Traditional online identity verification services aren’t just inefficient. They’re a risk to your business.

These outdated methods simply can’t keep up with evolving fraud threats, regulatory changes, and customer demands for convenience.

The shift toward smarter solutions offers intelligent AI-driven identity verification that improves accuracy, speed, and compliance.

Let’s explore how identity verification services are evolving and how to choose a future-ready solution.

Why conventional ID verification no longer works

Traditional identity verification processes are labor-intensive. Their manual nature can’t handle modern fraud threats or rising user expectations for speed and convenience.

They’re slow, costly, and error-prone. They’re a liability to businesses looking to scale and offer a smooth user experience.

Here’s why.

Outdated verification methods slow everything down

Outdated Know Your Customer (KYC) processes and ID verification methods rely on human agents. Staff must manually check ID documents, enter customer data, and assess risk.

This labor-heavy process means user onboarding happens one person at a time, so it’s painfully slow. In fact, most institutions say customer verification can take anywhere from one to six months.

Long onboarding times are frustrating for users. This results in high drop-out rates and missed revenue.

The cost of human error is untenable

Conventional checks rely on human judgment. Subjectivity in decision-making results in inconsistent outcomes. This can show up as false positives: meaning genuine customers are flagged as high-risk, and false negatives: meaning fraudulent users slipping through the net.

Plus, manual data entry leads to silly mistakes, like typos and overlooked red flags. While errors may seem small, they can result in costly breaches, long delays, and compliance risks.

Fixing these errors burns through time and budget. It drives up staff hours, inflating costs, and increasing the likelihood that your customers give up and drop out.

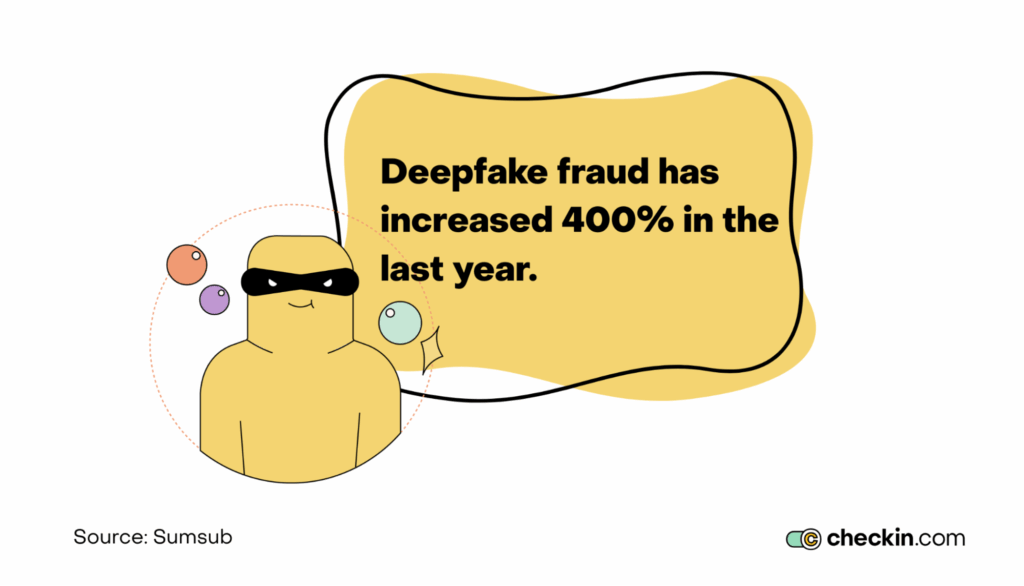

Fraud is getting smarter

Almost half of financial institutions reported rising fraud last year. But it’s not just an increase in fraud that’s worrying — it’s that fraud actors are getting smarter.

Deepfakes and synthetic identities are now commonplace. The use of deepfakes rose by 400% in the last year, alone.

And the problem with manual checks is that humans can’t spot AI fraud. For example, 59% of human reviewers say they struggle to distinguish AI-generated media from genuine media.

Compliance is a full-time struggle

Regulations are evolving and manual ID verification can’t keep up.

Not only does a lack of automation slow down due diligence. It also makes it harder to keep accurate audit trails.

Plus, manual systems need updating with new regulations. If your identity verification program isn’t automated, officers might miss a regulatory change and fail to update the system. Suddenly, you’re non-compliant without realizing it.

Operating costs prevent scalability

Manual identity verification processes aren’t built for growth.

Each new customer brings more paperwork.

And because verification happens one customer at a time, you need to hire more people to keep up. This is expensive and unsustainable.

Consider that, on average, KYC costs between $1,000 and $3,000 per customer. Multiply that by thousands of users, and that’s a serious drain on your profits.

So it’s not just that manual systems are slow and error-prone. They’re costly, so it’s hard to scale efficiently.

Top trends in online verification services

Manual identity verification (IDV) is taking a backseat as a new generation of IDV services emerges.

AI-powered identity verification services are far better at responding to evolving threats, incorporating regulatory requirements, and meeting user expectations.

Let's look closely at the biggest trends that'll affect online ID verification services in 2025.

AI-powered document and biometric verification

AI now leads the way in digital identity verification.

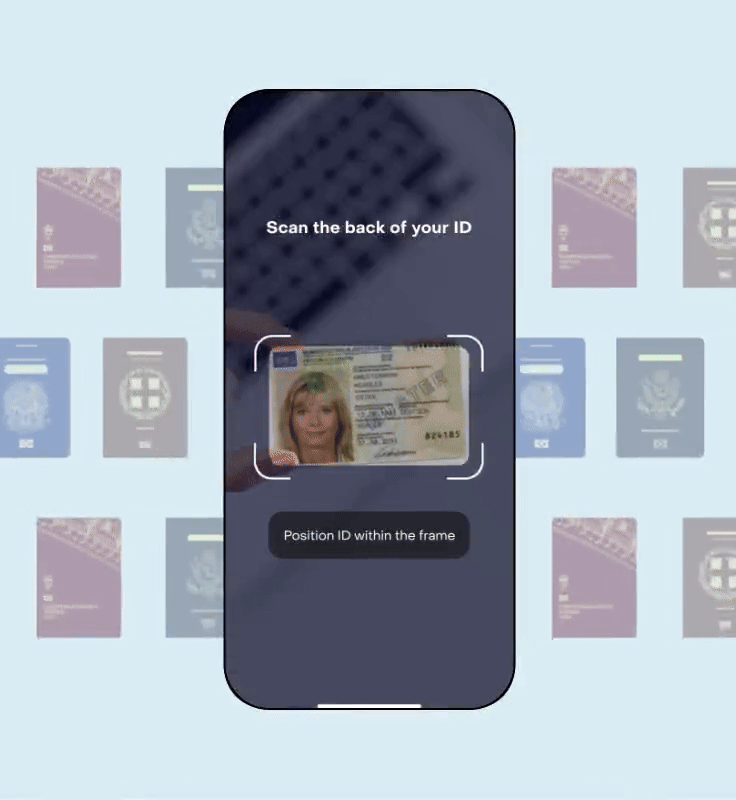

Modern tools use machine learning to analyze user applications. There’s no longer a need to rely on human supervision. AI systems automatically validate passports, IDs, and selfies using biometric verification and AI-powered document and image analysis.

Tools like Checkin.com can verify thousands of document types from over 190 countries using optical character recognition (OCR), image analysis, and facial recognition.

Thanks to 1:1 and 1:N biometric matching, it can confirm a user’s identity with exceptional accuracy in real time.

This solves many common onboarding process problems.

No more long wait times, human error, or identity fraud. And it creates a seamless customer experience since it takes less than five seconds.

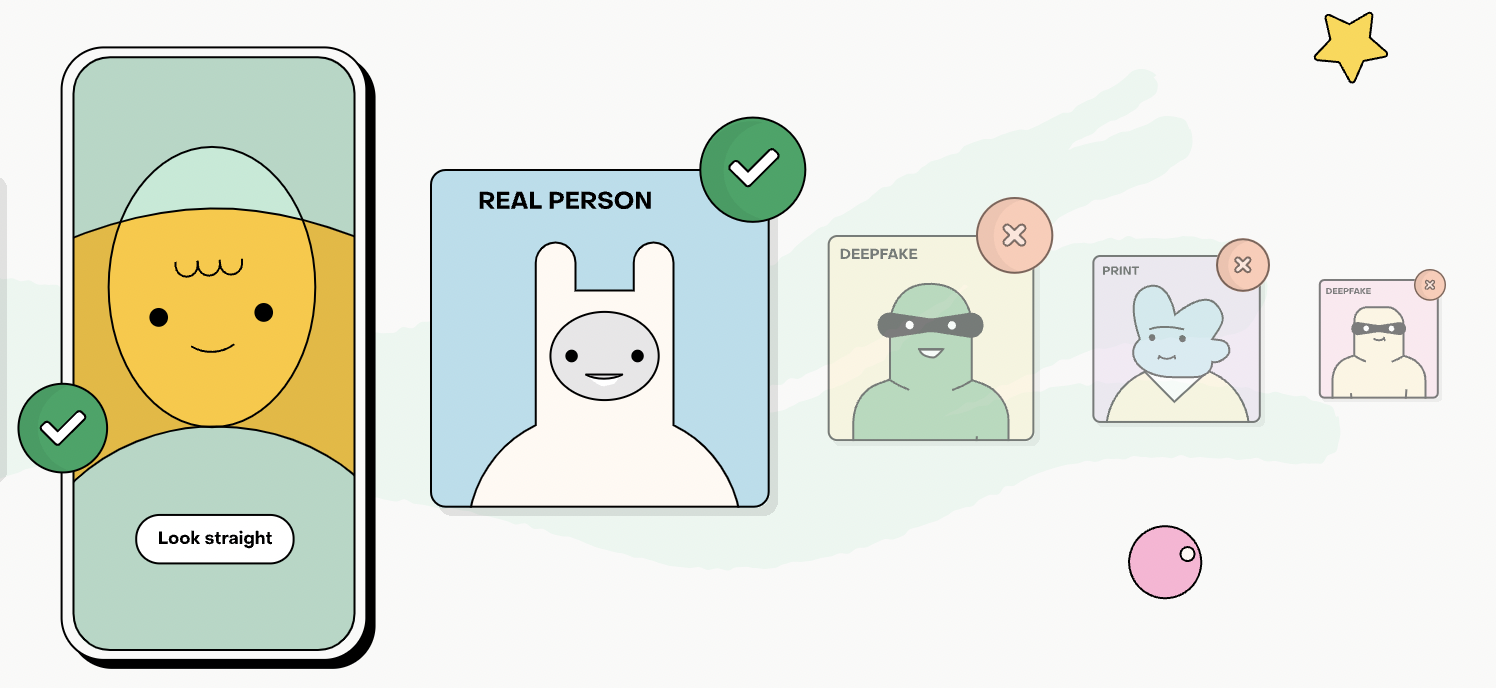

3D liveness detection and deepfake prevention

AI-generated fakes and synthetic identities are plaguing IDV processes. But AI-powered liveness detection offers an effective barrier against this.

The tech uses 3D facial mapping, motion analysis, and biometric cues to confirm that a real person is present during ID checks.

During identity verification, the system might ask a user to smile or blink. It analyzes the micro-movements and facial depth in the actions to prevent spoofing. This blocks deepfakes, pre-recorded videos, and 2D images.

Automatic cross-border compliance

It’s hard enough to keep up with compliance when you operate in one country. But for companies serving multiple jurisdictions, it’s a full-time job.

Modern identity verification platforms now offer automated built-in compliance. The system automatically adjusts AML and data privacy requirements depending on the user’s region. And it’ll update with new requirements if the regulatory landscape changes.

So with tools like Checkin.com, modular verification flows localize data storage and automate anti-money laundering (AML) and sanctions screening to meet local compliance requirements.

Real-time fraud detection

Conventional ID checks are a one-time static process.

But fraud doesn’t stop at the onboarding stage.

With this understanding, newer solutions offer real-time fraud detection. Behavioral analysis, device intelligence, and biometric vector comparison flag suspicious behavior at any stage of the customer lifecycle.

Unlike manual IDV solutions, AI-driven systems constantly monitor for red flags. Duplicate accounts, suspicious transactions, and unusual behavior trigger investigations before any damage can be done.

Take Checkin.com, for example.

Its Botlens tool scans for bot activity, while anomaly detection systems look for anything out of the ordinary. These advanced fraud detection services cut out the need for manual reviews and promote proactive security measures at all times.

Privacy-preserving capabilities

It’s not just that users want to know their data is safe. Regulators demand it.

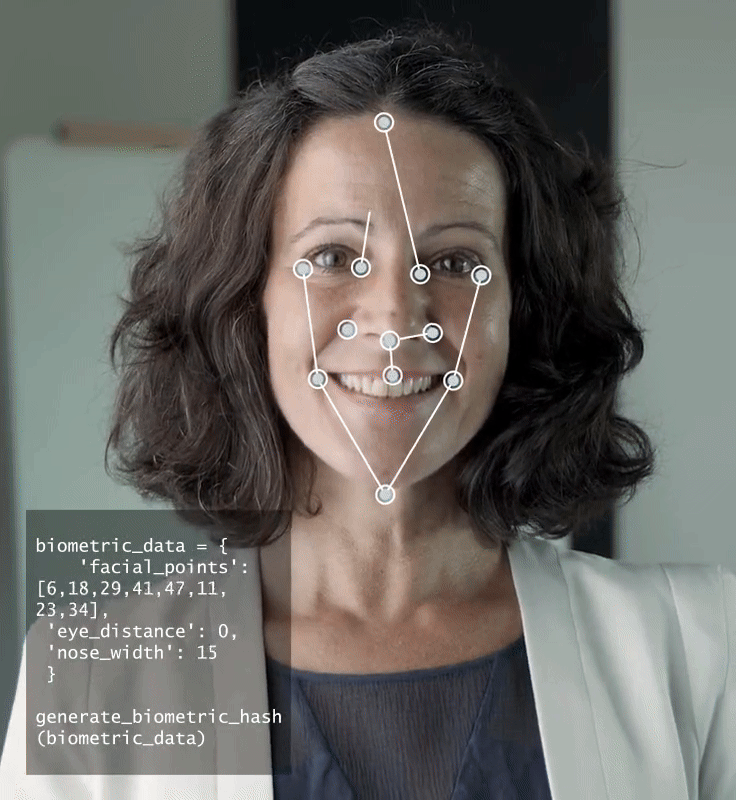

Modern identity verification software uses privacy-by-design principles to keep data safe.

Localized data storage, data minimization, zero-knowledge proofs, and encrypted biometric vectors protect user data from hackers trying to steal information.

For example, Checkin.com’s biometric vector storage doesn’t store full selfies, it converts facial features into encrypted mathematical patterns. These can’t be reverse-engineered so it protects user privacy while preventing fraudulent users from opening duplicate accounts.

AI-driven age verification

“Are you over 18?”

These basic self-declaration age gates are no longer good enough. Laws like the UK’s Online Safety Act demand “highly effective” age verification.

A simple click on a yes/no button won’t cut it. It’s too easy to bypass to be considered effective.

Instead, modern age verification tools use AI-powered identity proofing to verify age based on biometric data, backed by AI analysis of official documents.

This protects legitimate customers while preventing access by underage users.

Localized verification experiences

Users are far more likely to complete IDV processes if the processes feel straightforward.

That’s why leading IDV solutions now localize every step, from the interface language to the layout.

Checkin.com’s app, for example, is available in 80+ languages, with localized question flows and compliance requirements that kick in automatically.

So a user in Japan would see a completely different journey than a German user.

AI-powered perpetual KYC (pKYC)

The future of KYC isn’t just faster. It’s ongoing.

AI-powered perpetual KYC tracks risk signals on a continuous basis. When something changes in real time, such as a customer moving countries, the system immediately flags the risk and triggers a reverification or investigation.

This means you no longer need periodic manual reviews. Real-time risk scoring keeps profiles up to date, while catching fraud in action.

How do future-forward online identity verification tools actually work?

Modern online identity verification services leverage advanced technologies to solve speed, accuracy, and fraud issues.

Here’s how they work.

OCR + AI for document validation

Modern tools use OCR and AI-driven image analysis to scan, extract, and authenticate data from ID documents in real time.

These tools don’t just read the text: they verify layouts, fonts, and security features, comparing them against a comprehensive library of document templates.

The system cross checks user-submitted information with embedded document data to highlight inconsistencies.

It’s fast, it’s accurate, and it’s very convenient for the customer.

1:1 and 1:N biometric face matching and facial recognition

Facial biometric verification is a powerful security layer.

1:1 matching compares a user’s live selfie to their ID photo to check they’re the same. 1:N matching checks the image against broader databases to prevent identity fraud and deepfakes.

For added security, tools like Checkin.com store vector-based biometrics, not raw images. This allows the system to compare any new applicants against these past vectors to prevent fraudulent users from opening duplicate accounts.

3D liveness and deepfake detection

3D liveness and deepfake detection aim to prevent AI-generated identity fraud.

AI tracks micro-movements and analyzes image depth to confirm a real human is present during the verification process. This blocks spoofs, pre-recorded videos, and static images.

Ongoing AML database checks and sanctions screening

Real-time screening tools integrate with global AML databases and sanctions lists.

They continuously monitor transactions, behaviors, and status changes to update risk profiles and trigger further investigation.

This prevents fraud and mitigates risk in real time.

Who needs to upgrade their online identity verification services?

From fintech solutions to e-commerce platforms, businesses in every industry need faster, smarter IDV solutions that ensure compliance and reduce fraud.

Here’s a quick look at the types of companies that need more advanced online identity verification services and why.

| Industry | Example Services | How It's Used | Impact/Value |

| Financial Institutions | Banks, credit unions, investment banks | Verify customer identity, comply with KYC/AML, assess financial risk | Improves efficiency, reduces fraud, speeds up onboarding |

| Fintech Companies | Mobile wallets, crypto platforms, lending apps | ID verification, biometric checks, transaction monitoring | Faster onboarding, protects against digital fraud |

| Telecommunications | Mobile carriers, internet providers | Verify identity, detect SIM fraud, monitor suspicious behavior | Prevents SIM swaps, secures accounts, improves compliance |

| Rental Property and accomodation | Residential/commercial property managers | Tenant ID verification, background and credit checks | Streamlines screening, reduces tenant fraud |

| Insurance Providers | Health, life, and property insurers | Identity and risk profile verification, detect fraud | Improves underwriting, flags fraudulent claims |

| Travel Companies | Airlines, travel agencies, booking platforms | Verify traveller identity for booking and check-in | Prevents booking fraud, ensures regulatory compliance |

| E-commerce | Retailers, marketplaces, delivery apps | Verify buyers/sellers, ensure age compliance | Reduces chargebacks, prevents underage purchases |

| Healthcare & Telemedicine | Hospitals, clinics, telehealth apps | Verify patient ID for appointments, prescriptions, records access | Ensures HIPAA/GDPR compliance, prevents fraud |

| Online Gaming (non-gambling) | Multiplayer and social gaming platforms | Age estimation, real-time identity verification | Protects minors, improves platform safety |

| EdTech & Online Exams | Remote learning platforms, online testing | Verify student ID before/during sessions | Prevents cheating, maintains academic integrity |

| Ride-Sharing & Mobility | Car-share, bike-share, taxis | Verify drivers and riders during onboarding and access | Boosts user safety, reduces impersonation risk |

| Government & e-Governance | Public service portals | Secure citizen login and service access | Reduces benefit fraud, improves trust in digital services |

| Recruitment & HR Tech | Job boards, hiring platforms, HR SaaS | Verify candidate identity for right-to-work and background checks | Ensures hiring compliance, prevents false applications |

How to choose the right online IDV services

The right online identity verification service offers the perfect balance between speed, compliance, and user experience.

Here’s what to look for, and what to avoid.

Must-have capabilities

Modern IDV solutions should offer a suite of tools that help prevent fraud and improve accuracy.

Look for the following:

- AI document analysis of global IDs: Your tool should use AI to analyze thousands of identity document types across all the regions you operate in. Look for tools trained on diverse, global datasets to prevent bias.

- Biometric analysis: Fast, precise facial recognition is key. Your provider should offer both 1:1 and 1:N matching using privacy-respecting biometric vectors instead of raw image storage.

- Liveness detection: Choose a tool with proven 3D liveness detection and customizable acceptance thresholds.

- Cross-border compliance: Tools should support KYC, AML, and data privacy regulations in all the countries you service. Make sure the tool auto-updates to reflect regulatory changes.

- Easy integration with APIs and SDKs: Look for easy integration, clean developer documentation, and hands-on technical support during setup.

- User-friendly interface: Fast, mobile-optimized digital onboarding feels intuitive. Look for quick turnaround times and localized workflows.

- Privacy-first workflows: Find tools that offer data minimization, short retention periods, and privacy-by-design features to maintain privacy and meet compliance requirements.

- Strong security: Your IDV solutions should offer security features like robust encryption, audit trails, and multi-factor authentication. Look for ISO 27001 certification to ensure it meets global standards.

What to avoid

Avoid tools that rely on manual review systems. They’re slow, error-prone, and unscalable. It’s also tough to stay compliant when systems need updating manually.

Equally, make sure your provider can prove regulatory compliance. Without this proof, you risk breaching AML, KYC, and privacy regulations.

Lastly, avoid vendors with hidden fees and long-term contact lock-ins. Look for transparent pricing that scales with your needs.

Bonus features

There’s a few added extras to look for:

White-label solutions offer a branded customer experience that builds trust. Tools like Checkin.com allow full UI customization to fit your brand identity.

Equally, you need your solution to fit your systems without disruption. Look for providers that offer fast, expert-led integration support.

What now?

The future of IDV is already here.

Manual checks can’t keep up with increasing demands for ID verification, evolving fraud threats, and changing regulations.

It’s time to switch to a smarter solution.

Ready to modernize your verification flow? For future-forward online identity verification services that tick all of the boxes above, check out what Checkin.com can do.