Fake IDs aren’t just a teenager’s trick to buy alcohol underage.

They’re a growing threat to businesses in a world where all different types of fraud are evolving.

With strong document verification systems, fake IDs expose you to the risk of financial loss, compliance issues, and reputational damage — as well as putting minors in danger.

The worst part? Manual ID checks simply can’t keep up.

Let’s explore why fake ID is so problematic and how to spot fraudulent documents. We’ll dive into the failures of manual ID checks and how AI-driven identity verification (IDV) solutions can tackle these problems head on.

Why is fake ID so problematic for businesses?

Fake ID is a widespread, fast-growing threat.

In 2024, one in every 20 verification attempts was fraudulent.

And it’s impersonation fraud that’s the most dominant. It made up more than 82% of all fraud attacks.

Of this impersonation fraud, false identity documents make up a significant proportion of it: 16% of fraud cases involve fake, altered, or forged documents. That’s a 7% year-on-year increase.

Let’s explore the reasons this is so problematic for your business.

Leads to financial losses from fraud

Losses from fraud are rising with 70% of businesses reporting an increase in fraud losses last year. And what’s worse is that the dawn of AI means more convincing fakes. As a result, the problem is expected to increase.

There are lots of reasons people use fake IDs to commit fraud. From underage purchases to identity theft, from account takeovers to bonus fraud — fake IDs let people exploit services and steal funds.

This results in tangible financial losses for businesses. These losses include:

- Chargebacks on fraudulent transactions

- Lost goods and services

- Resources spent investigating fraud

- Increased insurance premiums

- Fines for non-compliance

It damages trust and hurts your reputation

Fraud doesn’t just affect your bottom line. It ruins your brand image.

Weak ID checks are a red flag for customers. So is a history of breaches.

Customers are more concerned than ever about digital safety. And this concern drives their purchasing decisions.

Nearly two-thirds of consumers say they’re worried about online security, while 68% say that the fear of fraud affects how they shop and interact with businesses.

The problem is that trust is everything. Once customers lose confidence, it’s hard to win them back.

As a result of fake ID-related breaches, businesses see:

- Fewer new sign-ups

- Higher churn

- A decline in brand perception

- Long-term credibility issues

With such competition in the digital market, one slip can leave a lasting mark.

Puts minors in danger

Fake IDs cause a world of child safety issues.

Underage users use fake IDs to bypass age restrictions. This gives them access to age-restricted goods, unsafe platforms, gambling sites, and adult content.

It’s not just that it’s unethical. It’s not even just a safety problem. It’s also a legal minefield.

When children access age-restricted goods and services with fake ID, businesses face fines and legal exposure for non-compliance.

On top of that, it harms your reputation. Your business gets a name for enabling harm to minors.

It leads to non-compliance

Fake ID use creates direct non-compliance for businesses covered under Anti-Money Laundering (AML) regulations.

Failing to verify someone’s true identity violates Know Your Customer (KYC) obligations, the heart of AML laws. It also puts you in jeopardy of breaching new regulations concerning age verification.

The result? Heavy fines, legal action, loss of licenses, and severe reputational damage.

Fake ID vs real ID: How to tell the difference

Fake ID isn’t as easy to spot as it used to be.

Fraudulent actors are getting smarter and AI contributes to more sophisticated forgeries.

Businesses need to know what forgeries look like or they risk letting fakes slip through.

Here are the key things to keep an eye out for.

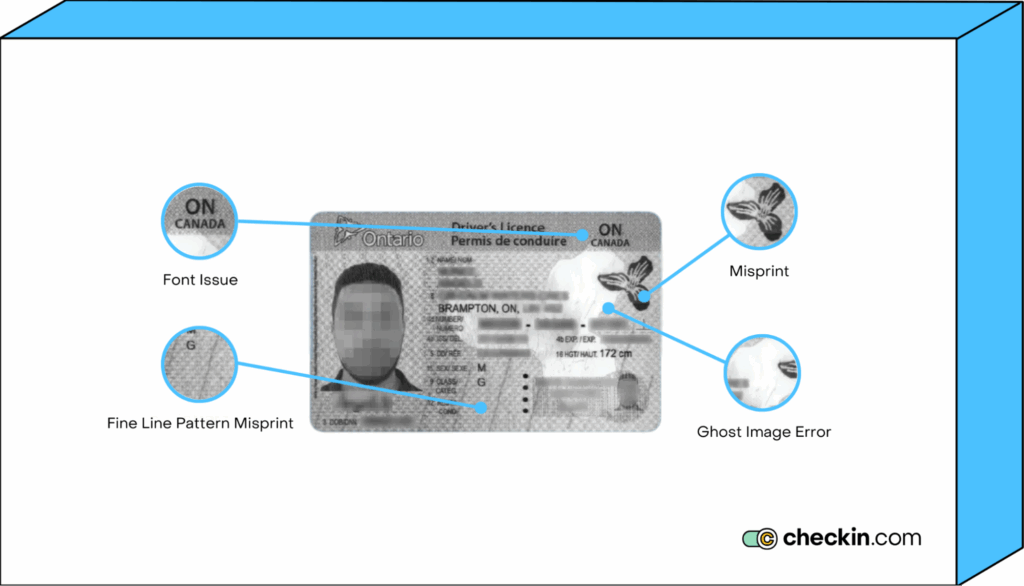

Visual authenticity

The first red flags appear in the way the ID looks.

In fact, 47% of fraudulent documents get flagged for visual inauthenticity.

Genuine IDs contain embedded security features such as:

- Hologram designs

- UV imagery

- Microprinting

- Laser perforation

- Ghost images

These security features exist because they’re hard to replicate. Forged documents often fail to mimic these elements accurately.

But it’s not just the complex features that forgeries get wrong. You can also see signs of tempering in basic elements like photo placement, font style, and coloring.

Data validation

Content checks are next.

Over a third of fraudulent IDs get flagged because the data doesn’t add up.

You might see an impossible date of birth that suggests the person is 130 years old. Or you might notice an address that doesn’t exist.

Some fake IDs simply miss mandatory data or include invalid characters and odd formatting.

Issue dates that come after expiration dates are also a common giveaway.

Data consistency

Lots of data on IDs appears more than once in the document. Fake IDs often don’t replicate this data consistently.

In fact, 17% of fake docs are flagged for conflicting information.

This might appear as mismatched names, gender discrepancies, or different addresses.

One of the most common examples is when the barcode or MRZ (machine-readable zone) data doesn’t match what’s printed on the ID.

Why manual ID checks don’t cut it

With rising AI-generated fakes and synthetic identities, manual ID verification leaves your business vulnerable.

Here’s why manual ID checks aren’t good enough.

Human error

Manual verification is at risk of human error.

It’s easy to miss red flags. Staff fatigue, rushed checks, and unfamiliarity with foreign identification cards all contribute to mistakes.

Whether it’s a formatting issue or inconsistent security features, untrained eyes let false IDs slip through.

Training can mitigate the risk somewhat. But even with training, human fallibility remains a significant risk.

Inconsistent decision-making

Subjectivity plays a huge part in decision-making.

While Reviewer A might reject a document for a formatting issue, Reviewer B approves it without a second glance.

If Reviewer B is right, Reviewer A is subjecting the client to unnecessary investigation. This is known as a false positive.

False positives increase applicant wait times, which is frustrating. It also costs your business extra money to investigate further.

If Reviewer A is right and Reviewer B is wrong, this is a false negative. Reviewer B just let a fraudulent applicant slip through the net.

Limited verification scope

Manual checks are surface-deep. A human reviews the document and makes a decision there and then.

There’s no checks against external databases to validate Social Security details or flag stolen data.

Without advanced techniques to access real-time data, most forms of identity documents only go through rudimentary checks.

Evolving and varied security features

Government-issued ID formats constantly evolve.

There are thousands of acceptable documents around the world. No employee can recognize them all — even with substantial training.

Valid proof of identity from one country can look completely different to an ID from another.

That’s one of the main ways fake IDs slip through.

For example, in the Americas, the top fraudulent document is the Indonesian National ID card. American ID reviewers are far less likely to be familiar with Indonesian ID, so it’s easier to fake it.

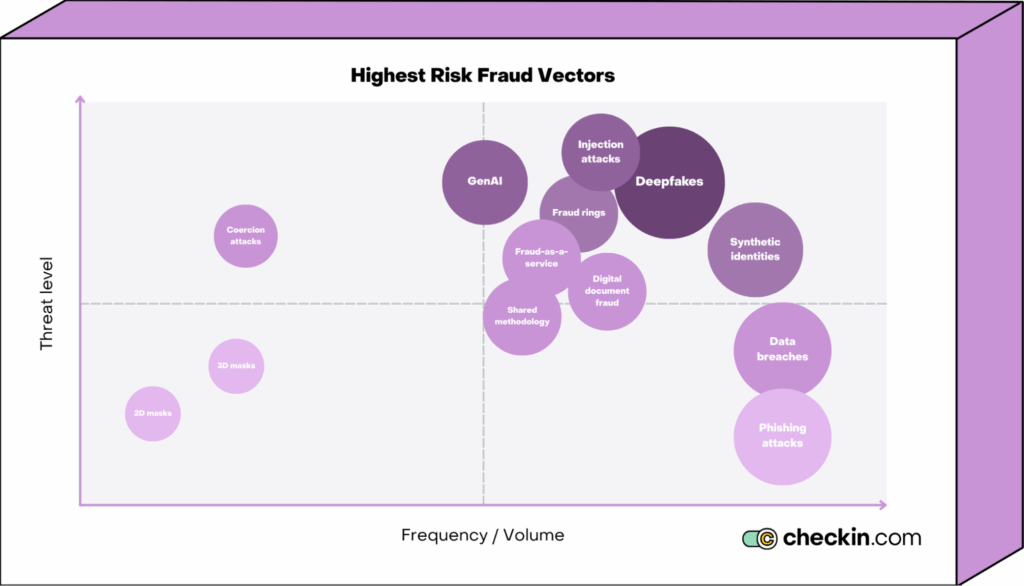

Sophisticated forgery techniques

Forgery is becoming increasingly sophisticated and easier to do, mostly due to AI. Digital forgeries increased 244% last year, now contributing to almost two-thirds of fake IDs.

AI-generated images, laser embossing, and deepfakes create nearly perfect fakes. In fact, deepfakes now account for 40% of all biometric fraud.

And the problem is, human reviewers can’t spot these fakes. Nearly 60% of people say they have a hard time telling the difference between real media and images created with AI.

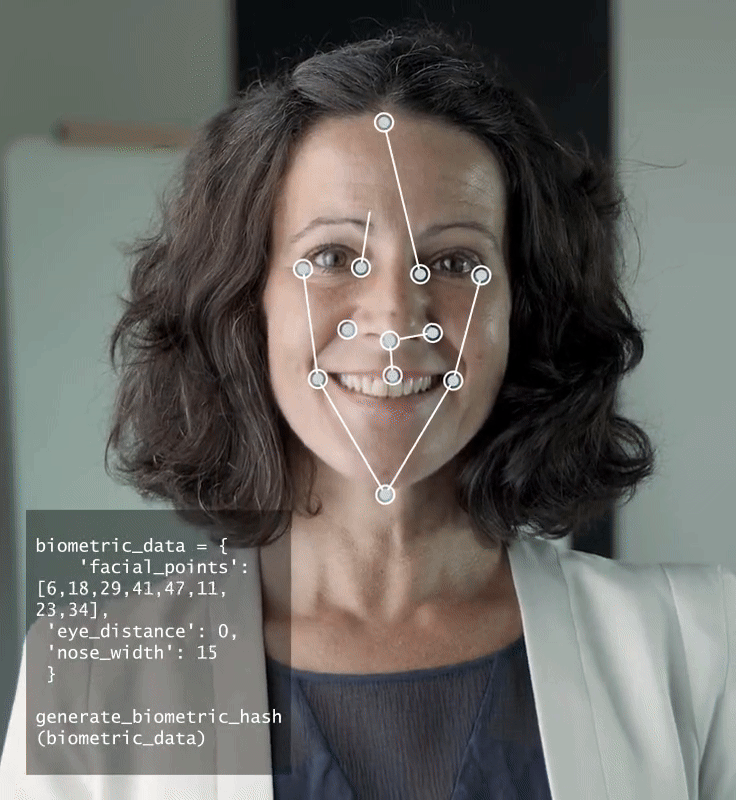

Lack of biometric matching and liveness detection

Manual ID checks rely on the human eye to visually compare an ID photo to the person presenting it. And this simply isn’t accurate.

Manual checks lack the precision of AI-powered biometric authentication and liveness detection. These technologies use advanced algorithms to analyze facial structure, image depth, and natural movement. Human reviewers rely only on their training and subjectivity.

How AI-driven IDV solutions solve the issues of fake ID

Businesses understand the importance of moving past outdated manual ID checks.

Two-thirds of businesses are already looking into using AI and machine learning to improve their fraud identification capabilities. And of these, 90% are confident these solutions will be effective.

Here’s why.

Document authentication

AI is far more accurate and powerful than the human eye.

It reviews ID documents down to the pixel level.

It analyzes document structure, layout, fonts, and embedded security features. Whether it's a missing holographic images or incorrect laser perforation patterns, AI systems use intelligent training to detect inconsistencies to a high degree of precision.

Yes, human reviewers do get training. But AI models learn from vast databases of both real and fake identification documents. This wealth of experiential learning enables them to pick up on subtle anomalies across thousands of forms of identification from all different countries.

Optical Character Recognition (OCR) and data extraction

Once past the visual check, OCR takes over. It automatically extracts birth dates, addresses, names, and other data, checking is against the visual details.

OCR ensures the data is consistent and positioned where it should be. It flags anything that doesn’t line up or add up.

Not only is this far more accurate than a manual check, it also eliminates human errors, like typos.

Real-time database checks

Once the data has been extracted, AI-driven IDV solutions immediately cross-reference the data with government-issued ID databases, watchlists, and trusted third-party sources.

Take Checkin.com. It checks IDs against hundreds of sanctions lists and 3 million politically exposed persons (PEPs) lists.

This enables the systems to instantly flag high-risk users, as well as IDs marked as lost or stolen.

Biometric facial matching and facial recognition

Instead of relying on subjective judgment, AI compares a live image or video of the applicant with the ID photo. Using facial recognition algorithms, the system analyzes factors like eye color, hair color, facial symmetry, and other physical features to ensure they’re a perfect match.

Using 1:1 face matching, the system verifies that the user presenting the document is the same as the document holder. With 1:N facial recognition, the system checks across broader databases to make sure the same face doesn’t appear with multiple identities.

This is far more accurate than a manual check, which is why 85% of consumers trust biometric checks the most. Despite this, only a third of businesses use biometric verification, giving those that do a competitive edge.

Liveness Detection

Liveness detection makes sure the person in front of the camera is real and present.

AI tools ask the user to perform small actions like moving, blinking, or smiling. They monitor lighting, depth, and natural expressions to confirm the user’s presence.

Since the user doesn’t know what the system will ask for, they can’t pre-record footage to match the requests.

This blocks the deepfake technology used in even the most advanced fraud attempts.

Age assurance

Fraudulent users often use fake IDs to bypass age checks. Users falsify birth months or years to sneak through to age-restricted services.

AI solves this in two main ways.

First, OCR reads the date of birth. Then, facial recognition algorithms estimate the user’s age by performing a facial analysis and comparing this with its vast training data of age-related biometric markers.

If the stated age doesn’t match the image, it gets flagged.

This ensures users meet the minimum age requirements.

Behavioral biometrics

The best AI systems go beyond appearance. They analyze how users behave to pick up on unusual behaviors that indicate fraud.

These tools track typing speed, mouse movement, and interaction patterns. These actions are unique to each person and tough to fake. So when something feels off, it usually indicates bot behavior — and AI can spot it instantly.

Risk scoring and anomaly detection

Human reviews end in a pass or fail. AI reviews give each ID verification attempt a dynamic risk score.

AI algorithms take into account small inconsistencies, slightly odd behavior, and high-risk indicators to work out whether an ID may seem a little off.

So even if an ID technically passes the checks, a high-risk score will still flag the account for further investigation.

This feature not only acts as a double-check for applications. It’s also an early warning.

If the same user later shows suspicious behavior, the initial risk score ensures they’re flagged sooner.

Continuous monitoring and auditing

AI-powered IDV systems evolve as quickly as fraudulent users.

They learn from every interaction. They get better at identifying new fraud trends. They adapt to newer forms of identification. And they update detection rules in real time.

This evolution helps the system spot fraud that occurs later on approved accounts. IDV solutions continue to monitor accounts for suspicious activity, applying new rules as it goes to flag anything that seems out of the ordinary throughout the customer lifecycle.

Everything is cataloged automatically.

Not only does this ensure you have audit-ready records for regulators, but it also builds a behavioral baseline. If new activity strays from that norm, the system flags it instantly as a possible fraud attempt.

Final thoughts

Fake ID is becoming more advanced.

The only way to combat the rise in fraudulent documents is to improve your defense.

Manual ID checks are no match for spoofs, deepfakes, and fraud-as-a-service.

The only way to catch fake IDs and stay compliant is to meet fire with fire, using AI-driven technologies to weed out fakes in real time.

Combining AI-powered document authentication, biometric verification, database checks, and behavioural analysis is the only scalable way to tackle fake IDs.

Checkin.com provides an all-in-one future-forward solutions to tackle the evolving fraudulent techniques using in fake IDs. If you’re ready for accurate identification that happens in a matter of seconds, speak to the experts at checkin.com now.