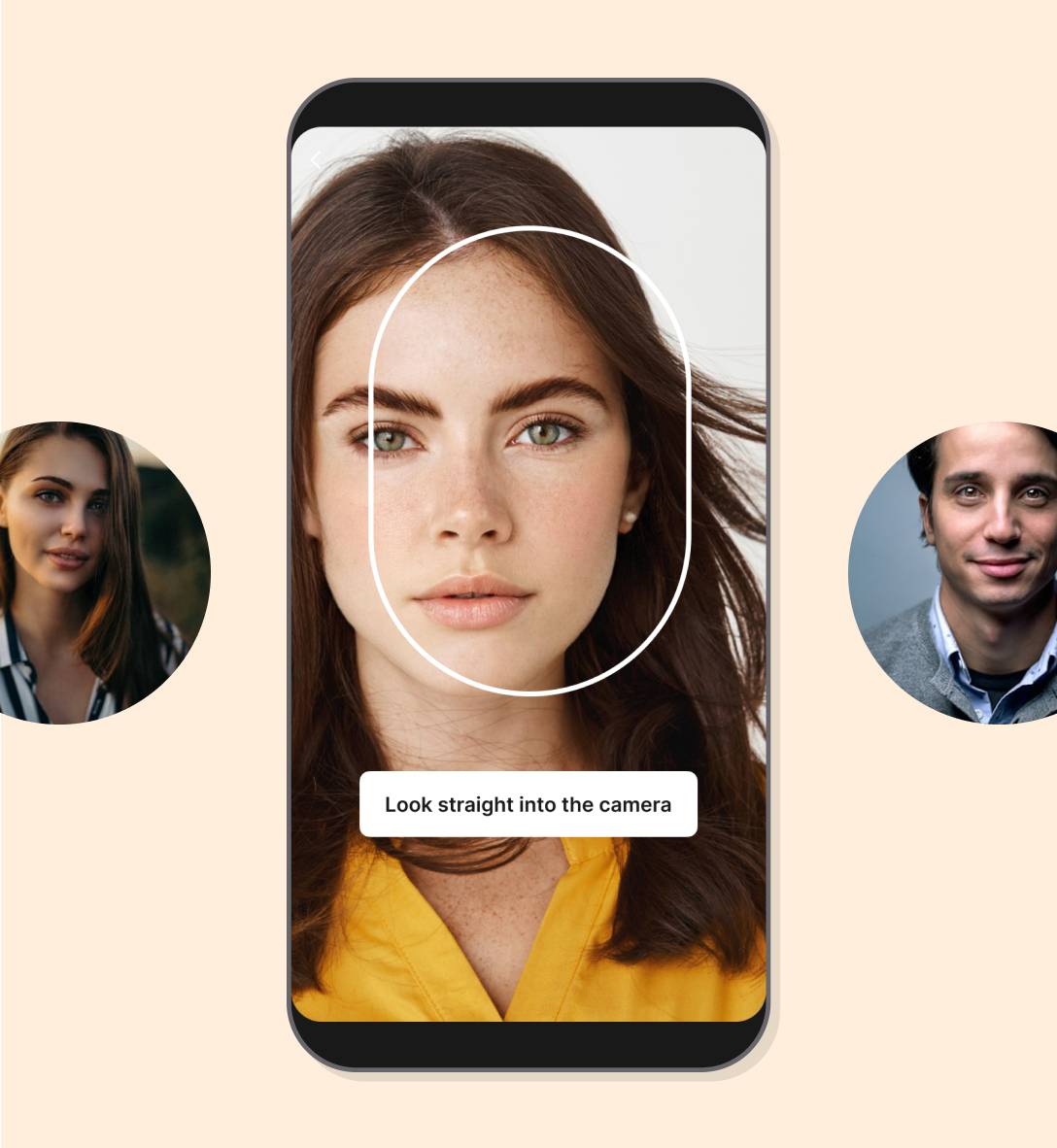

Liveness verification

to prevent identity fraud

without storing any images

Verify that the person is

the

same as on the ID

Detect, analyse, and compare human faces without storing any images. Get pass rates up to 99%

Automatic Real-Time Detection

Instantly determine if the user is physically present during the verification process.Spoofing Prevention

Our advanced algorithms detect fraud attempts using photos, videos or masks.Deepfake protection

Prevent fraud from AI-generated content by verifying the user's physical presence.Face recognition and comparison

In 1-1, a face is compared to another, while in 1-N, it's compared to all faces in a database.Add another level of security

to prevent fraud

ID scanning verification

Instantly verify the user's identity by scanning their document and matching it with their face in real-time through advanced facial recognition technology.Login and entrance system

We ensure top-level security by instantly verifying returning users. Through biometric authentication and encrypted data, we confirm the user’s identity matches the original registration.Payment confirmation

Our technology guarantees enhanced fraud prevention and peace of mind, ensuring sensitive information and financial data remain secure at all times.Age block

Our system quickly estimates age without relying on easily manipulated static images or videos, ensuring that only genuine users can access age-restricted content.Compare two types of verification

Protect your business from unauthorized access, confirm transactions, recognize returning users, and simplify password recoveryAI-driven passive liveness

Simple front-end integration

One line of code loads the framework and willreturn your data in JavaScript callbacks.

Connects to every platform

Your data is easily sent and validated via anyAPI or endpoint that you already use.

You get the same data as before

The user data collected will be the same asyou are collecting today.

We never store your data

Your customers’ privacy and data are fullyprotected since no data will be stored on our end.

Designed for enterprise

We work with innovative leaders in a wide range of industries to providetailored solutions based on your specific needs.

- Airlines

- Car rentals

- Hotels

- Cruise lines

- OTAs

- Currency exchanges

- Crypto exchanges

- Virtual currencies

- Trading platforms

- Payments

- Neobanks

- Platforms

- Lottery

- Fantasy

- Sports betting

- Casino

- Education platforms

- Recruitment agencies

- Communication services

- Marketing agencies

- E-commerce

- Events

AI-based Face recognition module

Verify that an identity document belongs to the person presenting it

See the person behind the screen

Human-like behaviour

Real-time tracking of movement, order of actions combined with irregular visual artefacts analysisHuman-like behaviour

Enables comparison of the captured face and portrait picture from the document

Reach out to learn more

about

liveness verification

Get a custom demo and pricing

Get startedFrequently asked questions

Liveness check is a biometric verification process ensuring that a user is physically present during an authentication session. It confirms the authenticity of the presented data by excluding static or replicated sources like photos, videos, or masks.

Passive liveness: The process happens seamlessly without requiring any user actions, such as blinking or smiling. It uses AI to analyze subtle movements or patterns in the live image. Active liveness: Requires users to perform specific actions such as head tilts or blinking to verify physical presence. This process is more interactive.

The average time for ID verification is under 5 seconds, ensuring a fast and user-friendly experience.

Fraud prevention: Ensures only live, real individuals complete verifications, blocking spoofing attempts like photos or deepfakes. Compliance: Helps industries such as iGaming and fintech meet regulatory requirements by confirming real user presence. Enhanced security: Validates identity during onboarding, account recovery, and transaction verification.