Imagine unlocking your phone.

You could type in a PIN. It’s a simple digital process that’s effective and fast.

But, you could also use Face ID. It’s faster, more intuitive, and almost impossible to hack.

That’s the promise of biometric Know Your Customer (KYC). Convenience meets security and accuracy.

Unlike traditional KYC methods, biometric verification confirms someone’s identity with data that’s biologically unique to the individual. Not only is this very user-friendly, it’s smarter and more secure than non-biometric methods.

After all, someone could always guess your PIN, but they can’t mimic your face easily.

Rather than sifting through ID documents with error-prone manual checks, biometric KYC is fast and precise. It gives you a powerful edge to fight fraud and deliver a seamless onboarding experience.

In this article, we’ll dive into how biometric KYC works. We’ll look at the benefits and how to implement it for maximum impact. Let’s explore how biometric KYC transforms identity verification and why it’s the future of onboarding.

What is biometric KYC?

Biometric KYC is an advanced technique for verifying a customer’s identity using unique biological features.

It replaces manual document checks with automated technology for stronger security and faster onboarding. Since it’s more accurate than manual verification, it also enhances compliance.

There are a few methods of biometric verification.

While fingerprint and voice recognition are classed as biometric verification, they’re not widely applied to KYC processes.

This is because biometric KYC checks need to validate and verify ID documents. There are no fingerprint or voice components to identity documents.

Instead, KYC biometric techniques focus on face matching, facial recognition, and liveness detection. All of these tactics help to authenticate documents and confirm the applicant is who they say they are.

Here’s how they work.

- Face matching:

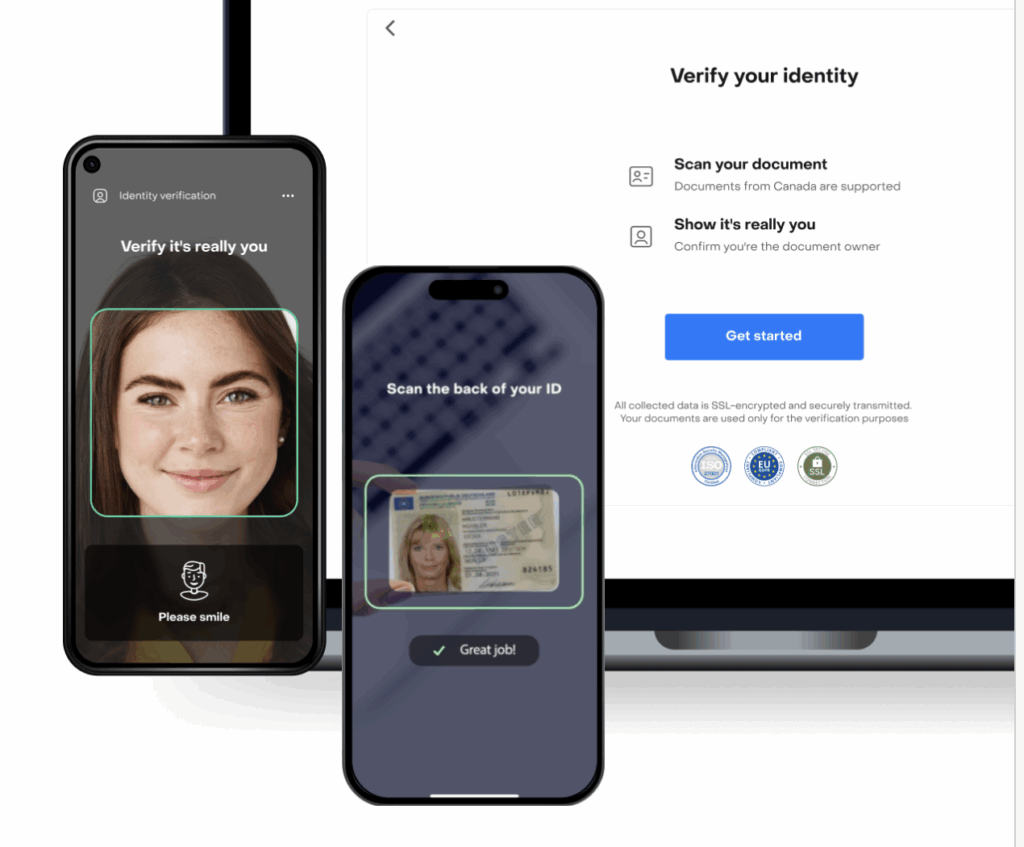

Face matching focuses on making sure the person submitting the document is the same as the person in the document. This is done through advanced AI-powered 1:1 facial analysis.

The process requires users to take a selfie or record a short video.

The technology scans the selfie and document image and extracts unique facial features from both images. It converts these facial characteristics into biometric markers, which are mathematical representations of facial features.

Unlike raw images, these biometric vectors can’t be reverse-engineered into a photo. This makes the process highly secure and privacy-compliant.

The software’s advanced algorithms perform a 1:1 comparison, which generates a similarity score between the two pictures.

Customers can customize confidence thresholds, setting their own acceptable match level. This helps to reduce false positives or negatives.

Not only is face matching an excellent way to verify a person against their ID, it also protects companies against fraud attempts by the same person.

The software stores the biometric vectors (not the full images). If the same person attempts to verify themselves using ID documents with a different name, age, or address, the system will recognize the familiar biometric vectors and flag the application.

This helps to detect repeat offenders automatically.

- Facial recognition:

Facial recognition technology expands on face matching. It checks a person’s identity against a broader database.

Algorithms analyze facial geometry using convolutional neural networks (CNN). These deep-learning models extract important biometric markers, such as a person’s nose shape, jaw contours, and the distance between their eyes. It uses these to create a unique facial signature before comparing it to external databases.

Face matching performs a 1:1 analysis, comparing one individual against a single document. Facial recognition performs a 1:N (one-to-many) search. It compares a live image to millions of stored biometric vectors in official databases to confirm a person’s identity.

1:N matching is particularly helpful for:

- Catching applicants who have been flagged for fraud before

- Speeding up re-authentication for return users

- Performing compliance checks such Politically Exposed Person (PEP) or sanctions screening

Speed is an important factor here. Some biometric KYC solutions can take up to 20 minutes to complete these comparisons. Checkin.com’s technology is one of the fastest on the market. It can process millions of comparisons in milliseconds.

- Liveness detection:

Liveness detection confirms that the customer is physically present during the application. It prevents fraudulent users from using spoofed images or pre-recorded videos to bypass security checks.

Fraudulent users will frequently attempt spoofing attacks using an altered image of somebody else’s face.

To prevent this, liveness detection gives the user motion prompts like smiling or moving their head.

It analyzes subtle physical cues to distinguish between real users and fraudulent attempts to enter the system.

Liveness detection uses AI-driven motion analysis and depth perception to analyze:

- Micro-expressions like blinking, pupil dilation, and facial muscle responses

- Depth to determine if the image is flat or three-dimensional

- Light reflection patterns to differentiate between real skin textures and screen or printed images

- Motion to determine natural human behavior from manipulated visuals

Adaptive AI algorithms mean the model continuously learns, enabling it to detect new fraud techniques as they emerge.

These three major biometric techniques work in unison for a secure, accurate KYC process.

But achieving this level of accuracy doesn’t happen overnight. Strong biometric KYC systems require extensive training.

Top-caliber biometric KYC tools aren’t simply built and deployed. They undergo continuous leaning on huge, high-quality datasets. This refines their ability to match faces and detect fraud. It also helps recognize evolving threats and adapt to them.

Checkin.com’s models are trained using millions of diverse facial images and demographic variations across a range of different angles and lighting conditions.

This training investment ensures the highest level of precision and helps to eliminate bias to make KYC biometric systems powerful and reliable.

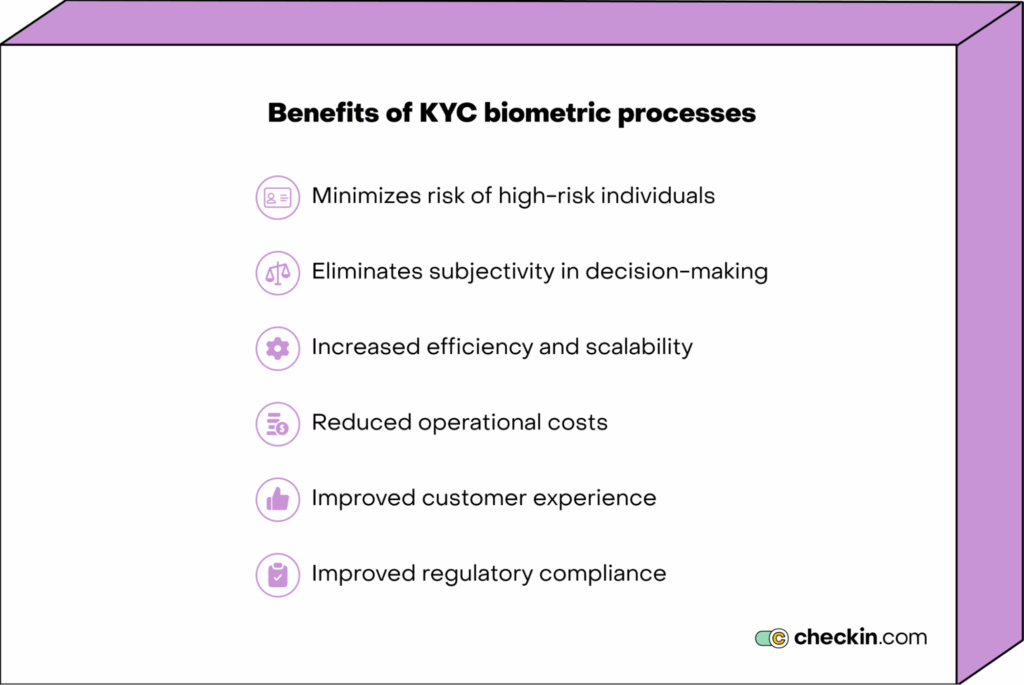

What are the benefits of biometric KYC processes?

Biometric technology transforms identity verification. Unlike manual or non-biometric verification methods, it uses unique biometric identifiers to confirm a person’s identity.

This offers a more secure, accurate, and efficient customer identification process.

This doesn’t just reduce the risk of error and fraud. It also keeps you compliant with evolving regulations.

Let’s look at how and why biometric KYC surpasses traditional methods of verification.

Reduces fraud

According to almost half of financial institutions, fraud is increasing. This makes it clear that traditional KYC methods aren’t robust enough to handle evolving fraud tactics.

Conventional KYC methods rely on human judgment to confirm a person’s identity. Biometric KYC uses biometric identifiers. These identifiers are almost impossible to steal or replicate.

By focusing on unique features like facial biometrics, the system can weed out document forgery, identity theft, and account impersonation. It uses a person’s unique features to spot inconsistencies that point to fraud.

You’re no longer relying on the skill and experience of non-biometric document reviews. Instead, biometric KYC software combines face-matching, facial recognition, and liveness detection.

These techniques provide an extra layer of security to ensure the person is present when applying and that their documents match their identity.

This practically eliminates the risk of deepfakes, altered images, and stolen or forged documents.

Minimizes risk of high-risk individuals

It’s not just outright fraudsters you have to worry about. Some individuals pose a high financial risk to businesses. They may be a PEP, have ties to high-risk regions, or have a history of poor credit.

Biometric KYC platforms pair biometric authentication technology with automatic database checks. They offer PEP screening and check applicants against sanctions lists. This creates a risk score that helps businesses build a risk profile to pinpoint high-risk individuals.

This way, you can automatically identify applicants that might be a financial or compliance threat to your organization.

Eliminates subjectivity in decision-making

Human agents bring subjectivity to decision-making. Whether it's due to fatigue, inexperience, oversight, or bias, humans can make different decisions about applicants each time.

Human errors in customer verification can lead to compliance issues and costly mistakes. They might onboard fraudulent individuals while rejecting legitimate customers.

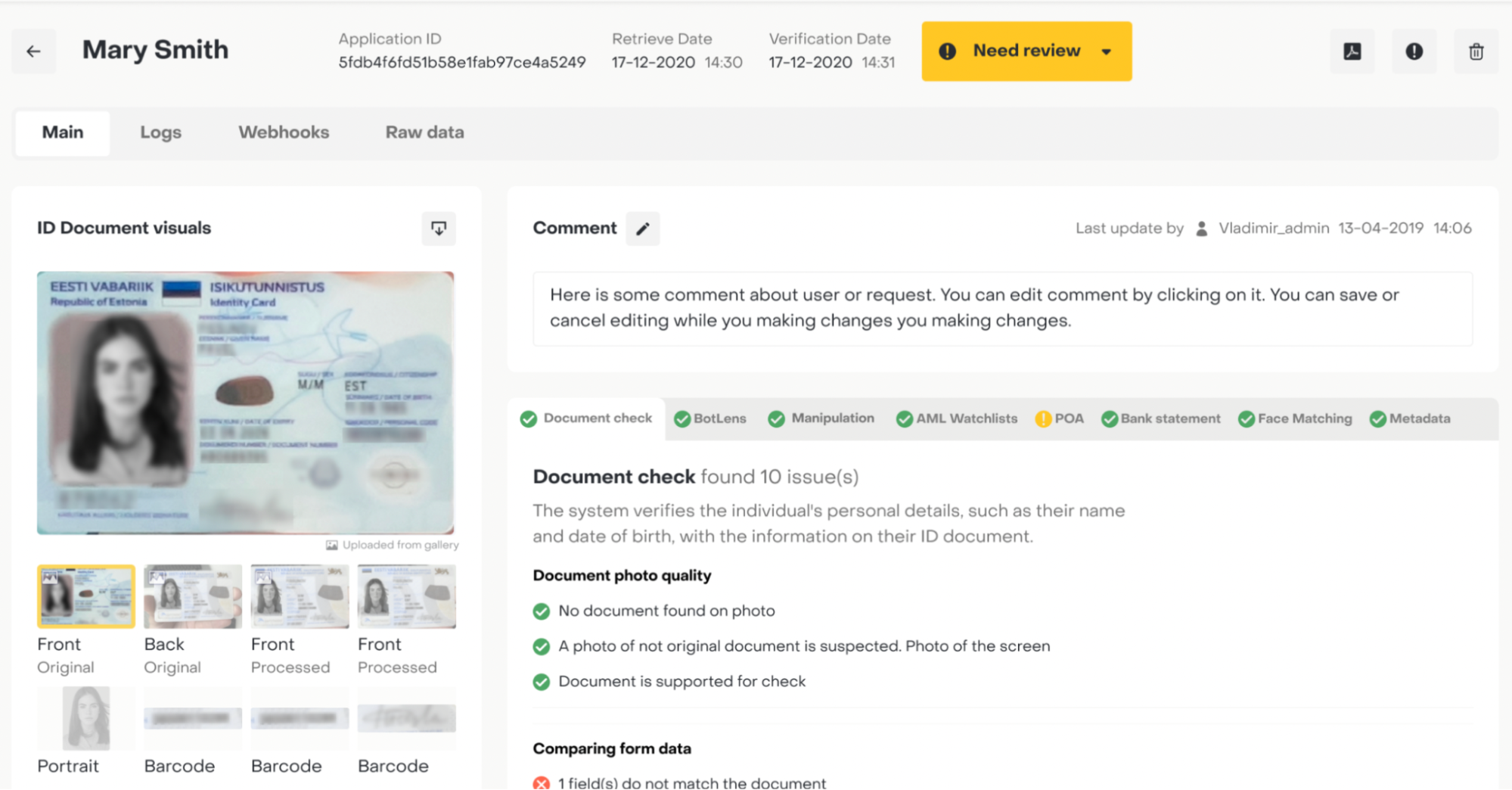

Biometric KYC systems cut out subjective decision-making. Intelligent algorithms follow standardized, unbiased processes based on pre-defined rules.

Using facial contours and expressions, the algorithms judge each applicant with the same set of criteria each time.

The high precision results in consistent decision-making. Only genuine customers pass through smoothly. Potential risks get flagged for further review.

Increased efficiency and scalability

What makes a system efficient and scalable? Accuracy and speed.

Biometric KYC systems automate the repetitive tasks associated with customer verification.

Currently, one in five applicants drop out of onboarding processes because applications take too long. This is because conventional verification methods are slow as humans have to scrutinize ID documents by hand.

In contrast, biometric KYC automates this process to confirm identity in seconds.

Take Decta, for example. Using Checkin.com’s biometric KYC systems, verification takes no more than five seconds. The result is a 20% decrease in processing time.

Plus, biometric systems can handle vast amounts of data quickly and accurately. This means they’re not only faster. They’re more scalable.

With traditional KYC methods, you’d have to hire more KYC officers to handle a higher volume of applications. But biometric KYC can handle lots of applications without increasing resources.

Reduced operational costs

Biometric KYC drives cost savings.

Accurate, scalable verification reduces reliance on labor-intensive manual processes. This cuts operational costs as you don’t need to pay as many KYC officers.

On top of that, you lower the costs associated with fixing mistakes. Since biometric KYC is so precise, errors don’t slip through. You no longer need to allocate budgets to error correction.

Biometric verification also cuts out fraud. Where budgets might previously cover a certain amount of fraudulent activity, you’re no longer subject to these financial losses.

And you can say goodbye to compliance fines. Since biometric KYC methods are so accurate, there’s no risk of compliance issues, so you don’t need to worry about the risk of fines.

Improved customer experience

Biometric KYC isn’t just a bonus for your business. It’s also more convenient for your customers.

You replace slow, paperwork-heavy onboarding procedures with user-friendly verification. The process completes in minutes, cutting out long wait times and tedious paperwork.

This boosts customer satisfaction and loyalty and lowers dropout rates.

Improved regulatory compliance

Regulatory requirements are strict. But they’re also constantly changing.

Manual KYC processes are too slow to keep up with regulatory evolution.

Biometric KYC algorithms evolve and adapt in real time to align with changing regulations.

This makes it a very reliable method to ensure compliance with anti-money laundering (AML) regulations and KYC standards.

This reduces your risk of fines, reputation damage, and operational disruption.

Best practices: 6 tips to successfully implement biometric KYC processes to streamline onboarding

Advanced methods of identity verification make way for operational efficiency and better compliance.

However, for you to truly realize the benefits of biometric KYC, you need to implement these measures strategically.

Here are the best practices to put your liveness detection and facial recognition systems into action effectively.

1. Assess your needs

Before adopting biometric identification tools, you must understand your needs. Evaluate your specific challenges to understand how to combat your weaknesses.

Does your company suffer from identity fraud? Is slow onboarding an issue? Do you want to fix compliance gaps?

Knowing your pain points helps you find tailored solutions that meet your needs.

Conduct an internal audit of your current KYC processes. Pinpoint bottlenecks and weaknesses during the authentication process.

Speak to compliance officers and customer service teams. Their feedback can help you identify the main fraud risks and show you where customers drop off.

This way, you can ensure your biometric solutions directly align with your business goals.

2. Choose the right technology partner

The success of your biometric checks comes down to picking a reliable provider.

Search for vendors with proven experience and advanced technological capabilities.

It’s not just about having top-notch facial recognition solutions. It’s also about finding KYC software with integration capabilities and security features that meet your needs.

Test out different solutions to find high-quality providers that prioritize security, user-friendliness, and scalability.

For example, some providers use raw images to perform KYC checks. This isn’t particularly secure.

Opt for a technology partner that uses encrypted biometric vectors to guarantee secure, compliant data handling.

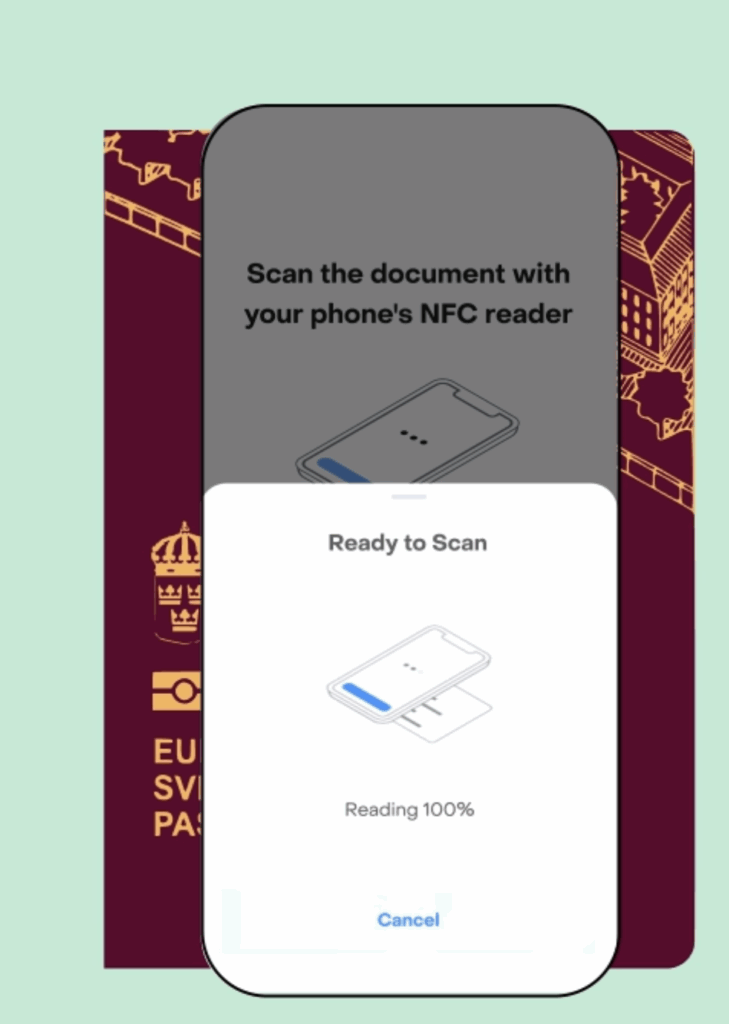

3. Integrate biometric tools

It’s more efficient to integrate biometric authentication tools into your current workflows, rather than overhauling your entire process.

You can do this using APIs or SDKs. This enables compatibility across all your devices and platforms, including web, desktop, and mobile.

KYC providers offer flexible SKDs to help you implement biometric KYC efficiently. This puts biometric verification front and center of your existing onboarding process without having to reinvent the wheel.

4. Design intuitive user workflows

Make it easy for your users.

Don’t just expect them to understand how biometric verification works. Simplify the process with clear instructions and easy-to-access support.

Offer onboarding in multiple languages to localize the experience. This improves customer satisfaction as they can access your services in their native tongue.

For example, platforms like Checkin.com support 80+ languages and 190+ territories. This means users worldwide can onboard without friction, increasing the likelihood of successful verification.

5. Train your team

It’s not just your customers who need to understand the process. Your teams also need to understand how your biometric systems work.

Educate compliance officers, support staff, and other key teams. Show them how to use the technology and explain the benefits.

Provide workshops, create training materials, and devise escalation procedures for special cases.

Make sure the provider you pick has a user-friendly interface so staff can benefit from the software as quickly as possible.

6. Monitor and adjust

It’s simple to implement biometric technology when you have the right provider. But it’s also important to regularly evaluate its performance.

Regular monitoring allows you to understand where you need to adjust your workflows for optimal performance.

Use the analytics and reporting features in your KYC solution to understand how well it works. Look at metrics like fraud detection rates, onboarding time, and customer dropout rates. This will show you where you need to improve the process.

Biometric solutions for secure, streamlined applications

Biometric KYC transforms the customer onboarding process.

You’re not just improving security and cutting down on fraud. You also enhance the entire process for the customer.

Applications go through faster, you need less staff, and there are far fewer mistakes.

It solves the key challenges of inefficiency and compliance risks all in one go, and delivers faster, more seamless experiences for customers.

If you’re ready to upgrade your onboarding experience, contact Checkin.com today. Explore our leading-edge biometric KYC solutions and elevate your customer journey.