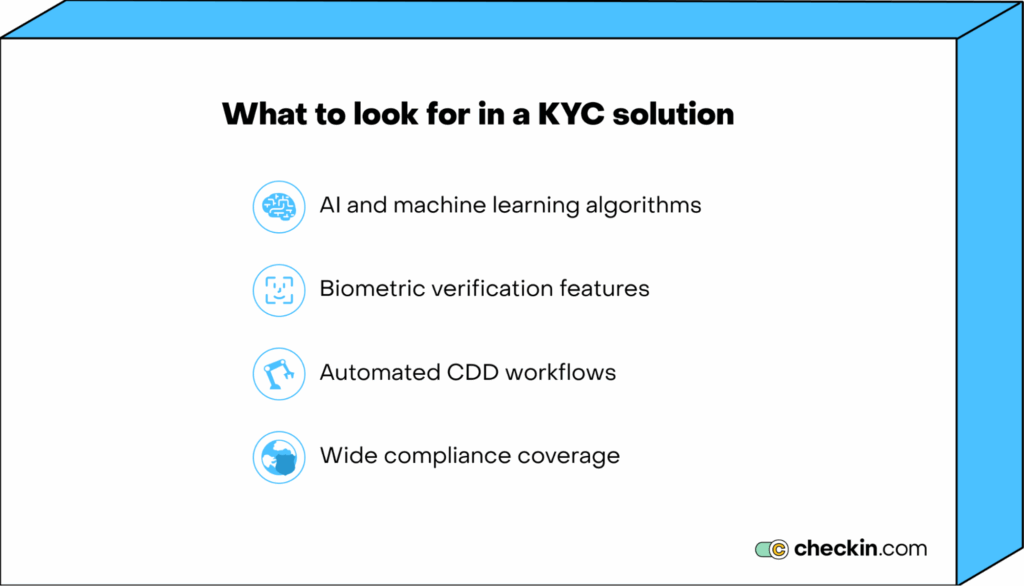

9 features to look for in a KYC solution

KYC isn’t just about meeting compliance regulations. You need a KYC solution that cuts operational costs, strengthens your defense against financial crime, and boosts customer satisfaction.

But how do you find a solution that ticks all the boxes? Here’s what you need to look for.

1. AI and machine learning algorithms

Artificial intelligence has transformed KYC practices.

These systems automate workflows in intelligent ways to accelerate the entire process. This means faster onboarding for customers and less paperwork for your staff.

But it’s about more than just speed.

AI can analyze vast datasets, spot patterns, and predict trends.

For KYC processes, AI can spot subtle signs of unusual activity far faster and more accurately than people can. It will notice a sudden spike in transactions or a small inconsistency on an ID card.

This means it catches fraud early and accurately while building detailed risk profiles based on a whole range of risk factors, from behavioral patterns to financial history.

And it doesn’t just do this during onboarding. AI will continuously monitor transactions and customer behaviors to update risk profiles and detect anomalies in real time.

This helps you catch fraudsters in the act.

But unlike conventional algorithms, machine-learning algorithms evolve. As AI systems continuously monitor activity, they learn from the data so they get better at flagging potential risks over time.

This is why 43% of companies say they’re prioritizing innovative technologies like AI KYC software — to automate ongoing monitoring for more precision and less manual work.

2. Biometric verification features

With the use of biometric verification, you can confirm most customer identities in minutes.

Since it uses unique biological traits, it’s far harder to bypass these mechanisms with forged documents or fraudulent identities.

For customers, onboarding is more convenient. And your business benefits from fewer false positives, while verification is consistent and accurate.

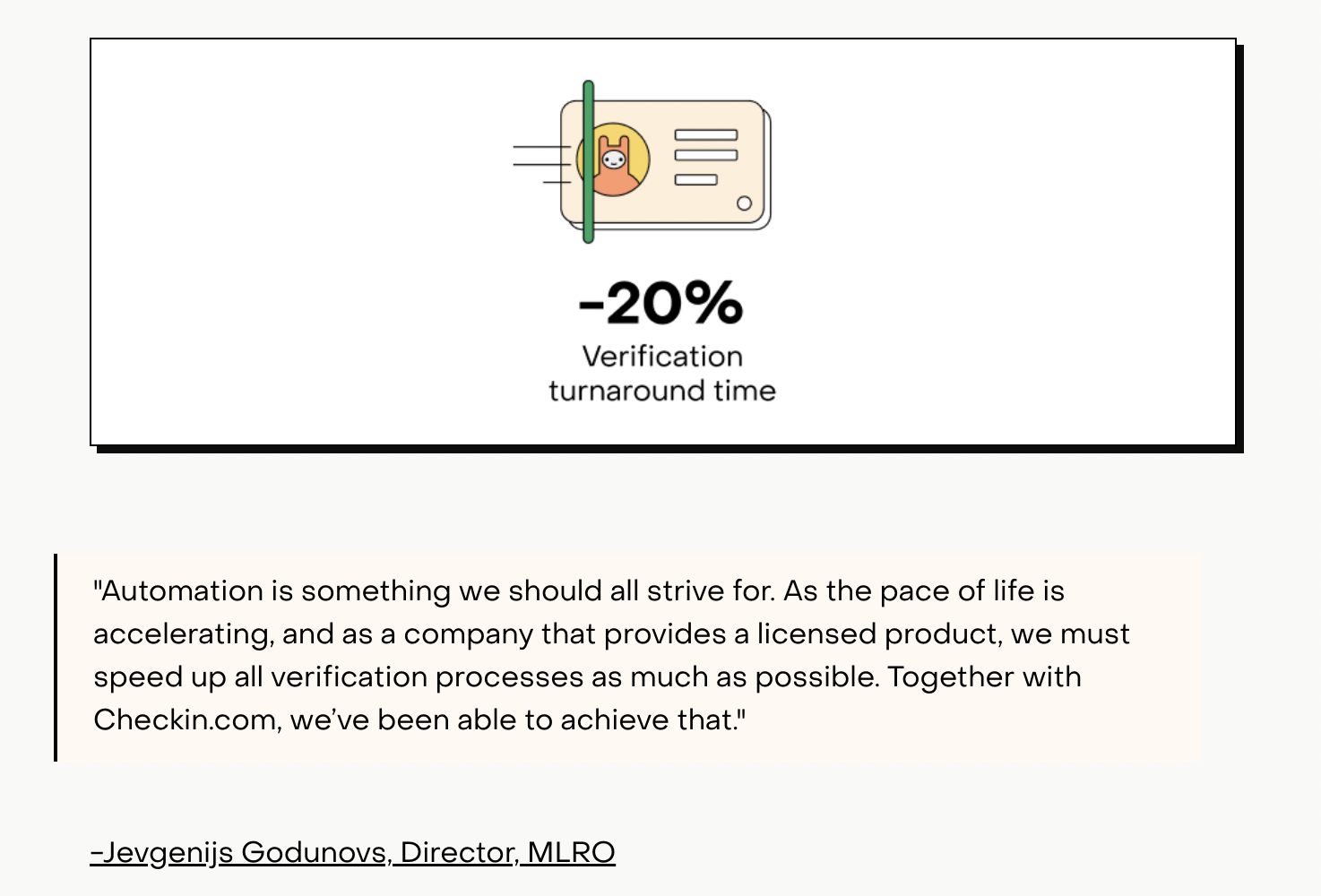

3. Automated CDD Workflows

Automating customer due diligence (CDD) saves time, reduces overheads, and cuts down on errors.

Risk scoring and document verification are far more precise, and data entry becomes a thing of the past.

This means more consistency in procedures, as well as better productivity. It’s also easier to scale workflows when there’s less need for manual intervention.

Streamlined automation also helps reduce dropouts

One in five applicants cancel applications because the process takes too long. With automated CDD workflows, most customers complete verification in minutes.

Take Decta, for example.

By using Checkin.com to automate workflows, the global processing firm reduced verification time by 20%.

4. Wide compliance coverage

Your KYC solution should ensure you’re compliant in all the places you operate. For example, Checkin.com can verify more than 14,000 document types across 190+ countries.

Compliance models should cover all requirements around:

- Anti-money laundering (AML)

- Counter-financing terrorism (CFT)

- Data privacy and security

In the US, you must follow the Bank Secrecy Act (BSA), while in Europe, companies must follow the Fifth Anti-Money Laundering Directive (5AMLD).

Beyond your basic legal requirements, you want a solution that meets international standards. Look for KYC tools with ISO (International Standards Organization) certification.

For instance, ISO 27001 is for information security management systems. It shows these tools have robust security and compliance coverage that meets international standards.

The best KYC solutions adapt to changing regulations in real time. Search for tools that use AI algorithms to update compliance models as legislative changes happen.

5. Multi-lingual support

A KYC solution that supports multiple languages offers users a localized experience. This improves the KYC process as customers can complete the steps in their native language.

This also helps you enter new markets, as you can offer KYC in a format that diverse backgrounds can understand.

Take Simple Casino: since Checkin.com supports more than 80 languages, Simple Casino had no issues expanding operations in Japan.

6. Easy-to-use interface

A user-friendly interface simplifies customer onboarding. If customers find it easy to complete KYC processes, they’re less likely to drop out.

Forza Football is a good example of this.

By implementing Checkin’s KYC solution, the sports app reduced dropouts and increased signups by 500%.

Look for tools that offer an intuitive interface that guides users through the process with clear instructions.

7. Tools for managing cases and applications

KYC should be as easy for your staff as it is for your customers.

The most effective KYC solutions offer tools for tracking applications, escalations, investigations, and updates.

An intuitive back-end dashboard helps keep everything organized so staff can track progress and prioritize tasks.

This helps them resolve issues faster while keeping transparent records to improve auditing.

8. Advanced reporting and analytics

Reporting and analytics help in two ways:

- They show you what’s happening so you can identify improvement areas

- Help your team prepare for audits and prove compliance

Look for solutions that offer detailed insights into customer risk, compliance trends, and the performance of KYC processes.

Your tool should generate reports on these important metrics. This helps you visualize patterns and show regulators how effective you are.

9. Branding capabilities

White-label solutions offer a personalized touch.

You can customize interface branding to offer a consistent customer experience and create a memorable brand identity.

How to choose between KYC solutions

Features aren’t everything. You also need a KYC solution that fits your budget and operational needs.

Here are some key factors to think about when choosing between KYC tools.

Price

Cost is a major factor and it comes in all shapes and sizes.

Consider the value you’re looking for so you can find a solution that aligns with your specific needs and budget.

There are a wide range of pricing models. Some solutions offer subscription fees, while others charge per transaction.

Whichever model you choose, read the contract carefully. Make sure there are no hidden costs such as setup fees, support costs, or integration expenses. The best tools have transparent pricing models with no extra fees.

You want a KYC solution that scales with your company. Look for solutions that allow you to add on extra features when you need them, without having to pay for unnecessary tools upfront.

Technical support

The best identity verification solutions support you throughout your compliance journey.

Reliable customer service means minimal downtime and fast issue resolution.

Look at what support packages the vendor offers. Will they help with troubleshooting, system maintenance, and training?

Explore its documentation to see how useful its support resources are in helping your team solve their own issues.

Read reviews around responsiveness and customer support quality to get a feel for how helpful the vendor is in a crisis.

Integration capabilities

If you want your KYC solution to fit seamlessly with your existing systems, you need to explore its integration capabilities.

It should connect to your CRM, transaction monitoring systems, and any other software that creates efficient compliance workflows.

Look for API availability for easy integration and find vendors that offer integration support. This guidance will help you connect your systems together in the most efficient way.

Scalability

As your business grows, you’ll need to handle increasing volumes of transactions and applications.

Your KYC system should scale alongside you.

Scalable solutions can handle increasing workloads without affecting performance. It should still run as quickly and effectively with very limited downtime.

For true scalability, your solution should be able to adapt to emerging threats and changes in the regulatory landscape. This keeps you compliant without disrupting operations.

Finding KYC solutions to fit your needs

The right KYC solution transforms your customer verification and monitoring processes. No more slow onboarding, error-filled paperwork, and inconsistent decisions.

Intelligent KYC solutions drive efficiency, reduce costs, and improve security.

Look for AI-powered technology, biometric verification, intuitive interfaces, and scalability. This helps handle business growth while staying compliant.

The right KYC solution can build customer trust and transform your onboarding process.

Explore Checkin today to see how our end-to-end KYC solutions elevate customer verification and ongoing monitoring processes. Contact us today for a demo.