Document fraud is getting smarter, faster, and harder to catch.

And it’s not just a risk to your profits. If fake documents slip through, you risk non-compliance.

If you’re still reviewing documents manually, you’re leaving yourself wide open. Humans just aren’t that good at spotting new forgery tactics, especially AI-generated fakes.

From identity fraud and underage access to regulatory penalties, outdated document verification systems leave you exposed.

Let's explore the challenges of manual verification and how to protect your business with AI-driven identity verification.

What is document verification and why do businesses use it?

Document verification is the process of checking whether identity documents are real and valid, and that they haven’t been tampered with.

But you’re not only checking that the document is authentic. You’re also confirming the person presenting the ID is who they say they are.

This is one of the critical steps in the broader identity verification process. It prevents fraudulent documents from slipping through, while ensuring you comply with regulatory requirements.

But why’s it so important?

It’s not just about regulatory compliance. Identity fraud is becoming increasingly common.

Customers want to trust that businesses protect their interests. If customers don’t believe your organization is secure, they won’t interact with you.

In fact, 68% of people say the fear of being scammed affects how they shop and interact with businesses.

Essentially, document authentication helps you mitigate fraud risk, build trust, and stay compliant.

But which industries need to verify documents? Here are a few examples:

- Financial institutions check documents to verify customer identities when approving loans and accounts.

- Online marketplaces vet buyers and sellers to prevent scams.

- HR teams verify IDs and qualifications to screen new candidates.

- Ecommerce platforms use document checks to enforce age restrictions.

- Travel companies verify documents for booking support and border security.

In short, document verification is a form of protection. In a world where fake documents and fraud run rife, ID checks keep your business, customers, and reputation safe.

What’s the process of document verification?

Document verification is a multi-step process that aims to detect fake documents, validate information, and confirm a person’s identity.

Here are the steps.

Document collection

The individual submits a physical or digital copy of their ID document. Accepted forms of ID usually include:

- Government-issued IDs

- Birth certificates

- National identity cards

- Residence permits

If document reviews are completed manually, the person might present their ID in person or send it by mail. If the process is digital, they’ll upload it via their device or submit it through a web portal.

Examination and authentication

The next step is a visual document inspection.

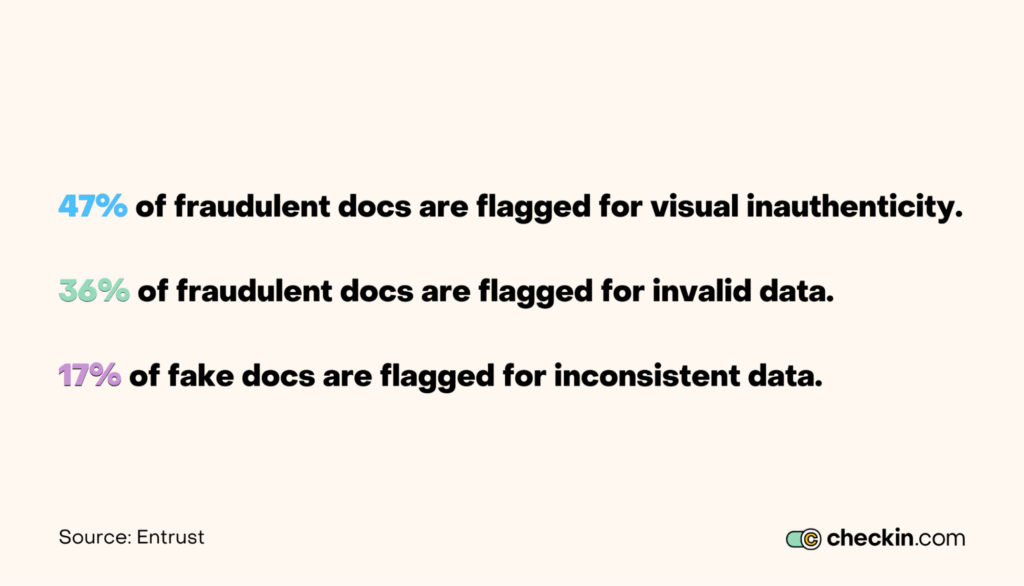

This step matters because lots of fraudulent documents don’t hold up under close scrutiny. This is often when fake IDs get caught out.

Of the fraudulent documents that get flagged…

- 47% are visually inauthentic

- 36% feature invalid data

- 17% contain inconsistent data

During this step, reviewers analyze the documents for security features, like watermarks, holograms, UV imagery, and microprinting. They’re looking for signs of tampering or forgery, such as strange fonts, incorrect laser embossing, and mismatched details.

Manual reviewers might use UV lights or magnifiers to assess the document’s integrity.

Identity verification (IDV) software takes this one step further. It uses AI algorithms trained on thousands of fake and genuine documents. These algorithms can detect the most subtle visual inaccuracies — inconsistencies that the human eye often misses.

Data extraction and information validation

Next, you extract the data contained within the document.

In manual processes, humans manually transcribe key information from the document image. IDV solutions use optimal character recognition (OCR) to pull this data automatically.

This includes the person’s name, date of birth, Social Security number, and more.

This data is compared to official records and external databases to confirm it corresponds to a real person.

Liveness detection

Next, you need to confirm that the person presenting the document is a real person and the rightful document holder.

When completed manually, the applicant usually needs to present the document in person.

In contrast, IDV software uses AI-powered liveness detection. The app prompts the applicant to complete certain facial gestures or movements, like blinking or smiling. This prevents spoofing attempts with photos or pre-recorded videos.

Decision and review

The results are reviewed to determine whether the person matches the document and whether the document is real.

If there’s suspicion, the account is passed to a compliance specialist who performs additional checks.

Record keeping and audit trail

Throughout the whole process, everything is logged for record-keeping and compliance purposes.

A full audit trail ensures you meet regulatory requirements and the data helps you improve future verification processes.

Common document verification issues: Why manual document checks don’t cut it

Sure, you can review documents manually. But while manual document verification worked in the past, it’s no match for the speed, volume, and complexity of new fraud tactics.

If your business still relies on human review processes, you’re exposing yourself to unnecessary and costly risk — not to mention poor user experience.

Let’s take a closer look at why manual checks fall short.

Human error and subjectivity

Manual reviews rely on human observation and judgment. Bias, fatigue, and poor training result in inconsistent decision-making.

Manual reviewers may miss subtle inconsistencies in forged identity documents. This is especially common when reviewers don’t recognize foreign government-issued IDs.

In the Americas, for instance, the most commonly forged document is the Indonesian National ID card. Fraudulent users rely on reviewers not being as familiar with foreign document types as they are with domestic ones.

Even with extensive training, human error still leads to false positives and negatives.

Put it this way: Checkin.com can recognize inconsistencies in 14,000 document types from over 190 territories. Even with extensive training, no human can remember every tiny aspect of every type of document.

Time-consuming processes

When you review documents manually, you have to scrutinize them one at a time.

This is labor-heavy, slowing down customer onboarding processes and delaying approval.

It drains team resources and drives up labor costs. And it’s frustrating for the customers that have to wait.

High operational costs and scalability challenges

Using manual reviews? You can forget about scalability.

If the volume of applications grows, you either increase each agents workload, or you hire more staff.

Overworked staff make more mistakes, and hiring more team members gets expensive.

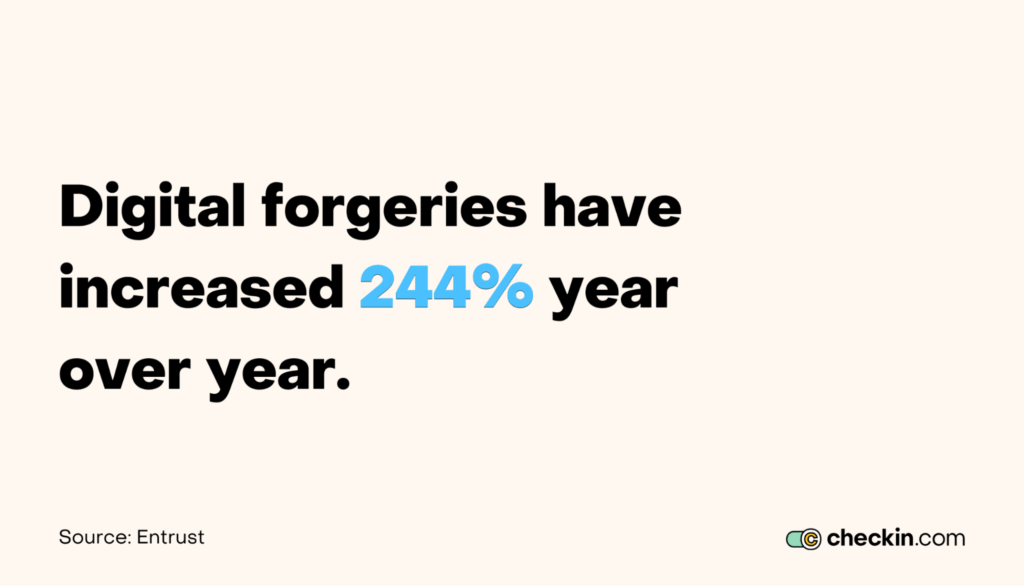

Difficulty detecting sophisticated fraud

Sure, conventional physical forgeries are decreasing. But these still make up a third of all fakes.

And while humans might be more adept at catching fake physical IDs, digital forgery is far smarter — and it’s getting worse. Digital fakes have increased 244% year-on-year, now making up nearly two-thirds of all forgeries.

Humans simply aren’t very good at detecting sophisticated fraud like AI-generated fakes and synthetic identities. In fact, 59% of people say they struggle to tell whether media is real or fake.

Deepfakes are often so convincing that they bypass manual identity verification without a second glance from the reviewer.

Limitations in verifying against databases

Manual reviewers might check documents against some official databases. Might.

But more commonly, the reviewer checks the document and makes a decision there and then.

They often lack access to real-time databases and watchlists that verify customer details and flag suspicious people.

Without real-time database and sanctions list checks, manual reviewers can’t confirm if the person actually exists or whether they’ve been flagged for suspicious activity before.

They also can’t see whether or not the same identity document details have been used in past synthetic identity fraud attempts.

This leaves your organization open to repeat fraud and compliance risks.

Poor audit trails and reporting

Manual verification requires manual logging. These audit trails aren’t reliable, and humans often fail to complete them consistently.

Without proper tracking, you can’t improve processes, prove compliance, or detect suspicious trends.

How IDV solutions tackle document verification challenges

Manual document verification doesn’t stand up to new fraud attempts.

AI-driven IDV solutions offer a faster, smarter alternative that’s far more secure. Not only can they handle increasingly sophisticated threats and learn from them. They’re also built to comply with changing regulations.

Let’s explore why IDV technology is the future of document verification.

Intelligent document authentication

Humans get tired and overworked, leading to mistakes.

AI doesn’t get tired. Every review is as accurate as the next.

AI-driven document verification software is trained on vast datasets of real and fraudulent documents from all over the world. This allows it to quickly analyze a document’s layout, structure, data, and security features, and spot inaccuracies with a high level of precision.

Even with the most in-depth training in the world, human reviewers often miss subtle inconsistencies — many of which are almost invisible to the naked eye.

AI-driven digital document verification doesn’t miss a trick.

It can spot everything from a slight misalignment to a distorted font — no matter where the document comes from in the world.

Smart data extraction

Input errors can lead to false approvals or rejections.

OCR accurately extracts text automatically, and cross-checks it with the document’s visual elements to ensure they’re consistent.

It’s fast, it’s precise, and it cuts out human errors, like types or missed fields.

Robust biometric verification

Manual document checks stop at the paper. AI links the document to the actual person.

This is why 85% of customers trust biometric technologies more than any other method.

Using 1:1 face matching, IDV tools compare biometric features in a live photo of video to the document image. Using AI to analyze potential discrepancies is far more accurate than a human visual inspection.

Following this, 1:N facial recognition compares the document image to external databases. This catches out duplicate applications, synthetic identities, and repeat fraudulent offenders.

Advanced liveness detection

Biometric checks aren’t enough on their own. You need to make sure the user is actually real and present.

3D liveness detection uses AI to analyze facial movements, depth, and image patterns to check the person submitting their document is there.

The advanced algorithms easily catch spoofing attempts using pre-recorded videos, 3D masks, and deepfakes.

Not only is this more accurate than a human reviewer, it’s also quicker and more convenient for the customer.

Real-time database checks

AI-driven digital identity verification platforms don’t just visually inspect IDs. They check the data behind the document.

The system automatically cross-references document information with government records, AML/PEP watchlists, and government databases like credit reports.

This process matches the person to trusted external records. It also confirms that the document hasn’t been lost or stolen, or linked to illegal activities.

Continuous learning and compliance updates

Fraud tactics evolve fast. And so do compliance rules.

AI-driven document verification solutions learn from every check and update their algorithms as they go.

As new fraud or forgery tactics emerge, the system adapts to monitor for these in the future. There’s no need for manual updates or extra training — the AI does this automatically.

At the same time, the system monitors for changes in global compliance requirements. If laws change, the software updates its compliance models to reflect this automatically. You stay compliant without the extra workload of manually updating regulatory requirements.

Final thoughts

Accurate document verification is a critical business function.

But manual checks aren’t enough anymore. They’re slow, inconsistent, and prone to failure.

From fraud prevention and regulatory compliance, foolproof verification processes build trust and protect your assets.

The future lies in AI-powered IDV solutions. Biometric matching, smart data extraction, and real-time validation all protect your business against fraudulent actors.

With a platform like Checkin.com, you can offer accurate, scalable document verification that’s fast, secure, and user-friendly.

Ready to cut risks and boost trust? Explore Checkin.com today.