Fraud is on the rise. And it costs businesses billions every year.

KYC solutions exist to try and identify and prevent fraud. The problem is that conventional KYC procedures aren’t effective enough at catching complex cases.

They take too long, they’re prone to human error, and they can’t spot new fraud tactics quickly enough.

It’s not just lost revenue you have to worry about. This damages your reputation and leaves you open to compliance fines.

This is why you need to consider KYC automated solutions.

They revolutionize fraud prevention with real-time detection and highly accurate verification.

In this article, we’ll explore the ways automated KYC combats fraud and picks up the slack where manual KYC checks aren’t working.

The problem with manual KYC in combating fraud

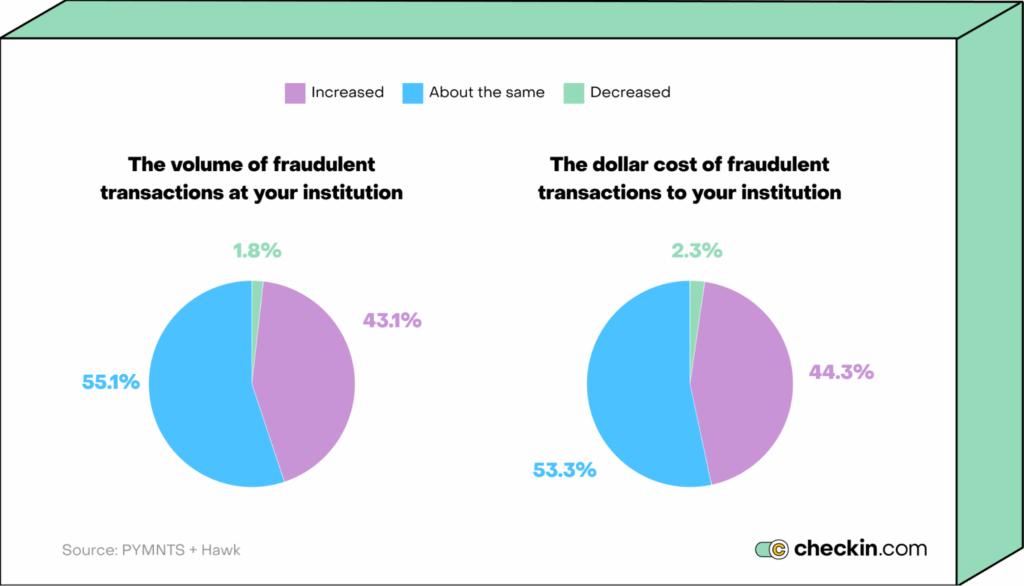

The rate of fraud is rising. Almost half of financial institutions say there’s been an increase in both the amount and cost of fraud in the past year.

Manual processes are slow, error-prone, and costly.

This makes it tough for organizations to catch fraud during the onboarding phase. And harder still once an application has been approved.

Let’s take a closer look at the issues with manual KYC processes.

There’s too much room for human error

Manual errors create a big risk in the customer onboarding process.

It’s too easy for humans to make mistakes in manual data entry, identity verification, and document authentication. Human agents frequently miss signs of suspicious activity.

This can result in illegitimate individuals slipping through the net. Overworked or undertrained staff might approve falsified identity documents or overlook potential risks.

These mistakes help fraudsters thrive.

Sophisticated fake IDs can bypass manual security checks due to subjectivity. What seems “off” to one person might seem plausible to another.

As companies grow, the problems get worse. As human agents do more and more security checks, they have less time to scrutinize documents. Fake IDs are more likely to pass through unnoticed.

Fraudulent tactics evolve too quickly

Fraudsters are getting cleverer. Companies still using outdated manual systems are falling behind.

There are more advanced methods than ever before to bypass old-fashioned mechanisms.

Manual identity verification is no match for new threats, like deepfakes.

Using deepfake videos, fraudsters can convincingly pose as real individuals to bypass security measures. This would easily fool a tired or inexperienced KYC agent.

Unfortunately, manual KYC procedures lack the tools to adapt to these changing tactics. Fraud tactics evolve faster than institutions can train staff to detect them.

In fact, many institutions don’t even know about these new tactics. Unlike automated KYC, human-led KYC doesn't have self-evolving algorithms that catch modern methods.

KYC processes are too slow

Traditional KYC processes are tedious. Manual document verification and background checks take a long time.

A person has to review all identification documents by hand. This is slow and delays the client onboarding process.

Fraudsters exploit these delays.

They attempt to open multiple accounts using falsified documents across different institutions. The delays allow some of these accounts to slip through the cracks before others get flagged.

If someone notices the fraud, there are further hold-ups as human agents have to deal with the issues. This means longer wait times for legitimate customers.

It’s expensive to improve the manual process

Manual KYC is resource-heavy.

Teams of people process documents and assess potential risks by hand.

This means high operational costs.

And, for institutions to scale client onboarding, they have to hire more and more people to handle the increase in security checks.

Focusing budgets on paying staff means diverting resources from combating fraud effectively.

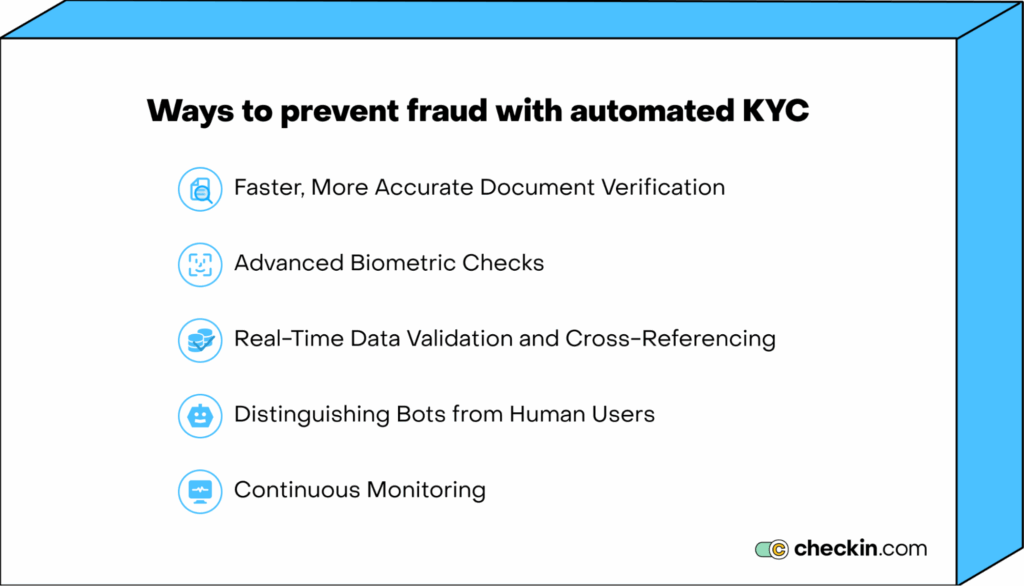

How KYC automated solutions help prevent fraud

Automation solutions transform onboarding processes.

These advanced technologies improve speed and precision. Businesses verify customer identities faster and with greater accuracy. This reduces the risk of fraud.

Automated KYC solutions use digital identity tools to stay ahead of potential fraud.

Here’s how.

Faster, more accurate document verification

Automated document verification uses Optical Character Recognition (OCR) and facial recognition to analyze government-issued IDs.

This is far quicker than manual verification, and much more accurate.

Take Admirals, for example. Using Checkin, the financial services company decreased verification time by 90%.

But it’s not just that automated KYC can verify documents quicker. It’s also true that these tools can identify fraudulent activity instantly. This is why 51% of financial institutions plan to introduce document verification technology to combat fraud.

These technologies catch forged documents, mismatched data, and tampered visuals immediately. By addressing fraud upfront, businesses avoid the disruption of fraudulent applications slipping through.

With AI-powered solutions, fraudsters face more difficulty bypassing the customer due diligence process. But legitimate users enjoy faster, seamless onboarding.

Advanced biometric checks

In 2024 and beyond, 55% of financial institutions plan to introduce advanced biometric and liveness detection to prevent fraud. This is because biometric technology strengthens the customer verification process.

It uses liveness checks and biometric authentication, like facial recognition technology. These tools check a person is real and match them to their documents.

These tactics block attempts to use deepfakes or stolen IDs. Biometric verification validates features that are unique to each person. The uniqueness of the data points makes them almost impossible to impersonate.

Plus, unlike manual systems, biometric technology doesn’t rely on physical documents. This means a lower risk of ID tampering.

This significantly improves security while offering convenient customer experiences during the verification process

Distinguishing bots from human users

Fraudsters often use bots to try and sneak through KYC measures.

Intelligent automation tools like Botlens detect activity that looks like a bot in milliseconds.

It analyzes mouse movements, keystrokes, and navigation patterns to flag actions that don’t feel human. It also uses flow sequence control to track the logical progression of actions. This will identify behavior that’s typical of a bot, like unusually fast movements or repetitive behavior.

Automated KYC tools also perform integrity checks and source monitoring. These checks make sure devices are authentic and trustworthy. They analyze the device’s unique identifiers and assess behavioral patterns to detect tampering. This prevents fraudulent activities like account takeovers and SIM swaps.

Continuous monitoring for risk management

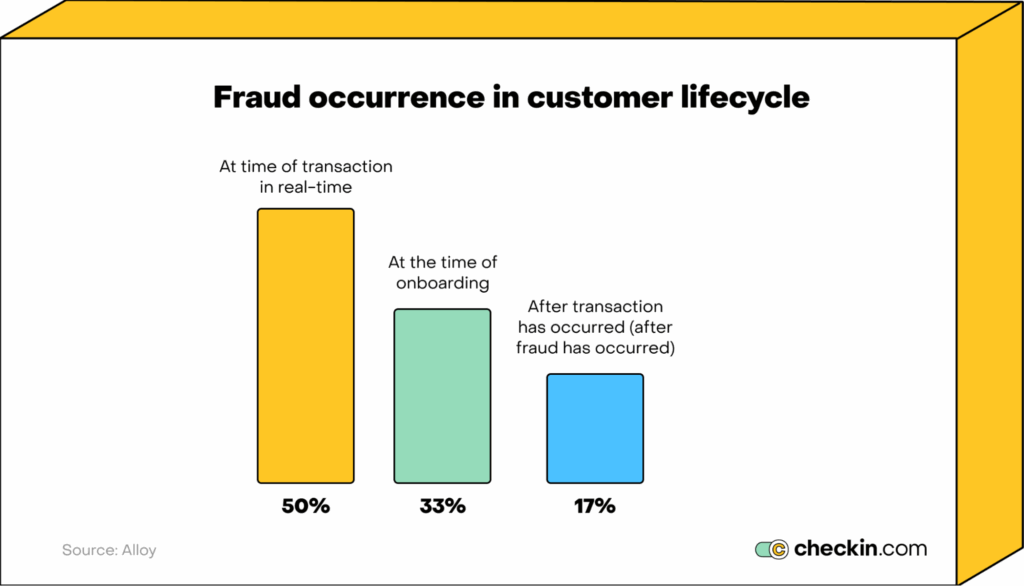

Fraud doesn’t just happen during onboarding.

It’s true that 33% of fraudulent transactions happen at the signup stage. But half of all fraud is caught at the point of transaction — not during onboarding.

Automated systems continue to watch for suspicious activity after the onboarding stage.

They track financial transactions and automatically update a customer’s risk status over time. They flag anomalies like mismatched locations or sudden large transactions that might indicate fraud.

Continuously analyzing customer behavior helps AI systems self-evolve to catch emerging fraud tactics.

Through continuous monitoring of customer transactions, institutions combat anti-money laundering violations and identify long-term fraud risks. Businesses stay compliant while improving their capacity to detect new threats.

5 common types of fraud and how KYC automated solutions combat them

Three-quarters of financial institutions still manually check anywhere from 26% to 44% of customer applications.

This makes them highly vulnerable to fraudsters.

Here’s how KYC automation addresses some of the most common types of fraud.

1. Combating identity theft

Identity theft involves stealing personal information or ID documents to impersonate someone.

The problem with manual checks is that they often lack cross-referencing capabilities. This allows fraudsters to use their stolen data to bypass basic verification measures.

Automated KYC validates identity documents against external databases automatically. It flags discrepancies and suspicious behavior. This lowers the risk that fraudulent applications will go through.

2. Detecting document forgery

More than 11% of fraud relates to fraudulent documents.

The problem is that conventional KYC methods struggle to detect this type of fraud. Human reviewers often miss subtle inconsistencies in official documents that point to fraud. Think missing holograms, altered fonts, or slightly incorrect data fields.

While humans struggle to notice these nuances, advanced OCR and AI-powered KYC tools don’t — they can spot these irregularities without issue.

They analyze document integrity and flag mismatched elements or missing security features. And unlike a human, automated KYC recognizes errors in thousands of different types of documentation.

For example, Checkin can scan and verify over 14,000 document types from 190+ countries.

In this sense, automated KYC tools are far better at spotting fake identities.

3. Addressing synthetic identity fraud

Synthetic identity fraud is complex. Fraudsters combine real details with fake information to create plausible false identities.

And synthetic identity fraud is so sophisticated that it’s very hard to recognize.

In fact, statistics say that synthetic fraud only accounts for 4% of all fraud. But most financial experts agree it’s likely very underreported.

This is because it can take a fraudster years to create a realistic synthetic identity. And it can take even longer to use it.

Fraudsters often don’t commit the fraud straight away. They wait for a long time after an application is accepted to carry out financial crimes. Experts say that data stolen in 2020 will start to resurface now.

These applications are tough to spot because human reviewers often accept information at face value. They fail to validate data points like addresses or Social Security Numbers (SSNs).

In contrast, automated KYC cross-references multiple data points instantly. This automatic reconciliation immediately identifies inconsistencies that point to synthetic profiles.

4. Blocking deepfakes and spoofing

Deepfakes and spoofed media use AI-generated visuals to falsify documents and live interactions.

For example, fraudsters may use videos that convincingly mimic a real person or embed a fake image into a real passport.

It’s very hard for a human to detect pre-recorded AI-generated videos, fake live streams, or altered IDs.

Biometric verification solves this issue.

Liveness detection ensures the person is physically present and that they match their ID. Facial recognition and consistency checks flag manipulated visuals.

Unless a person is present and matches their ID, they can’t move forward with onboarding.

5. Mitigating insider fraud

Insider fraud occurs when staff collude with fraudsters to approve fake applications.

This is possible because manual processes allow for human subjectivity. This gives room for corruption.

There’s no subjectivity in KYC automated solutions. These tools remove human control from the verification process. They apply consistent rules using unbiased algorithms. Plus, role-based access means staff only see what’s necessary for their position.

This cuts out the opportunity for corruption.

Knock fraud on the head with automated KYC solutions

With automated identity verification solutions in play, fraud has met its match.

Manual verification systems have significant limitations. Inefficient processes combine with human errors. The result? Overwhelmed and underresourced teams overlook fraudulent applications.

But it’s not just onboarding fraud that’s an issue. When you rely on manual processes, it’s hard to catch fraud later in the customer lifecycle.

Automated KYC solutions help tackle this with precise, scalable fraud prevention mechanisms.

From liveness detection and biometric verification, to transaction tracking and anomaly identification, automated KYC offers a real-time solution to evolving fraud tactics.

Don’t risk your bottom line with manual KYC. Take action now to protect your business and customers.

Book a consultation with our team to explore our automated KYC solutions to supercharge your fraud prevention.