Compliance isn’t a one-time affair.

KYC is a vital part of onboarding. But it’s also just as important to continuously monitor your customers to remain compliant.

This is where perpetual KYC comes into play.

It’s not just that your customers change. So do regulations.

Without continuous monitoring, you face outdated risk profiles, missed red flags, and changes to regulatory standards. This puts you at risk of non-compliance fines and fraudulent activity.

Perpetual KYC offers a dynamic approach to ensuring compliance and risk mitigation.

In this guide, we’ll explore the meaning of perpetual KYC and why it’s so important to keeping your organization compliant. We’ll look at the benefits of choosing the right software and how to implement it effectively.

What's perpetual KYC?

Perpetual KYC (pKYC) is an ongoing approach to customer due diligence (CDD).

Traditional methods of ongoing due diligence rely on manual periodic reviews. This can be resource-heavy and risks often slip through the net.

Intelligent tech-driven pKYC approaches use real-time monitoring to flag changes to customer risk status. They continuously monitor transactions, adverse media sources, and watchlists to identify these changes.

Powered by artificial intelligence (AI) and machine learning, pKYC processes are triggered by specific events. This might be a change in a customer’s address, an update to a sanctions list, or a difference in transaction behavior.

The system will automatically update customer details and risk profiles in response to changes and evolving potential risks.

This automated approach guarantees accurate customer information at all times and limits the need for manual reviews.

Through this event-driven approach, pKYC solutions can flag suspicious activity and keep on top of significant updates to customer records.

Not only does this give you an accurate reflection of a customer’s risk level to prevent exposure to financial crime risks. It also ensures you stay compliant with changing regulations while lowering operational costs associated with manual reviews.

Why is perpetual KYC important?

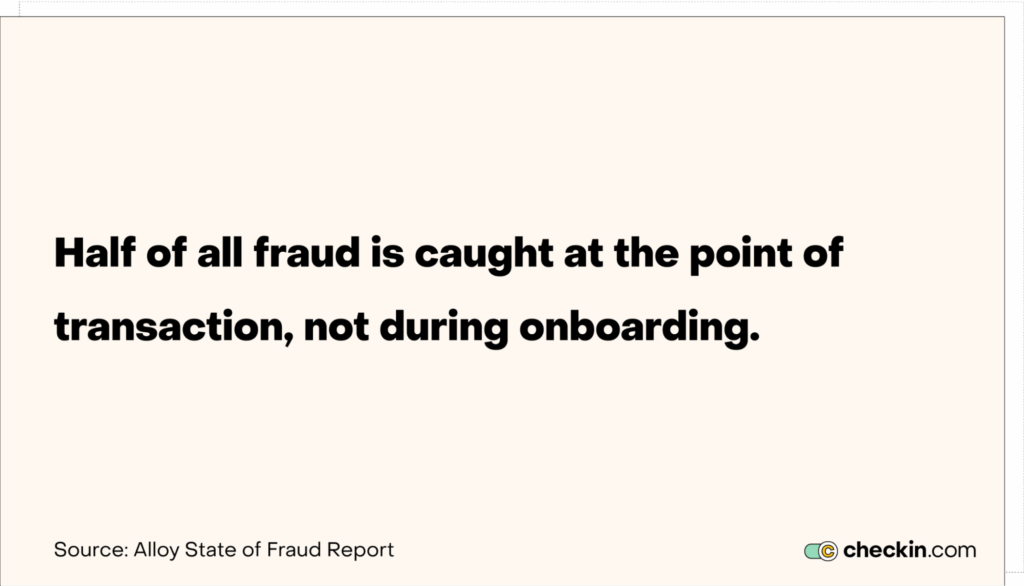

Fraud doesn’t always happen at the signup stage. While 33% of fraudulent activities occur during onboarding, 50% of fraud is discovered during transactions.

This is why ongoing monitoring is so important.

pKYC enhances fraud detection throughout the entire customer lifecycle. It’s a proactive approach that identifies suspicious activity, such as fraud and financial crime, that might not be present during onboarding.

Let’s consider synthetic fraud, for example.

Some bad actors create synthetic identities by combining false data with real data that’s been stolen. In other cases, they combine different sets of real data to create a false identity.

Bad actors pass identity checks and then wait to activate these accounts later for financial crimes. And it could take years for this to happen. Experts predict that data stolen as far back as 2020 will only start to resurface now.

With perpetual KYC solutions in place, it doesn’t matter how long these accounts lay dormant. As soon as fraudulent activity starts to occur, the system will flag this suspicious behavior.

But it’s not just the risk of fraud that pKYC software assists with.

pKYC solutions dynamically update customer risk profiles as their status changes or new threats emerge. This helps businesses uncover non-criminal risks, like the threat of non-payment or media scandals that could damage their reputation. It flags these threats in real time and updates profiles accordingly.

All of these benefits help to keep your business compliant as your customer base evolves and regulatory requirements change.

And pKYC tools don’t just update risks. They also update compliance models automatically to keep pace with evolving regulations. This means they can alter risk statuses based on changes to regulations as well as changes to risk.

What are the benefits of a robust perpetual KYC solution?

A strong perpetual KYC solution isn’t just about staying compliant. It’s about improving efficiency and reducing risk so you can scale your business.

Where legacy approaches are slow and inaccurate, pKYC solutions can accelerate and streamline ongoing monitoring.

Here are the benefits of picking the right robust pKYC software.

1. Reduces operational costs

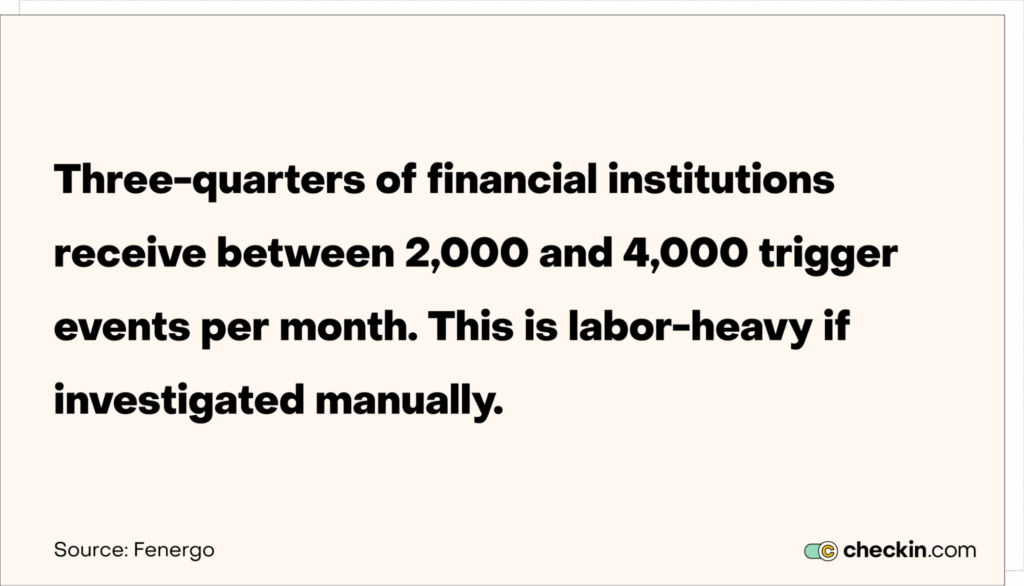

It’s resource-heavy and inefficient to monitor and update customer risk profiles manually. More than three-quarters of financial institutions receive between 2,000 and 4,000 trigger events each month.

Despite this huge volume of alerts, 67% of organizations still conduct between 20% and 50% of ongoing KYC review tasks manually.

This eats up a lot of time and skyrockets operational costs.

When you automate your pKYC process, you reduce the need for human intervention. Ongoing CDD becomes much more efficient and you significantly reduce labor costs.

2. Enables proactive risk mitigation

An advanced pKYC solution is proactive at responding to threats. It identifies risks in real time so you can catch suspicious activity before it escalates.

This approach minimizes financial crime risks, lowering financial losses from fraud and money laundering. It also protects you against fines and penalties that come from not meeting compliance thresholds.

Plus, pKYC systems automatically update in response to emerging threats.

If you’re using legacy, manual-heavy systems, you’ll need to do lots of research to stay ahead of new risks and update your systems accordingly.

pKYC solutions do this automatically, protecting you from evolving risks that might not have come to your attention yet.

3. Improves customer experience

Frequent manual re-verifications lead to customer frustration.

With a sophisticated pKYC solution, there’s no need for constant disruptions. It automatically updates customer records and risk profiles without needing constant manual input.

This provides a far more seamless experience as customers don’t need to do anything to stay verified.

4. Improves compliance accuracy

It’s critical to stay up-to-date with regulatory requirements. But they frequently change.

Being unaware of changes is no excuse for non-compliance. You’ll still fall foul of penalties and fines.

As with emerging threats, staying ahead of all local and global regulations can be tough — especially if you operate in lots of jurisdictions.

This is why you want AI-driven pKYC solutions that feature self-evolving algorithms. These algorithms automatically update compliance models to align with new regulations and threats.

Plus, a pKYC solution that functions across multiple countries will update regulations for all these locations.

This reduces the risk of non-compliance with new regulations or due to unforeseen threats.

5. Enhances data-driven decision making

Advanced analytics and reporting offer valuable data and insights into customer behavior, risk trends, and the effectiveness of your compliance programs.

This provides you with information on how to optimize your KYC processes and improve overall risk management.

It’s almost impossible to get the same level of overview from manual systems, as it’s hard to collate and process the data. And it can be just as tough to do this with disjointed legacy KYC systems spread across spreadsheets.

This is where AI-powered pKYC systems come into play, as they can offer intricate insights into trends and patterns in real time.

6. Allows CDD operations to scale

If your CDD processes are manual, you need to hire more staff as your operations grow.

With a robust pKYC solution, you can monitor increasing volumes of transactions without extra hands on deck.

The system evolves and updates automatically. This enables it to process more customers and new market entries to support growth without compromising compliance or security.

Best practices for implementing perpetual KYC effectively

To get the most from your pKYC solution, you need to implement it correctly.

Follow these key best practices to make sure you align with your business goals and compliance requirements.

1. Define clear scope and objectives

Identify your organization’s needs.

Ask yourself:

- What are the compliance requirements in all of the jurisdictions you operate?

- What’s your risk tolerance?

- Are you dealing with low-risk or high-risk customers?

- What operational challenges do you face?

Set clear objectives on how you’ll handle these issues. Consider the features you need to overcome current bottlenecks, improve efficiency, and stay compliant.

2. Select and implement robust technology

The right perpetual KYC technology matches your business needs.

Your solution should support and streamline your current operations to improve accuracy and efficiency.

In particular, look for the following:

- AI and machine learning for sophisticated risk assessment

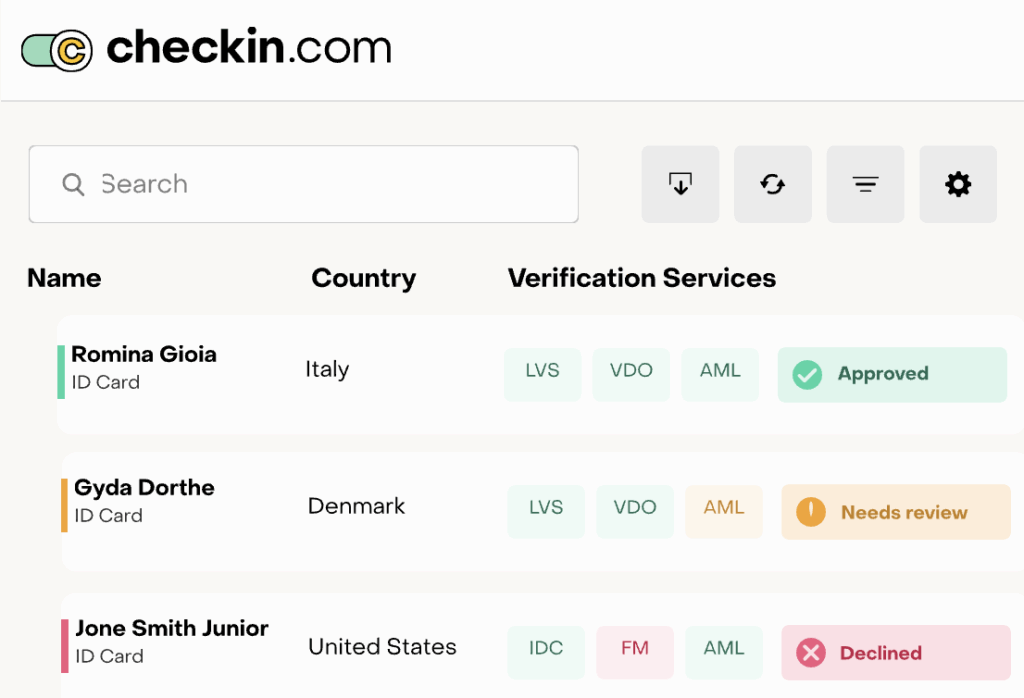

- An easy-to-use dashboard to track cases and escalations

- Advanced analytics and reporting to improve compliance processes

- Integration capabilities that work with your existing systems

When picking a solution, consider how the provider will support you in implementing the system as best possible. Over half of organizations still haven’t integrated KYC with their ongoing transaction monitoring. This makes it tough to keep customer profiles updated.

Look for providers who'll assist with integration and onboarding. For example, Checkin.com has a dedicated team to help you integrate pKYC with your existing systems.

3. Develop and document clear policies and procedures

Establish clear protocols for perpetual KYC. Consistent application of pKYC procedures will help you deliver consistent outcomes to your clients.

Consider how you’ll handle the following:

- Customer onboarding

- Risk assessment

- Ongoing monitoring

- Escalations

- Exceptions

Train your employees on these policies so everyone’s on the same page about how they deal with triggers.

Regularly review and update these policies so they reflect changes in regulations and your business needs.

4. Conduct regular audits and performance reviews

While your pKYC solution may improve efficiency when you implement it, you need to make sure it continues to perform well.

Regularly audit and review the effectiveness of the software by using the analytics dashboard.

Assess how well it updates regulations and ensures compliance. Check your monitoring performance to reduce false positives and negatives.

Consciously identify areas for improvement and make necessary adjustments to keep the software running smoothly.

Embrace perpetual KYC to manage ongoing risk and compliance

Perpetual KYC is your key to ongoing compliance and proactive risk management.

By keeping a close watch on customer risk profiles and changing regulations, you avoid non-compliance fines and identify risky activity straight away.

Manual KYC reviews simply aren’t practical. They’re labor-heavy and don’t scale, as well as being error-prone and slow.

Instead, perpetual KYC software uses intelligent automation to monitor and review risk profiles to flag suspicious activity in real time. Self-evolving AI-powered algorithms update the system as regulations change and new threats emerge.

This keeps you compliant, while improving efficiency, reducing costs, and enhancing security. It’s a scalable solution that keeps you one step ahead of emerging risks.

Ready to guarantee ongoing compliance without the labor-heavy burden of manual reviews? Explore Checkin.com’s end-to-end KYC solution to safeguard your business and stay compliant. Talk to our experts today.