Feel like your customer onboarding processes aren’t performing as well as they should?

If you rely on a manual Know Your Customer (KYC) method, you’re likely experiencing inefficiencies. Slow verification and processing errors lead to higher operational costs and a poor customer experience.

These outdated approaches struggle to keep up as your company scales and fraud evolves.

To combat these issues, lots of companies have switched to automated KYC verification. But not all KYC systems stack up.

It’s true that most companies are moving away from manual processes. But those that use subpar automation tools fall behind intelligent KYC leaders.

Businesses using advanced, cutting-edge KYC tech enjoy quicker onboarding, smoother customer experiences, and better fraud prevention.

Let’s explore the issues with manual KYC and how you can reap the rewards of the right KYC software to enhance your onboarding procedures.

What is automated KYC verification?

Automated KYC verification streamlines onboarding with intelligent automation.

It replaces manual checks with intelligent digital solutions. It verifies customer identities and assesses their risk levels. This ensures regulatory compliance and reduces the chance you’ll approve fraudsters.

The positive impact is clear. Your business benefits from:

- Faster processing

- Fewer errors

- Stronger fraud prevention

- Improved compliance

Customers enjoy quicker onboarding and an improved customer experience.

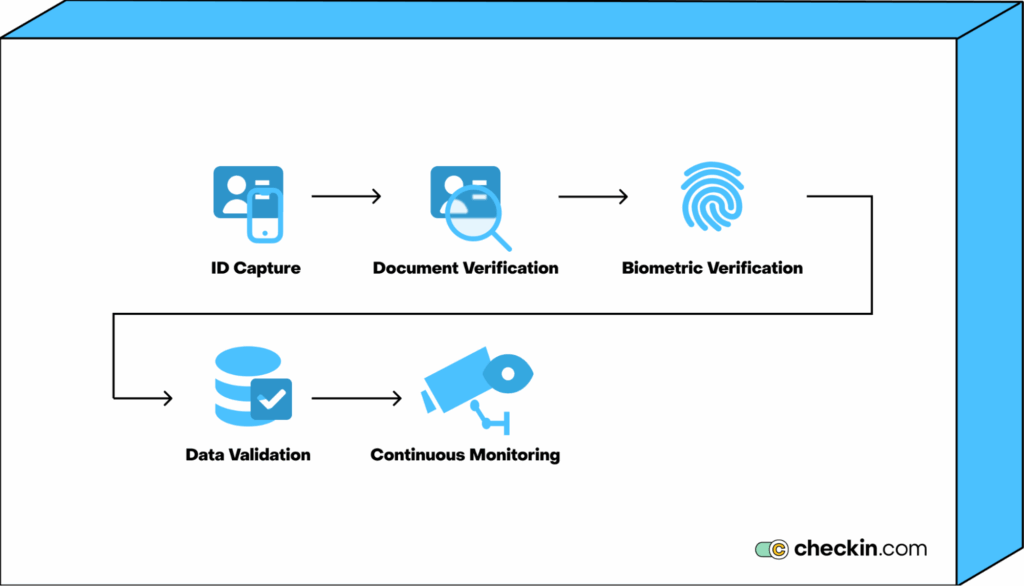

Here’s how it works:

- Document capture, analysis, and verification

KYC software automatically extracts information from ID documents using document scanning and Optical Character Recognition (OCR). It visually analyzes the documents for authenticity. This prevents the approval of forged documents.

- Biometric verification

Various types of biometric technology verify that documents match the person and that the person is who they say they are. This includes:

- Liveness detection - Ensures the user is physically present to safeguard against deepfakes and spoofing

- Face matching (1-1 matching) - Matches the government-issued ID to the live face

- Facial recognition (1-N matching) - Matches the live face to external databases of photos

- Age estimation - Analyzes facial features to flag mismatches between the user’s age and the document or service they are trying to access

- Data validation

Automated tools cross-reference data against external databases like government registries and credit bureaus. This helps you devise a risk profile and further verify their information.

- Continuous monitoring

Ongoing monitoring of transactions helps to flag any suspicious activity. It also keeps customer risk profiles up-to-date to spot emerging threats.

The challenges of manual KYC

Manual KYC processes are still widely used. Almost 75% of financial institutions still check more than 25% of customer applications manually.

The problem is that manual onboarding comes with serious drawbacks. Slow processing and errors can affect operational efficiency. They also reduce customer satisfaction and make it harder to comply with regulatory standards.

Let’s take a closer look.

Time-consuming and labor-heavy

There’s significant human effort in verifying documents and data manually. Staff spend hours reviewing documents, inputting data, and conducting background checks.

This results in slow onboarding times and requires lots of compliance officers.

On average, KYC can take between a month and 6 months, with 22% of institutions claiming KYC takes up to a year.

These delays frustrate customers, harming the client experience. If customers feel onboarding processes take too long, they simply drop out. This results in missed business opportunities.

Prone to human error

Human agents make mistakes when managing large volumes of data manually.

Errors leave institutions open to potential financial risks. Think incorrectly entered information and missed red flags.

This can result in the approval of false identities. This gives way to fraudulent activities and a failure to meet compliance standards.

And it’s not just financial losses you have to worry about. Errors can lead to significant reputational damage and high regulatory fines.

Inefficient and costly

Manual KYC procedures are expensive and inefficient.

The need for lots of human agents means high labor costs. Excessive paperwork leads to inefficient workflows.

In fact, on average, KYC costs between $1,000 and $3,000 per customer. With such high overheads, it’s tough for businesses to scale operations.

Plus, inefficiencies within the system lead to lower productivity and profitability.

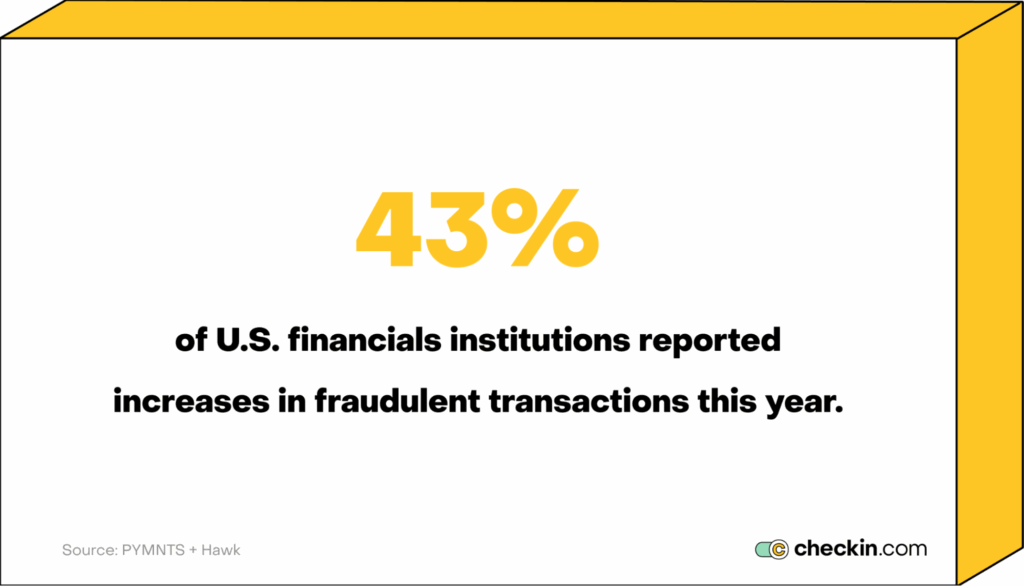

Susceptible to fraud

Fraud is on the rise: 43% of financial institutions reported higher fraudulent activity this year than in previous years.

In 2023 alone, consumers lost $10 billion to fraud — a 14% increase in one year.

Manual KYC is highly vulnerable to fraud, such as document forgery and identity theft.

Human reviewers find it hard to spot subtle inconsistencies in ID documents. Bad actors count on these mistakes to infiltrate the system.

This can lead to financial losses, a damaged reputation, and regulatory penalties.

Subjective decision-making

Manual KYC processes rely on subjective judgment. Different analysts interpret the same data in different ways. This leads to inconsistent decisions.

This unfair treatment can cause customer dissatisfaction and increase the risk of fraud.

Over time, you’ll suffer from lost client trust. This puts your organization at risk of legal challenges if customers feel their treatment is unfair.

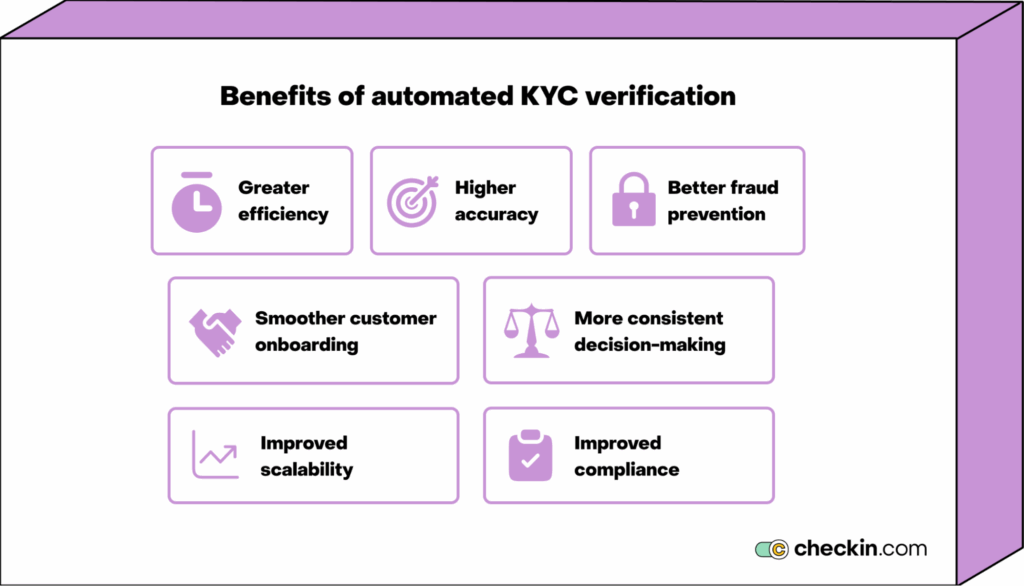

Why automate KYC verification? The top 7 benefits (700 words)

With the right automated KYC verification software, it’s easier to meet regulatory requirements. It also improves operations and helps you deliver a top-notch customer experience.

Here are the key benefits of automating KYC.

1. Faster, cheaper, and more efficient

Automation can significantly cut down processing time and operational costs.

Automated systems can handle far larger volumes of documents quicker and more accurately than human agents.

Automated KYC software eliminates repetitive tasks and automates key processing activities.

This reduces the delays caused by manual processes. You can onboard customers faster with fewer staff. And, you won’t waste lots of time correcting mistakes.

In the long term, this means increased productivity. Quicker turnaround times mean you can process more applicants.

You’ll have happier customers with fewer drop-outs, and you’ll save costs.

2. More accurate

Manual processes are riddled with data entry mistakes and overlooked red flags. This is due to human error and subjectivity.

The algorithms in KYC software cut out bias and require proper validation to proceed. These tools immediately flag inconsistencies, so incorrect data can’t slip through.

With higher precision in customer checks, businesses meet compliance requirements easily. And, you cut down on the poor decisions that arise due to bad data.

Better data quality leads to far stronger security and risk management in the long run.

3. Identifies fraudulent activity

KYC is critical for early fraud detection.

Unlike manual KYC processes, automated systems can analyze vast datasets in real time. This enables your KYC software to flag patterns and anomalies that suggest fraudulent or suspicious activity.

With a proactive approach, you can intervene earlier to protect your business reputation and prevent financial losses.

4. Smoother customer experience

Automation simplifies the onboarding process. Customers get a better user experience as they no longer face long wait times and endless paperwork.

Instead, they follow an intuitive user journey for faster onboarding without complex interactions.

Positive customer experiences result in increased satisfaction and more loyalty. You strengthen customer relationships and earn a better brand reputation. This drives growth.

5. Consistent decision-making

Automation applies predefined rules and consistent algorithms that assess risk. This eliminates the subjectivity that’s so common to manual KYC processes.

This results in unbiased, standardized assessments that treat everyone equally. Plus, when businesses lower bias, it improves compliance and reduces the risk of internal collusion.

6. Improved scalability

If you’re trying to grow your business, manual processing creates a bottleneck.

Automation offers the power of scalability. It can handle increasing volumes of applications without compromising efficiency.

Since it can process applications far faster, there’s less need for big teams. This lowers your operational costs. You can accept more applicants without increasing overheads.

The capacity to scale KYC means better agility in your business. You can adapt to new regulatory changes and capture new market opportunities quicker.

7. Helps you keep up with regulatory changes

To avoid penalties and legal risks, you need to stay compliant with evolving regulations.

KYC software automatically integrates and applies new compliance standards. This way, you stay aligned with new regulations.

It ensures that compliance checks are up-to-date throughout your whole organization, lowering the risk of repercussions from non-compliance.

KYC automation in practice: 5 use cases

KYC verification is widely known for its role in opening bank accounts. But applications extend further than the financial sectors.

From telecoms to property management, automation solutions can turn KYC practices around. The results? Better compliance and improved customer experiences.

Here are five key use cases to show automated KYC solutions in action.

1. Traditional financial institutions

KYC is integral to traditional financial institutions like banks and credit unions. It’s vital to comply with regulations and prevent money laundering. It’s also one of the key processes for assessing customer risk to the organization.

Automation helps these institutions verify identities and check financial histories faster and with more accuracy.

For example, a bank might use automated KYC verification to analyze and validate a customer's government-issued ID. Then, they compare that information with government databases to verify the customer.

By automating these processes, they reduce operational costs, boost security, and speed up processing.

2. Fintech companies

Fintech organizations are tech-driven businesses that offer financial services. This includes companies like mobile payment apps, cryptocurrency platforms, and peer-to-peer lending services.

These companies use KYC to comply with regulations and mitigate risk.

But it’s also about fraud prevention. In the last few years, fintech has seen a significant jump in fraud.

Take digital wallets, like Samsung Pay and Apple Pay. These payment apps have seen the sharpest rise in fraud rates in recent years.

This shows the urgent need for robust KYC mechanisms. This is where automated KYC comes in.

For instance, a cryptocurrency platform might use automated KYC checks to protect against identity theft.

Face-matching, facial recognition, and liveness checks prevent new users from opening accounts using stolen IDs. Biometric technology achieves this by flagging inconsistencies between the applicant and the document.

3. Telecommunications providers

Telecom providers also use KYC to protect their networks from fraud and meet compliance standards.

Automated KYC makes it easier to verify IDs and monitor network activity for suspicious activity.

For example, a mobile network provider might use automated KYC for continuous monitoring to identify unusual usage patterns. Its KYC software will flag behavior like spikes in international calls or changes to SIM card usage.

In doing this, it detects potential fraud automatically, such as SIM swap attacks.

4. Rental property management companies

Rental property managers use KYC to verify potential tenants and assess their creditworthiness.

KYC software can automate tenant screening. This simplifies the user experience and ensures more reliable results.

For example, a property management company might use KYC tools to analyze a tenant’s ID documents, confirm details, and perform background checks. These checks might include criminal history and credit reports.

This helps a property manager understand a tenant’s reliability and financial stability.

5. Insurance companies

Insurance companies use KYC to verify identities and create risk profiles. Ongoing monitoring helps to update these risk profiles throughout the customer’s lifetime. This makes it easier to detect fraudulent claims.

For instance, an insurance provider might monitor customer behavior to check for anomalies like multiple claims within a short period.

They would also use the software to perform automated risk assessments. These risk assessments continuously update a customer’s risk score as a proactive fraud prevention measure.

Reduce risk, improve accuracy, scale onboarding

Automated KYC verification transforms compliance, streamlines onboarding, and helps combat fraud.

Advanced technologies like real-time ID scanning, biometric verification, and liveness tests deliver faster, more accurate processing. It delivers a smoother customer experience and reduces risks in assessing customers.

A beneficial step for enterprises in finance, insurance, gaming, property, and more, automated KYC doesn’t just give you the competitive edge. It also reduces costs, boosts efficiency, strengthens security, and enhances compliance.

It’s time to upgrade your KYC process. Book a meeting with the Checkin.com team today to discover the ways our solutions can elevate your operations.