ID scanning technology is no longer reserved simply for onboarding and KYC.

It’s transforming how businesses verify identities across all kinds of business operations.

From securing financial transactions to account recovery, ID scanning technology offers fast, accurate ID verification to improve security and enhance the user experience.

Let’s dive into the benefits of ID scanning technology and explore the ways it can streamline verification in all areas of your business.

What is ID scanning technology?

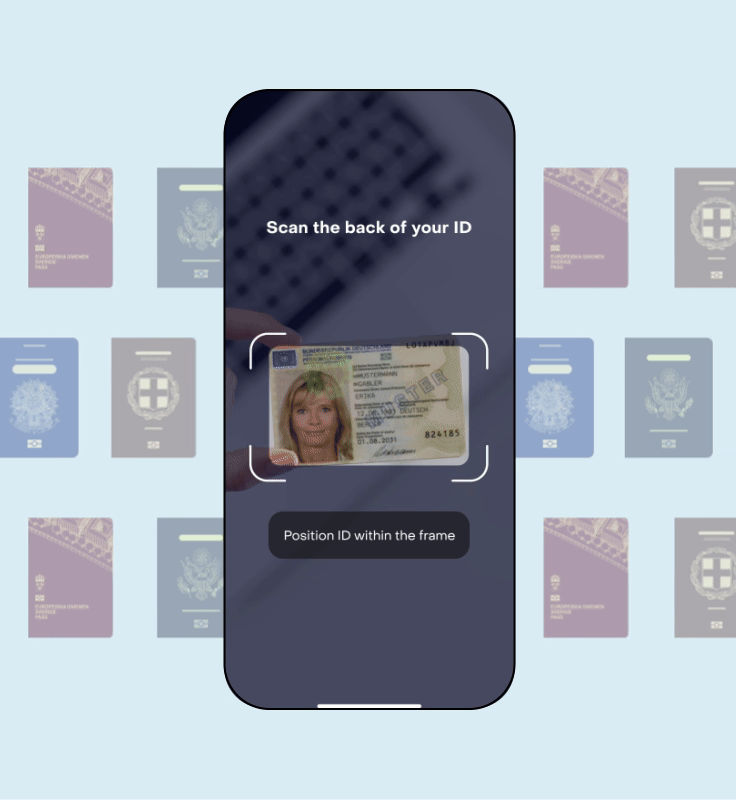

ID scanning technology authenticates and verifies identity documents to confirm a person’s identity.

It automatically captures information from official identity documents and cross-references this using biometric verification and database checks. This verifies that the document is genuine, the person is real, and that the person presenting the ID is the same as the person on the ID.

According to Regula, 65% of businesses are already using digital document verification. This is because it’s quick and accurate and helps to prevent fraud while streamlining verification processes.

Here are the key features of ID scanning technology:

- Optical Character Recognition (OCR): Captures and converts printed document text into machine-readable data automatically.

- Document authentication: Analyzes document elements like holograms and security features to detect forgeries, tampering, and expired documents.

- Data validation: Cross-checks information against official databases to ensure accuracy.

- Biometric verification: Face matching matches a live selfie to the document, while facial recognition cross-checks databases to find an identity match.

- Integration: Seamlessly links with existing platforms via APIs and SDKs to streamline workflows.

- Compliance: Automatically updates with changing regulations to meet legal requirements like KYC, AML, and GDPR regulations.

These features work together to authenticate documents and verify identity in a precise, easy-to-use way.

How to use ID scanning technology in your business: 11 use cases

ID scanning technology streamlines identity verification. It enhances security and helps businesses stay compliant across a whole range of industries.

It’s best known for its role in confirming identity during onboarding. But that’s not all it can do.

ID scanning technology works at all different stages of the customer lifecycle to ensure customers are who they say they are.

Let’s explore the different ways you can use ID scanning tools in your business.

1. Seamless customer onboarding and KYC

For some sectors, ID verification is mandatory to ensure compliance with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations.

Banks, fintech firms, ecommerce platforms, and gaming providers are all examples of companies that need to verify identities from the outset.

But, with slow legacy verification systems, manual ID checks are time-consuming, leading to high customer abandonment rates.

This is where an ID scanning solution changes the game.

By combining OCR with automatic document authentication, facial recognition, and database checks, you can confirm customer identities in seconds.

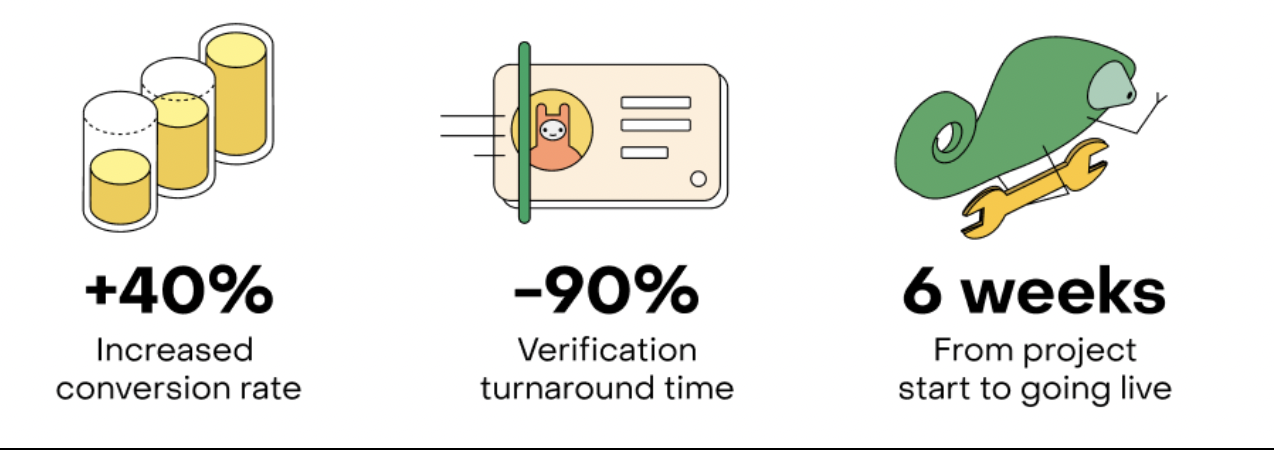

Take Admirals, for example.

The global financial services firm uses Checkin.com to automate ID verification during onboarding. This has reduced verification time by 90% and increased conversion rates by 40%.

2. Age verification for restricted products and services

Businesses that sell age-restricted goods need to verify customer ages or they risk the legal ramifications of selling to minors.

But manual checks are unreliable.

Parental consent and self-declaration mechanisms are easy to bypass, while rudimentary manual ID checks are vulnerable to deepfakes and spoofing.

ID scanning technology uses AI to improve accuracy and catch fraudulent access attempts.

The tool captures document data, extracting a user’s age. AI algorithms analyze the document's image, assessing biometric markers such as facial structure, wrinkles, and skin texture.

It compares these to databases of known age-related markers to determine if the age of the person in the image matches the age on the document.

It’s very fast and highly accurate, preventing underage access to restricted products, services, and content.

Take Betcity as an example. The gaming platform uses Checkin.com to scan IDs to prevent underage individuals from accessing its online gambling services.

3. High-value transaction verification

Financial fraud is a growing concern, and it doesn’t always take place as soon as someone opens an account.

While 33% of fraudulent transactions occur during onboarding, half happen at the point of transaction.

ID scanning technology enables companies to verify a person’s identity as an extra authentication layer for large transactions. This stops fraud before it causes financial losses for banks, crypto exchanges, payment processors, and other similar platforms.

For example, imagine a bank sees a rise in high-value wire transfers to high-risk jurisdictions. This indicates money laundering.

In response, the bank sets up ID scanning technology to trigger verification for transactions of $5,000 or more to particular locations.

4. Password resets and account recovery

Weak account recovery services allow fraudulent users to request a password reset and take over an account. This allows them to steal personal details and sensitive data while using the account for nefarious purposes.

For example, a person could take over an ecommerce account to purchase products using the account holder’s credit card.

ID scanning technology prevents bad actors from hacking accounts by resetting the password.

Instead, when a user wants to recover an account, they must submit ID documents. AI algorithms verify the authenticity of the documents and the user presenting them.

This is a far more secure method for helping users re-enter accounts.

5. Secure document signing and e-signatures

Forged signatures are problematic for industries like the legal, financial, and real estate sectors.

If you don’t confirm a person’s identity before they sign a contract, you risk committing to something that’s not legally binding.

Instead, ID scanning technology can confirm a person’s identity to ensure the person signing the document is who they say they are.

Not only that, but sophisticated ID scanning tools like Checkin.com incorporate signature verification features.

The signatory submits the signed document and also signs the app to create a digital signature. AI algorithms compare the two signatures to ensure they match. It then compares this signature to official databases to ensure it matches other official documents.

This prevents forgeries and removes the human subjectivity of manually authenticating signatures.

6. Access control for secure content or facilities

Some organizations require authorized access to sensitive data, confidential files, or restricted locations.

ID scanning technology strengthens access controls. It authenticates a person’s identity documents before granting access to a system or location. This prevents impersonators from entering restricted domains.

For example, a law firm might integrate ID scanning into its document management systems. This restricts access to confidential files to protect client data and sensitive legal documents.

Alternatively, the security team at a festival might scan identity cards to make sure that all entrants have booked and paid.

7. Preventing fake and duplicate accounts

Fraudulent users will create fake or duplicate accounts to take advantage of promotional offers and free trials.

For example, an online casino might offer a $10 signup bonus for new users. A user opens a second account under a different name to pose as a new user and gain this $10 bonus.

This is known as bonus fraud, and it’s very common.

In fact, in the online gaming industry, it accounts for almost 70% of all fraud.

ID scanning technology stops this commonplace trick by confirming a person’s identity and comparing it to previous users.

The AI algorithms not only catch attempts to open second accounts using the same ID. AI-powered fraud detection will also identify fraudulent documents that use stolen data, manipulated images, and AI-generated deepfakes.

8. Secure hospitality and faster check-ins

Hotels, airlines, car rental services, and other hospitality businesses rely on ID verification to confirm bookings and stop unauthorized changes,

The problem is that manual ID checks are slow and human agents don’t always spot subtle discrepancies in forged documents — especially if the content is AI-generated. In fact, most people can’t tell if a document was created using AI.

ID scanning technology improves the check-in process by authenticating documents and verifying identity in real time.

This offers travelers a frictionless experience while dramatically enhancing travel and border security.

For instance, the travel company Flighthub integrated Checkin.com’s ID scanning to verify travelers at check-in. This reduces fraudulent bookings and stops unauthorized users from changing flight details.

9. E-commerce and marketplace seller verification

Online marketplaces are vulnerable to fraudulent sellers deceiving buyers.

This is why accurate verification is a must. Without it, scammers can create fake profiles to sell counterfeit products. Alternatively, they sell a product or service, collect the money, and then never deliver the goods.

ID scanning technology authenticates seller identities and cross-references documents with official databases to ensure their legitimacy.

This prevents sellers from illegally selling fake products or disappearing with funds after a transaction.

What are the benefits of ID scanning technology?

ID scanning technology offers a user-friendly method of verifying identities in a secure and compliant way.

Suitable for all industries, automatic AI-driven verification reduces fraud, speeds up processing, and improves the user experience.

Here’s why ID scanning is so beneficial.

Enhance security and fraud prevention

Deepfakes and identity fraud are on the rise. More than half of all companies say they’ve had to deal with fake or modified documents in the past year alone.

Not only are traditional ID checks slow, human reviewers struggle to spot manipulated documents. A notable 59% of people admit they couldn’t identify AI-generated content, meaning lots of forgeries go unnoticed.

ID scanning technology uses AI algorithms to authenticate documents with security features, like holograms and watermarks.

Biometric verification ensures the person presenting the document matches the document.

On top of this, 3D liveness checks prevent fraudulent users from submitting pre-recorded content and deepfakes to spoof the system. It analyzes motion and image depth to ensure the person presenting the document is physically present.

This catches fraud attempts, synthetic identities, and manipulated ID documents in real time.

Fast, automated verification

Manual verification is slow as human reviewers have to check each document one by one. This delays the verification process and frustrates users, increasing abandonment.

ID scanning technology speeds up this process by extracting ID data automatically using an OCR solution. It automates biometric checks and instantly validates documents against databases.

With the right ID scanning system like Checkin.com, verification for genuine users takes five seconds or less.

This significantly improves the customer experience and increases efficiency, while reducing drop-out rates.

Fewer false positives and negatives

False positives occur when genuine customers get flagged for further review unnecessarily. This frustrates users as it slows down verification.

False negatives are even more problematic. Fraudulent users are approved when they should be flagged.

Both of these occurrences are common with manual verification systems, as human subjectivity is prone to error.

AI-powered ID scanning is highly accurate. Machine learning algorithms spot all kinds of fraud instantly and evolve to improve their detection methods as new threats emerge.

This adaptive risk-based verification means fewer legitimate users are subject to extra investigation, and all fraudulent users are caught in the act.

Automated global compliance

Almost half of organizations say identity management solutions reduce legal risks.

This is because AI-driven ID scanning simplifies compliance with counter-terrorist financing (CFT), AML, and data privacy regulations.

The algorithms automatically update as regional regulatory requirements change. This ensures real-time legal compliance with legislation in all the territories you operate in.

Localized, user-friendly experience

Poor experience is to blame for 50% of customer dropouts during onboarding.

This is why 41% of companies have started using identity verification software to improve customer satisfaction, with 61% saying it works.

ID scanning technology makes it quick and easy for customers to verify their identity in one handy app.

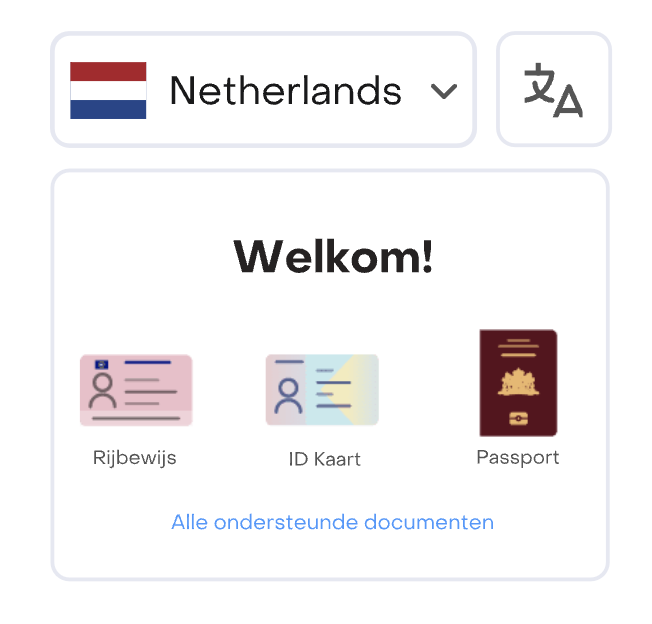

But for global businesses, it’s important to pick an identity verification solution that supports cross-border verification. Identity verification tools that work in all the jurisdictions they operate in.

Solutions should recognize a range of foreign document types and offer verification processes in the customer’s native language.

For example, Checkin.com supports 80+ languages and can verify 14,000+ kinds of identity documents from more than 190 territories.

This makes it easy for users from anywhere to complete verification in their own language.

Integrated workflows

ID scanning technology connects seamlessly with your existing tools, such as your CRM, fraud detection software, and payment systems.

This improves operational efficiency and enables you to integrate ID scanning into all different aspects of your business.

Look for a solution like Checkin.com that offers simple integration with APIs and SKDs, along with dedicated integration support. This helps you connect your systems easily and in the most effective way for your company.

Cost efficiency and scalability

Manual verification is costly and it doesn’t scale well. To handle more verification requests, you’ll need to hire more reviewers.

And many organizations are seeing the benefits of the switch to IDV: 38% say ID verification technology has reduced IT spending.

It does this by:

- Reducing financial losses from fraud

- Cutting down on unnecessary investigations due to false positives

- Automating verification to decrease manual workloads

- Handling high verification volumes without adding staff

Faster, more accurate ID scanning

ID scanning technology is a great way to streamline the customer onboarding process and stay compliant with KYC.

But that’s not all it can do.

ID scanning can help you verify customers at all different stages of your operations.

Are you resetting a customer’s password? Are you checking the age of customers at checkout? Are you controlling access to private content? ID scanning helps you do this in a secure, compliant way.

Ready to adopt advanced ID verification solutions and roll them out across your business? Explore Checkin.com’s ID scanning technology today to enhance your verification processes.