Case study: Decta

By Adam Brandt

Published 09 May 2022Subscribe to our newsletter!

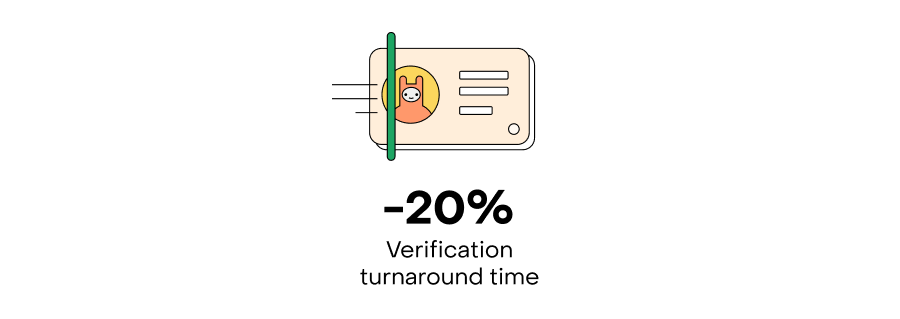

Read on to learn how the global processing company has implemented automatic customer identity verification and speeded up complex ID document checks by 20%.

"Automation is something we should all strive for. As the pace of life is accelerating, and as a company that provides a licensed product, we must speed up all verification processes as much as possible. Together with Checkin.com, we’ve been able to achieve that."

-Jevgenijs Godunovs, Director, MLRO

Case and History

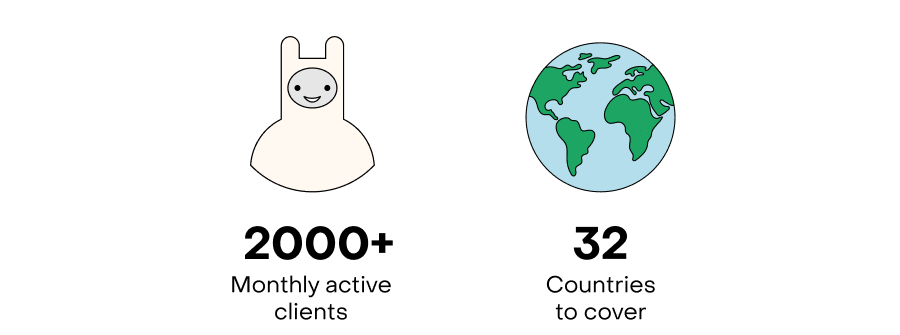

DECTA is a global payment processing company based in the UK, a reliable platform for processing online payments, including internet acquiring and issuing payment cards for banks, service providers, and corporate clients. DECTA serves over 2 thousand companies from 32 countries.

Two critical events at once led the company to introduce automatic customer verification into its process.

Firstly, DECTA needed to reduce the time of onboarding new clients. As a licensed financial institution, DECTA is obliged to perform legal check-ups which is a time consuming process. Several employees used to carry out the verification process at once. After analyzing the process, it became clear that it is necessary to automate the verification of ID documents, which would allow to greatly reduce the number of involved employees and the amount of time spent on manual data entry.

Another event was an independent audit, as a result of which DECTA’s team received a recommendation to add a third party provider to carry out the KYC process for verifying individuals.

The company began searching for a supplier and ultimately chose Checkin.com as it was able to provide a flexible and suitable solution to solve the problem.

”Checkin.com’s ID Scan solution has been seamlessly integrated into our customer onboarding process. The extensive capabilities of the API integration allowed us to solve several tasks more efficiently.”

-Valērijs Bikovs, Head of Internal Automation Department

Process and Results

The integration of Checkin.com into DECTA’s system was broken down into two stages. Initially, the developers evaluated and tested the system. DECTA’s experts used the Checkin.com backoffice to upload different types of ID documents for verification. The results have exceeded their expectations.

In the second phase, DECTA switched to a combination of automatic and manual verification. Checkin.com’s task is to recognize the type of an ID document and check its validity and visual authenticity. In case of negative result, Checkin.com has to send its recommendations to DECTA’s KYC officer. It’s important to note that the specifics of DECTA’s work process require special attention to the verification rules’ settings. Since the standard settings weren’t suitable here, DECTA’s team adjusted the verification flow for itself. Thanks to the flexibility of Checkin.com’s API, Checkin.com could be easily integrated into DECTA’s processes to achieve full automation.

Moreover, DECTA’s team started to use extracting information from ID documents as a source of filling in contact data in CRM. It enabled the system’s operator to reduce the time to enter data significantly. As a result, it allowed to optimize the entire process of working with clients and make it more efficient.

So, to date, the legal check-up time has decreased by 20% which, in turn, enabled DECTA to onboard more new customers in shorter time. DECTA plans to increase the efficiency of the onboarding process by automating several other steps. We look forward to achieving this result together!

“When choosing a partner, it’s important to find a common language with the team. We’ve found a common language with Checkin.com and were able to solve the set tasks quite quickly,” notes DECTA.

KYC features and integrations used

Subscribe to our newsletter!

Popular articles

The Cost of Compliance: KYC Outsourcing vs. In-house Solutions

In an era of increasing regulatory scrutiny, businesses in the crypto and online gaming industry need to implement efficient Know Your Customer (KYC) and Anti-Money Laundering (AML) processes in their signup flows.

CheckinSpeed up compliance with a killer KYC signup flow

Expanding into a new market means dealing with complex KYC (Know Your Customer) and AML (Anti-Money Laundering) laws and implementing localised onboarding workflows, which can quickly become complicated. 9 out of 10 hard-earned users in the financial services industry never complete the registration process because of tedious flows. In fact, according to a Thomson Reuters report [https://d3kex6ty6anzzh.cloudfront.net/uploads/70/701ba3b81955f279e932e9443b0875adb3b6fc1f.pdf] , onboarding takes 3

InsightsStreamline client onboarding KYC with the right software: A comprehensive comparison

Compliance standards are designed to protect against financial crimes such as fraud, corruption, money laundering and terrorist funding. But just about every week, fines are slapped [https://www.theverge.com/2023/1/4/23538731/coinbase-fine-crypto-money-laundering-laws-new-york] on iGaming, FinTech, and crypto [https://checkin.com/industry-fintech/] companies for not meeting regulatory requirements. As compliance becomes more stringent, implementing the KYC verification process becomes more ti

InsightsLocalized ID Verification simplifies the user verification and helps onboard more new customers

Introducing the Localized ID Verification Flow, a feature that enables users from different countries to enjoy a localized and simplified ID verification process!

ProductCase study: Admirals

Learn how the leading financial services company has implemented automatic customer identity verification and reduced the registration time down to 6 minutes. > “...While even more important we have been able to open up new countries as a result of our ability to successfully verify clients from countries where previously we did not have such an option.” – Andreas Ioannou, Head of Global Compliance at Admirals Case and History Admirals is the leading provider of financial solutions [https://ch

case-study4 reasons why you should use an end-to-end KYC solution for onboarding

In this article we’ll explore the main challenges for sign-up flows and how using professional solutions for user sign-up flow can benefit your business website or app.

InsightsCase study: Decta

Read on to learn how the global processing company has implemented automatic customer identity verification and speeded up complex ID document checks [https://checkin.com/id-scanner/] by 20%. > "Automation is something we should all strive for. As the pace of life is accelerating, and as a company that provides a licensed product, we must speed up all verification processes as much as possible. Together with Checkin.com, we’ve been able to achieve that." -Jevgenijs Godunovs, Director, MLRO Ca

case-studyCase study - Betcity.nl

Read on to find out how Checkin.com has helped the Dutch iGaming brand Betcity to automate customer ID Verification process [https://checkin.com/id-scanner/] and stay compliant with strict Dutch regulations [https://checkin.com/industry-igaming/netherlands/]. > "One of the main things that I value about Checkin.com is that they understand the iGaming world, and the needs that iGaming operators have. Checkin.com has provided us with a stable, quality, and flexible service that enables us to s

case-studyOpen banking, identity verification standalone, and Connect

This update is about a few major product areas we’ve been working on the framework.

ProductCase study: Simple Casino

A localized solution for Simple Casino in Japan Launched in September 2019, Simple Casino delivers a brilliantly simple, simply brilliant casino experience to Japanese players. From registration, through payment to playing, simplicity and ease of use lie at the heart of Simple Casino. Case and History Hero Gaming's brand Simple Casino planned to enter the Japanese market. They required a streamlined sign-up solution that was agile, robust, met the unique needs of their new target market and des

case-studyImprovements to data services, Schufa support, and a few words about Checkins

In this update, I’m going to tell you about our focus areas within the product last month and what we were busy developing.

ProductThe importance of locally adapted UX to drive more conversions

In this update, we are going to describe the role of localization and its effect on conversion rates of the sign-up flows. Localization doesn’t only mean the correct translations, it’s usually so much more, and when done right can bring great results.

ProductImprovements to different data verification modules and a new data enrichment gateway

Our big focus this month has been improving the services that relate to data verification and a new Regily Data Enrichment Gateway as a separate service!

ProductOCR - Allow users to scan information from ID documents

OCR stands for “optical character recognition” and allows users to scan information from their identity documents instead of typing. It has widely spread as an identity verification method and many customers are already familiar with the experience.

ProductEmbedded signups – a new way to trigger your flow

Pop-up - is our current type of integration that allows partners to start using Regily’s flows with just a few lines of code. The reason for this simplicity is that it is front-end-only and it enables your sign-up to run without having to change the parent page.

ProductEmbedded flows & OCR product discovery

We’re working on a new type of integration - Embed. It allows placing the sign-up on the parent page. An optical character recognition that allows users to scan information from their ID

ProductImprovements to Regily Remote, street selector & native apps optimization

May 2020 product updates

ProductWunderino enable sign-ups directly on affiliate sites in partnership with Internet Vikings and Regily

iGaming brand Wunderino is using the solution from Regily with its Brand Protection partner Internet Vikings.

CheckinNew improvements to Regily Remote & social sign-ups

April 2020 product updates

ProductIntroducing Regily’s latest innovation, Regily Remote.

Regily Remote increases affiliate conversion by allowing users to sign up directly from affiliate sites!

CheckinNew features to eliminate drop-offs on different screens

March 2020 product updates

ProductTechnical improvements on Flowbrain and OTP

February 2020 product updates

ProductLessons from user tests in regulated markets

January 2020 product updates

ProductGeo-location improvements & new localization features

December 2019 product updates

ProductIntroducing Flowbrain™

November 2019 product updates

ProductIntroducing: two new add-on components & a new password module

October 2019 product updates

ProductForza Football X Regily

Interview with Forza Football CEO Patrik Arnesson

ProductNew: Localization features

September 2019 product updates

ProductHow Forza Football increased Conversions by 500%

Forza Football is a web application platform for live scores, notices, lineups, polls, and video highlights, with highlights from more than 420 football leagues and cups worldwide. Forza Football's vision is to gather fans 'opinions and make fans' voices heard.Forza Football was seeing fewer conversion rates when they decided to build their own in-house sign-up form. They quickly realized that building sign-up forms was not their core strength and knew there had to be a better way to do it. Luck

ProductEnhancements for desktop conversions & language support

August 2019 product updates

ProductCase study: Forza Football

How Forza Football increased Conversions by 500% Case and History Forza Football is a web application platform for live scores, notices, lineups, polls, and video highlights, with highlights from more than 420 football leagues and cups worldwide. Forza Football's vision is to gather fans 'opinions and make fans' voices heard. Forza Football was seeing fewer conversion rates when they decided to build their own in-house sign-up form. They quickly realized that building sign-up forms [https://c

case-studyA new date of birth screen and Apple sign-ups are here

July 2019 product updates

ProductThe future of sign-ups: a 100% individualized experience

AI and Machine Learning are no longer hype! Machine Learning in its many forms is now a sheer necessity to succeed in today’s tech landscape. For us, that means ML needs to be fully embedded into our framework.

InsightsBehavioral analytics tests & a new add-on fraud tool

June 2019 product updates

ProductHow a bad airport experience sparked the idea of fun registrations

See our CEO and co-founder Kristoffer Cassel taking center stage at the Brilliant Minds Conference to share how a bad airport experience sparked the innovation of Checkin.com. (We were named Regily at the time)

Checkin