KYC onboarding driven by manual processing is riddled with bottlenecks. Errors and inefficiencies slow down processing times, leaving customers frustrated.

But it doesn’t need to be this way.

With the right strategies and tools, you can streamline KYC onboarding.

Think automated document verification and AI-driven risk assessment. Just imagine how much these tools speed up the process and deliver a better customer experience.

Let’s explore the essential steps to take to accelerate KYC onboarding without compromising security or accuracy.

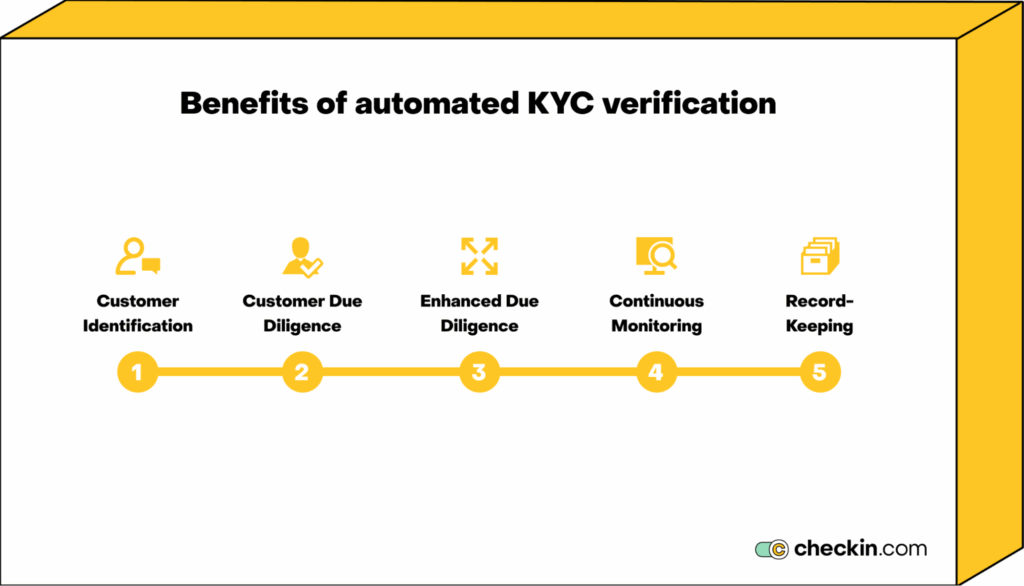

What are the five stages of KYC onboarding?

KYC checks start during onboarding to develop a customer risk profile. But they don’t stop there — it’s an ongoing process.

Once you verify the identity of an individual and assess their financial risks, you continue to monitor their behavior to spot fraud in the future.

This process keeps you compliant with anti-money laundering (AML) regulations.

Let’s break down the five essential stages from onboarding to ongoing monitoring.

1. Customer identification

The first step in the customer onboarding process is identity verification.

This involves collecting and validating government-issued IDs, like a passport or driver’s license.

You conduct document authentication to make sure the paperwork is real and matches the person applying. You can do this through biometric verification or manual document analysis.

You also confirm the customer’s address and contact information by comparing it to other documents and databases.

Lastly, you carry out tests that verify that the person presenting the document is the same as the person on the document.

This is sometimes done in person, with the applicant physically presenting the document themselves. Alternatively, you can use a digital KYC solution to perform a liveness check.

This step confirms the customer is who they claim to be. This helps reduce the risk of fraud.

2. Customer due diligence (CDD)

CDD creates customer risk profiles. In this step, you evaluate a customer’s financial activities and capital sources to make sure they’re legitimate.

You gather information on their source of funds, financial history, and business activities. You also look for red flags like connections to high-risk customers or suspicious transactions.

Other risks include connections to or a history of:

- Fraud

- Money laundering

- Terrorist financing

- Corruption

You check for these risks through sanctions list checks and PEP screening. Cross-referencing applicants with third-party databases highlights associations with risky activities.

3. Enhanced Due Diligence (EDD) for high-risk customers

EDD only applies to high-risk customers. If a customer appears suspect, you’ll take a deeper look into their financial risks and business activities.

During EDD, you will analyze complex transactions, search for adverse media coverage, and review financial documents. The aim is to uncover any criminal activities or suspicious behavior.

4. Continuous monitoring

While KYC is crucial at the onboarding stage, it’s an ongoing process.

Continuous monitoring of customer transactions helps you flag anomalies and suspicious activity before it becomes problematic. This ensures AML compliance and protects you against fraud.

5. Record-keeping and reporting

To make sure you’re compliant with AML regulations, you need to store identification documents and customer details securely.

You also need to generate regular reports to support audits. This shows you’re following due diligence procedures that prevent criminal behavior.

Common bottlenecks that slow down the KYC onboarding process

Outdated systems and manual workflows slow down the client onboarding process.

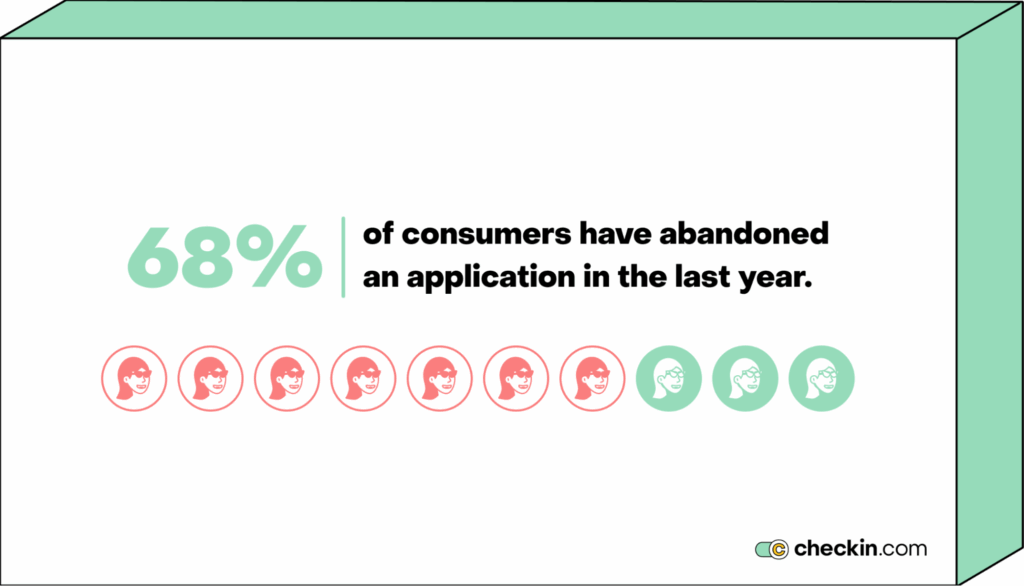

An astounding 70% of institutions admit that KYC procedures take between a month and 6 months.

The impact on customers is clear: 68% abandoned applications last year, with 21% saying it’s because the process took too long.

Manual data entry

When companies rely on manual onboarding processes, customer verification is slow.

It’s not just that document validation and cross-referencing is a tedious manual process. It’s also because there are often errors that need correcting.

This reduces operational efficiency and increases costs. It also frustrates customers trying to complete the signup stage quickly.

Inefficient document verification

Manual document verification is slow. Where automated KYC solutions can analyze a document almost instantly, humans have to do this by eye.

This also means it’s very error-prone. Humans often miss subtle inconsistencies in falsified documents, leading to the approval of fraudulent accounts.

Without automation, mistakes lead to compliance risks and put your business in danger of criminal activity.

Complex risk assessment

Manual background checks and risk assessments are tedious.

Human agents have to cross-reference customer information with different databases to find potential risks.

This takes a long time, especially for intricate cases.

And it’s not just that it’s a lengthy task. It also leads to inconsistent decision-making. What one person might see as “suspicious”, another might disregard as harmless.

Legacy mainframe systems

Outdated systems can’t keep up with modern KYC needs.

Old platforms and manual processes are inflexible, unscalable, and unable to adapt to evolving regulations.

Frequent system failures and slow processing times affect the customer journey and make it hard to meet regulatory requirements.

7 tips to accelerate the KYC onboarding process

Slow KYC onboarding processes are a compliance nightmare and they frustrate users.

KYC automation offers advanced digital solutions that streamline KYC workflows.

Here are some top tips to deliver a frictionless onboarding experience without compromising security and compliance.

1. Automate data capture

AI-powered tools combat errors common to manual KYC processing. They also speed up the workflow.

Optical Character Recognition (OCR) automatically extracts relevant data from official documents, like ID, bank statements, and proof of address,

It’s much faster and far more accurate than entering data by hand.

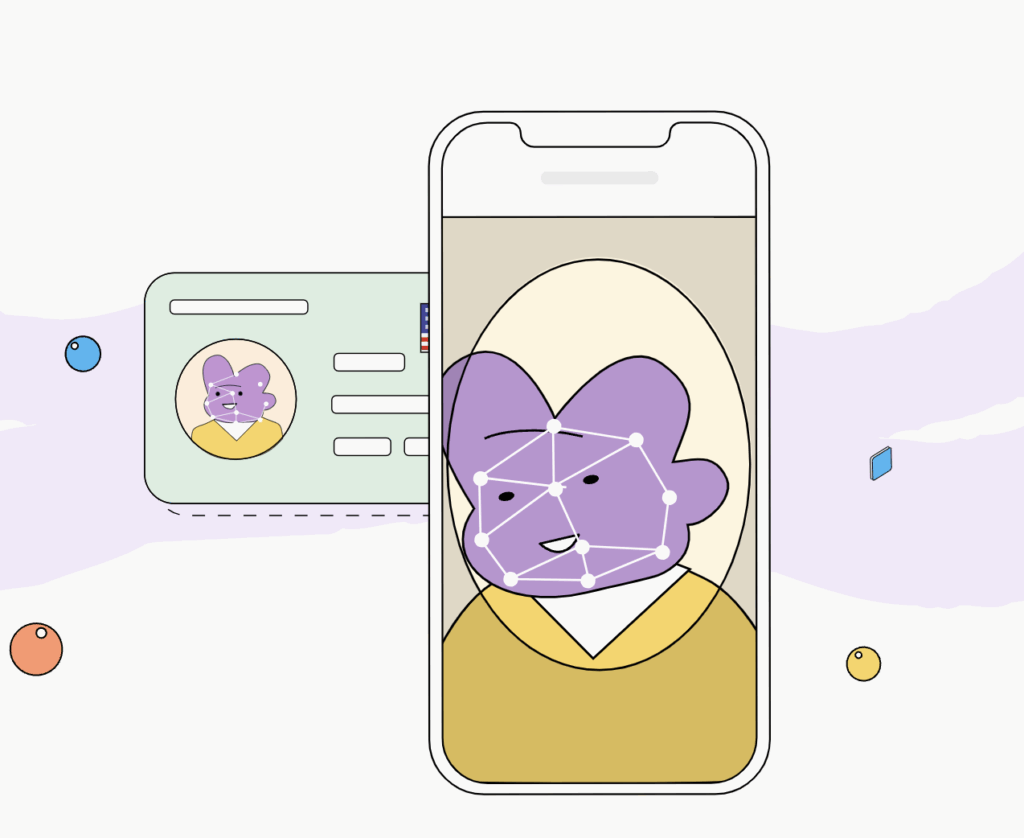

2. Automate document verification

Manual document verification isn’t just slow. It’s dangerous. Errors can lead to illegitimate documents slipping through the net.

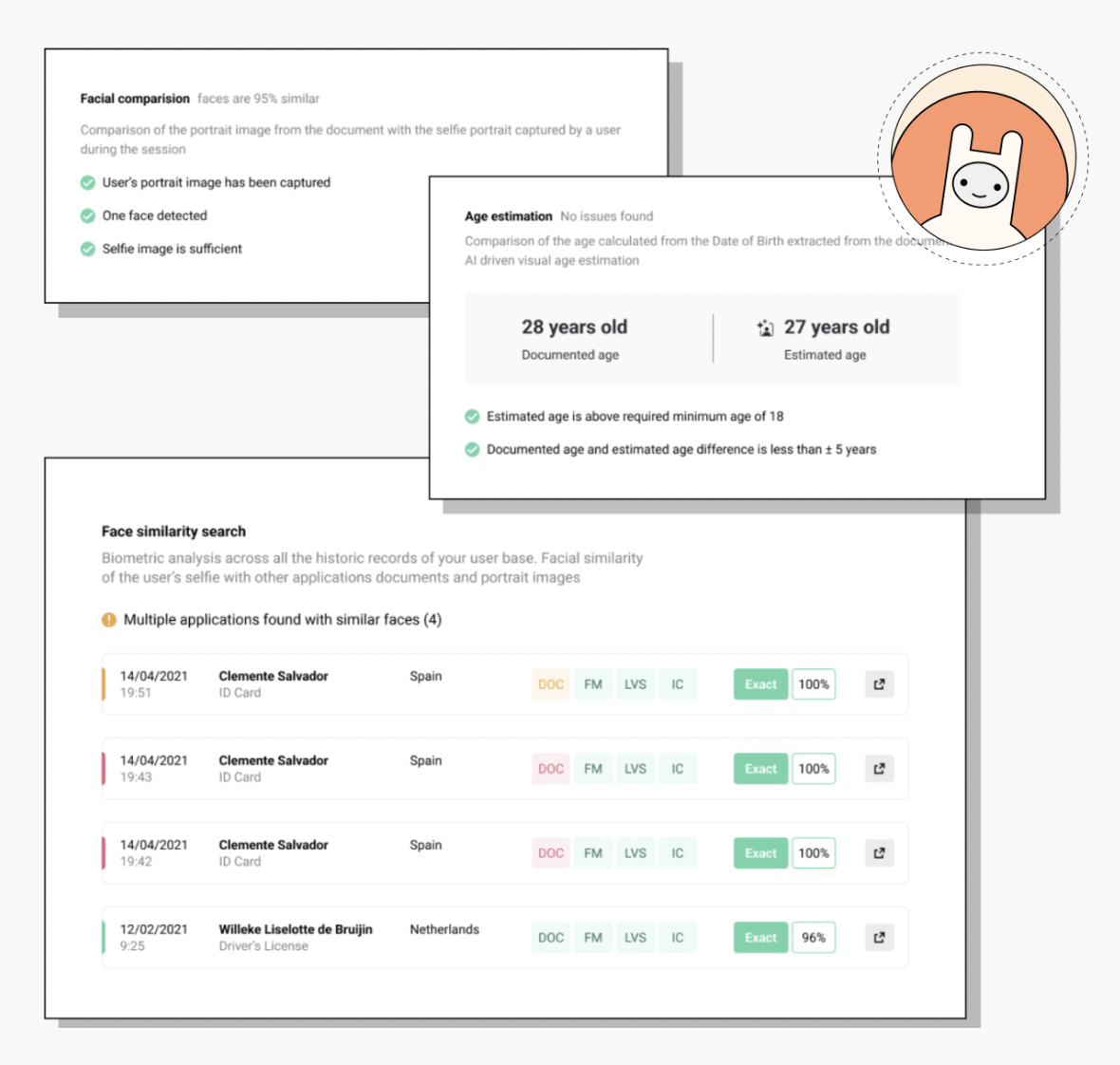

Automated KYC tools use machine learning and biometric technology to authenticate and analyze documents.

Through liveness checks and facial recognition, automated KYC verifies documents, ensures the applicant is present, and matches them to their ID. It takes seconds and it’s highly accurate.

And, it can recognize inconsistencies in many more types of documentation than a human can. Providers like Checkin.com can scan and verify over 14,000 document types from 190+ countries.

Automated document verification doesn’t just speed up the KYC onboarding process. It’s also very good at preventing fraud.

3. Scan for bots immediately

Lots of fraudsters use bots to overwhelm systems and bypass verification at the signup stage.

To make sure genuine customers receive the experience they deserve, it’s important to detect bots early. Otherwise, they put operational strain on compliance teams.

Tools like Botlens identify bot-like behaviors immediately. Botlens looks for illogical user flows, ultra-fast movement, repetitive actions, and suspicious source activity.

In doing this, it can spot bots straight away, flagging potential fraudulent activity.

4. Streamline the risk assessment process

Inefficient risk assessment models slow down onboarding.

Instead of treating every customer the same, introduce a risk-based approach.

Prioritize high-risk customers for additional checks and fast-track low-risk profiles. Putting everyone through EDD is a waste of time and resources.

The issue is that it’s hard to do this if you’re assessing risk manually. Manual cross-checking is slow.

AI-powered risk assessments automate AML screenings and check against sanctions lists in real time. It’s far quicker to investigate a person’s history and connections, allowing you to generate a risk profile faster.

5. Implement efficient workflow management

Manual task delegation is slow and inefficient. If everything’s done by hand, it’s hard to follow up on cases and track statuses to keep on top of applications.

Digital workflow tools allow you to automate workflows to streamline tasks. This leads to faster processing and better operational efficiency.

Back-office tools enable you to track application status in real time, while filtering data for easy access. The dashboard provides live updates and valuable insights into customer onboarding progress.

This makes it quick and easy to work out each next task as applications work their way through processing.

6. Upgrade the customer journey

If a customer feels frustrated, it’s likely that they’ll drop out of the onboarding process.

Instead, your setup stage should be user-friendly so customers stay engaged.

Audit your existing onboarding procedures to work out where you can simplify the process. If it’s too complex to sign up, customers won’t bother.

If you operate internationally, make sure you localize the experience.

Offer multi-lingual onboarding so customers can access your services in their own language. Remember, though, it’s hard to offer this if you’re using manual KYC processes. You’ll have to hire lots of agents who speak a variety of languages.

Alternatively, automated KYC tools can support 80+ languages to optimize onboarding across all devices and regions.

Lastly, be proactive in offering support.

Provide self-service support so it’s easy for customers to find assistance themselves. But also offer channels that allow customers to speak to an agent if necessary.

7. Update systems to stay compliant

Outdated processes slow down onboarding, and in the worst cases, halt your whole operation.

It’s not just about legacy systems crashing.

Outdated procedures often fail to align with evolving AML regulations and global compliance standards. This puts you at risk of fines and operational shutdown.

AI-powered KYC tools help you avoid this issue thanks to their self-evolving algorithms. These tools update and adapt to changing regulations worldwide as they happen.

This ensures compliance and improves operational efficiency.

The role of advanced KYC software: Here’s why you need it

Advanced KYC software transforms customer onboarding and compliance by automating key processes.

Removing human intervention from document data capture and biometric verification means fewer errors and less human bias. It’s not just speedier. It strengthens fraud prevention and improves compliance.

With real-time database checks and automated risk scoring, it’s easier to identify high-risk clients. This improves security and saves time on due diligence.

Plus, integrated bot detection flags suspicious activity instantly, to prevent fraudsters from cheating your onboarding systems.

What ties it all together is the adaptability of the self-learning algorithms. They keep your onboarding processes compliant by updating your systems in real time as regulations change.

Ultimately, KYC software replaces weeks of complex checks. Customers get reliable, hassle-free onboarding, and businesses maintain compliance at all times.

And what makes it even more valuable is its operational efficiency.

You can track and manage all KYC processes in one place. You save time, reduce admin overheads, and ensure nothing falls through the cracks. With centralized workflows, teams can collaborate more effectively, spot bottlenecks quicker, and maintain clear compliance audit trails.

Combining intelligent automation with efficient centralization, KYC platforms make it easy to scale onboarding. You can process thousands more applications without increasing compliance teams, compromising security, or sacrificing the user experience.

It’s fast, secure onboarding that scales with your business.

Speed up KYC onboarding

Streamlined KYC onboarding is a necessity in a world where customers expect fast processing and regulatory bodies expect you to keep up with compliance.

Manual processes slow you down. Not just because data entry is tedious, but also because mistakes take time to rectify.

This frustrates your customers, leading to higher drop-out rates.

With advanced KYC software like Checkin.com, you can automate critical steps.

From document capture to risk assessment, you can deliver a seamless customer experience without delays. Plus, you stay compliant.

Want faster, more scalable onboarding? Schedule a call with the experts at Checkin.com to see how we can accelerate your KYC onboarding process and help you stay ahead.