Deepfake technology is infiltrating businesses at an alarming rate.

Malicious actors use AI-generated videos and images to simulate real people, creating false identities that bypass traditional KYC checks.

This puts your business at risk of financial crime, identity fraud, and non-compliance.

This is where AI-powered deepfake detection software can upgrade your KYC mechanisms.

Let’s look at how deepfake detection works to safeguard KYC and how leading industries put it into action to stay compliant and prevent fraud.

How do fraudulent users use deepfakes in KYC?

As Ofcom, the British Office of Communications, defines it, a deepfake is “audio-visual content that has been generated or manipulated using AI, and that misrepresents someone or something”.

In KYC, fraudulent users generate content with AI to create convincing fake identities. They use these identities to bypass conventional KYC verification processes.

Deepfakes are used to cheat KYC in a few different ways:

- Face-swapped ID documents - Original ID photos are switched with an AI-generated image to create a new identity using real ID data.

- AI-generated selfies - Deepfake-generated videos or images of a face that match the manipulated ID to pass liveness detection.

- Manipulated video verification - AI-generated videos designed to match the manipulated ID and selfie, and used to bypass liveness detection checks.

- Synthetic identities - Fabricated personas or mix altered images with real data to create false identities.

- Fake age assurance - AI alters an underage user’s facial features to make them appear older.

It’s almost impossible to detect AI-generated deepfakes during manual KYC processes. Humans are subjective and error-prone, often missing manipulations. In fact, 59% of people admit that they find it tough to tell if an image is AI-generated.

This makes it easy for fraudulent users to bypass traditional KYC mechanisms. This is why modern, intelligent KYC software is so important.

How does deepfake detection software work in KYC?

Deepfake detection software uses artificial intelligence (AI) to spot AI-generated images, fake videos, and synthetic identities during KYC.

Many industries, like financial services, gambling sites, and ecommerce sites, use it to prevent illegitimate users from accessing accounts and services.

These tools use advanced AI algorithms to verify ID documents, natural movements, and signs of aging to distinguish between real footage and manipulated media. It does this by combining document authentication, biometric verification, liveness detection, and watchlist screening.

Here’s how deepfake detection methods work.

AI-powered document verification

Optical Character Recognition (OCR) automatically extracts data from ID documents.

ID scanning technology validates the document’s authenticity. It examines security features, like fonts, textures, security markings, and holograms, to identify manipulations and AI-generated content.

The system will automatically flag any documents that appear to have been altered, face-swapped, or synthetically created.

Advanced biometric analysis

Biometric identity verification looks for AI-generated images and synthetic content in the following ways:

- It uses face matching to compare live selfies to official ID images.

- It checks for facial inconsistencies that indicate signs of manipulation.

- It assesses elements like facial features, structure, skin texture, and lighting variations to determine if images are fake.

Following this, the system uses facial recognition to cross-reference images against watchlists, government databases, and past verification attempts.

It aims to verify that the images belong to a real person and identify any high-risk individuals or people who have previously tried to submit false documentation.

Liveness detection

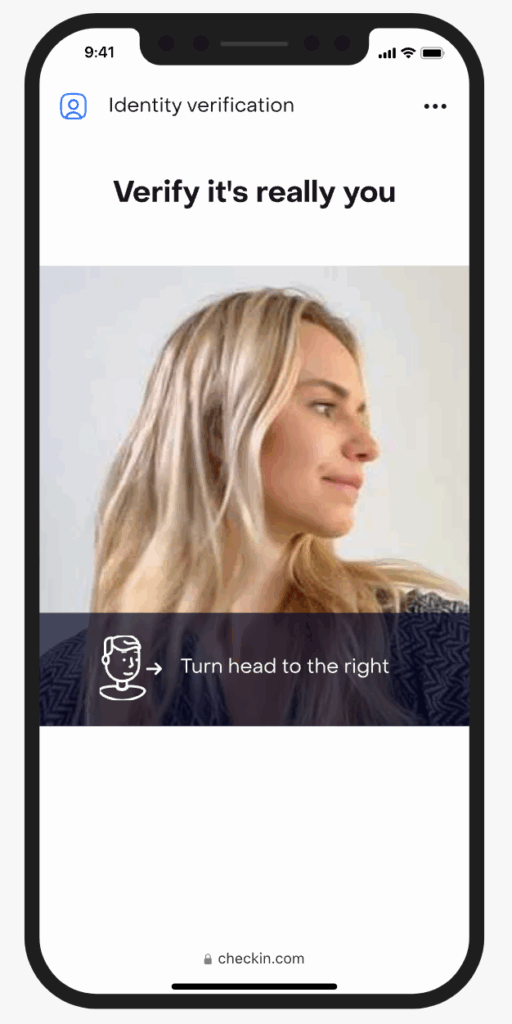

Liveness detection asks the user to perform motion prompts, like blinking or nodding, to ensure they’re present during the KYC process.

It analyzes elements like micro-expressions, blinking patterns, lip movements, and natural face movements to spot manipulations.

While AI-generated images are convincing to the human eye, they primarily alter visual information as a flat image or video. Liveness detection uses depth perception tracking to catch these 2D deepfake attacks.

This blocks attempts to use sophisticated deepfakes, such as facial filters or pre-recorded videos.

Real-time age assurance

Age assurance technology assesses facial features to block underage users from accessing age-restricted services.

Deepfake detection algorithms scan facial structure, skin texture, wrinkles, and other facial characteristics of an applicant's ID image and life selfie.

Then, it compares these images to a database of known age-related facial features to estimate a person’s age.

It looks for discrepancies between the two images or between the images and the age date on an identity document. Any disparities indicate that the images have been manipulated.

Continuous learning to stay ahead of evolving deepfakes

AI-based deepfake detection technology continuously improves to accommodate new deepfake techniques.

As new types of deepfake fraud emerge, AI algorithms identify these tactics and automatically update detection protocols to include them.

This helps you stay ahead of developing fraud techniques, reducing false negatives while improving detection capabilities.

Why businesses need deepfake detection software in KYC processes

Fraudulent users submit AI-generated content to bypass KYC to launder money and commit financial crimes.

Deepfake detection technologies help you catch malicious actors in action to prevent non-compliance, financial losses, and reputation damage.

Here’s how deepfake detection systems offer your organization protection:

Fraud prevention to catch AI-generated impersonation

Deepfake fraud is on the rise. Deepfake usage has risen 400% in the last year, now accounting for 7% of all fraud.

Criminals use deepfakes to impersonate real individuals or create false identities. They might manipulate real images or use AI to generate a realistic-looking identity.

These false identities allow bad actors to create fake accounts or hijack existing ones.

When a fake user has an account that doesn't match their real name, they can commit loan fraud, launder illegal funds, steal money, and access age-restricted services.

For example, a fraudulent user might create a deepfake video of a real person to open a high-value loan account at an online bank.

Deepfake detection uses facial biometrics, proof of liveness, and document authentication to spot manipulated media during the KYC process.

Age verification

Up until now, self-declaration has been the main form of age verification. It’s unreliable as users can simply lie.

To combat this, companies attempt to verify age by asking users to submit ID documents. This process still isn’t rigorous enough, either. Minors and malicious actors circumvent these processes by using deepfakes to create false identities.

The result is that underage applicants use false identities to access age-restricted services. Worse still, over-age users can create younger-looking identities to access services aimed at minors.

This doesn’t just leave minors vulnerable to inappropriate material and bad actors. It can also lead to non-compliance with age-related regulations, leading to legal penalties and reputation damage.

Deepfake detection systems verify a user's age by comparing facial features in ID documents and live selfies to databases of known age-related data to find discrepancies. It also scans official databases to try to match users to a known identity.

This blocks attempts to bypass age restrictions.

Compliance with AML & KYC regulations

Compliance with anti-money laundering (AML) and counter-terrorist financing (CTF) regulations is mandatory.

Failing to meet the requirements ends in hefty fines, legal action, and reputational damage.

Deepfake detectors prevent fraudulent accounts from committing financial crimes that can leave you non-compliant.

And unlike manual fraud detection, AI-powered deepfake detection evolves automatically to incorporate new regulations and emerging threats. This keeps you compliant without having to continuously update your systems manually.

Top benefits of AI-powered KYC deepfake detection software

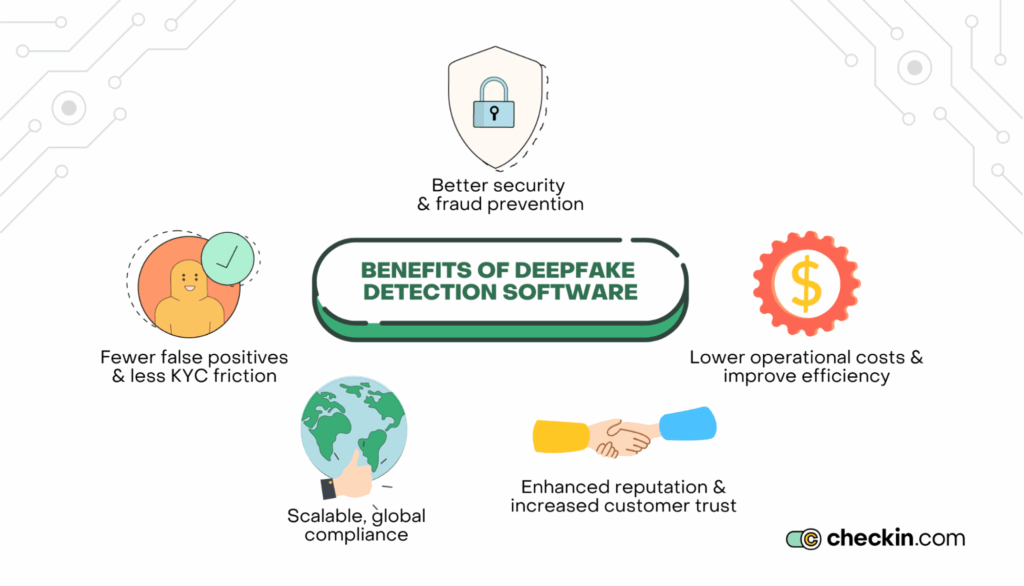

AI-powered deepfake detection streamlines KYC and increases security to build a solid brand reputation.

Here’s how.

Better security and fraud prevention

Manual KYC systems struggle to keep pace with the evolving sophistication of new types of fraud and financial crime.

AI-powered systems use a variety of techniques to spot suspicious activity and high-risk behavior as it occurs, including:

- Deepfake detection

- Anomoly detection

- Bot detection

- Transaction monitoring

- PEP, sanctions, and adverse media list screening

Using these techniques, AI can spot subtle cues, patterns, and discrepancies that human reviews often miss.

Fewer false positives and less friction in KYC

It’s tough to balance security with user experience. While you need to catch fraudulent users, you don’t want to create so much friction that genuine users abandon their applications.

The problem is that manual reviews are prone to human error. They find it hard to tell if ID documents and applicant images are real or fake.

This can lead to lots of false positives where legitimate users are submitted for enhanced due diligence (EDD) processes. This further investigation slows down KYC, causing approval delays.

Deepfake detection decreases the number of users incorrectly flagged as suspicious. This leads to smoother onboarding for genuine applicants and fewer dropouts.

Lower operational costs and improved efficiency

Manual fraud detection is labor-intensive, slow, and expensive. Human reviewers have to scrutinize applications one by one.

AI-based detection models automate the process using digital identity verification, document authentication, and automated screening.

This reduces manual review workloads and cuts back on the cost of unnecessary investigations. KYC processing is faster and more efficient.

Scalable, global compliance

If you’re operating internationally, you need to stay compliant with AML and KYC regulations within the regions you operate in.

It can be tough to expand globally while keeping up-to-date with evolving regulations and emerging fraud tactics.

It becomes even harder when human reviewers have to try to spot deepfakes within a variety of foreign ID documents.

Tools like Checkin.com can analyze over 13,000 ID types across 190+ countries. This ensures compliance with global KYC and AML in markets like the US, Canada, EU, and APAC, while identifying deepfakes present in documents from all these regions.

Plus, AI-powered systems automatically configure to meet changing AML laws and new deepfake techniques in different regions. This enables you to scale globally without fear of fraud or non-compliance.

Enhanced reputation and increased customer trust

Long-term business success relies on customer trust.

Companies with a reputation for fraud struggle to attract new customers and keep existing ones.

By implementing deepfake detection software, you add an extra layer of security that prevents bad actors from entering your organization.

This demonstrates a commitment to security that enhances your brand image and fosters loyalty.

Real-world use cases: Industries that benefit from deepfake detection software during KYC

Who needs deepfake detection? Any business that verifies identities.

Whether you’re trying to prevent financial crime, stop account takeovers, or restrict underage users, a real-time deepfake detector is a must.

Here’s how top industries are using these tools.

Financial institutions

Banks, fintechs, payment processors, and other financial entities are prime targets for deepfake fraud.

Criminals use AI-generated identities to open accounts, secure loans, or access customer accounts illegally.

Deepfake technology analyzes ID authenticity, verifies biometric data, and performs liveness checks to catch deepfakes during KYC. On top of this, continuous transaction monitoring flags suspicious activity, passing users are for further investigation.

Take Decta, for example.

The global payment processor uses Checkin.com’s automatic ID verification to speed up document checks by 20%. The technology catches falsified documents immediately, preventing false positives that slow down KYC.

Online gaming and gambling

The online gambling industry is ripe for fraud.

Bad actors use deepfakes to:

- Bypass age verification

- Create multiple accounts to take advantage of bonus schemes

- Take over someone’s accounts

- Obscure their history of financial crime

- Hide their reputation for poor gambling practices

Intelligent KYC software detects deepfakes used to bypass age checks, create duplicate accounts, and open fraudulent accounts.

Betcity.nl is a good example of reliable deepfake detection software in action.

The online gambling site automates KYC and age verification with Checkin.com. It catches deepfakes during account setup and keeps the company compliant with changing regulations worldwide.

Cryptocurrency exchanges

Malicious actors create deepfakes to create fake accounts or to impersonate real crypto exchange users for unauthorized access.

Deepfake detection kicks in during KYC to verify users during onboarding and spot manipulated images.

But it can also be used to verify users who have forgotten their passwords or to sanction high-value transactions.

For example, if an exchange user applies to change their password, the system would prompt biometric re-verification. AI document analysis, liveness detection, and biometric authentication check that the true user is present.

Ecommerce platforms

Deepfakes are used on ecommerce platforms to:

- Purchase age-prohibited goods

- Commit seller fraud

- Take over accounts

- Create fake reviews

- Facilitate fraudulent returns

Deepfake detection verifies both seller and buyer identities.

AI-powered identity verification confirms seller legitimacy, prevents account takeovers and fraudulent returns, and detects synthetic content in reviews.

Travel industry

Deepfakes can be used to create fake travel documents, bypass security checks, and access travel accounts to change details.

Deepfake detection verifies passenger identities against their official documents. It can compare a live person to their document at check-in to prevent travelers from using deepfakes to get through security checks.

For example, travel company Flighthub uses Checkin.com’s ID scanning and biometric authentication to verify traveler identities. It detects fraudulent documents so only legitimate travelers can pass through.

Detect deepfakes and combat fraud

Deepfake fraud is becoming more prevalent. It’s so advanced that traditional KYC processes are vulnerable to its cleverly evolving tactics.

Effective deepfake detection tools strengthen identity verification. Using facial recognition, liveness detection, and document authentication, you can spot deepfakes in their tracks.

By integrating real-time deepfake detection techniques, you can reduce fraud risks, improve compliance, and cultivate customer trust.

Don’t compromise security with deepfakes. Explore how Checkin.com’s deepfake detection tools can protect you from evolving threats. Contact us today.