Online gamblers want to log on and get playing fast.

But the gambling industry needs to balance smooth onboarding with security and compliance. Stricter regulations and sneakier fraud tactics mean online gambling sites need more advanced verification methods than ever before.

So how do you stay secure and compliant without scaring off customers with slow onboarding processes?

KYC gambling trends are evolving to offer a smoother customer experience without comprising compliance.

New KYC trends — like biometric verification, AI-powered risk profiling, and real-time monitoring — are shaping the landscape for online gambling. Let’s dive in to explore the cutting-edge ways you can keep your security tight without disrupting gameplay.

What's KYC for gambling sites?

Know Your Customer (KYC) is a legal requirement for gambling sites. It helps to prevent fraud and make sure gambling operators are compliant with Countering Financing of Terrorism (CFT) and Anti-Money Laundering (AML) regulations.

Online gambling platforms must verify the identities of customers and build risk profiles. This verification process helps gambling companies understand a player’s potential for financial crime or problematic gambling. It ensures customers are who they say they are and that they’re old enough to play.

KYC identity verification first happens at the onboarding stage. Beyond this, ongoing monitoring tracks financial transactions and changing circumstances to identify illegal activity or fraudulent behavior.

This proactive approach keeps gambling sites compliant with CFT and AML while protecting the company and genuine customers from online gambling fraud.

Why are robust KYC gambling processes more important than ever?

The gambling industry is under increasing regulatory pressure. With evolving fraud tactics and illegal gambling operators, authorities are tightening rules to make sure the online gaming industry actively reduces the risk of fraud and financial crime.

In response, gambling organizations need proactive measures that show their efforts to curtail illicit and fraudulent activity.

Robust KYC processes are a vital step in this. Here’s why.

Regulations are constantly changing

AML, CFT, and data privacy regulations change regularly.

For example, FinCEN recently proposed a rule to update AML/CFT regulations. These changes demand that AML and CFT measures are more effective and risk-based, with operators facing increased scrutiny to make sure their measures are up to scratch.

Equally, in Singapore, the Monetary Authority of Singapore (MAS) has announced its National Strategy for Countering the Financing of Terrorism. This strategy lays out a strict framework for swiftly punishing organizations that aren’t compliant with CFT regulations.

But it’s not just that these regulations are stricter. Regulatory requirements vary across different jurisdictions.

Gambling operators must stay compliant in all their operating locations. There’s no grace given for being ignorant of new laws. If you’re found to be non-compliant, you face hefty fines and legal penalties.

Robust KYC software automatically updates compliance models as regulations change. This keeps you compliant at all times — no matter which rules change.

Fraud tactics are evolving

In the last two years, fraud in the gaming industry has increased 64% year-over-year. But it’s not just the volume of fraud that’s a problem. It’s also the tactics that bad actors use.

Fraud is becoming more sophisticated. AI, bots, and deepfakes all contribute to more advanced fraud.

Here are a few of the fraudulent tactics used to trick gaming providers:

- Affiliate fraud: Bad actors use bots to generate fake clicks on affiliate links. This inflates affiliate bonuses, so companies pay out more.

- Deepfake ID fraud: The use of AI-generated fake identities to create fraudulent accounts has increased tenfold in online gambling.

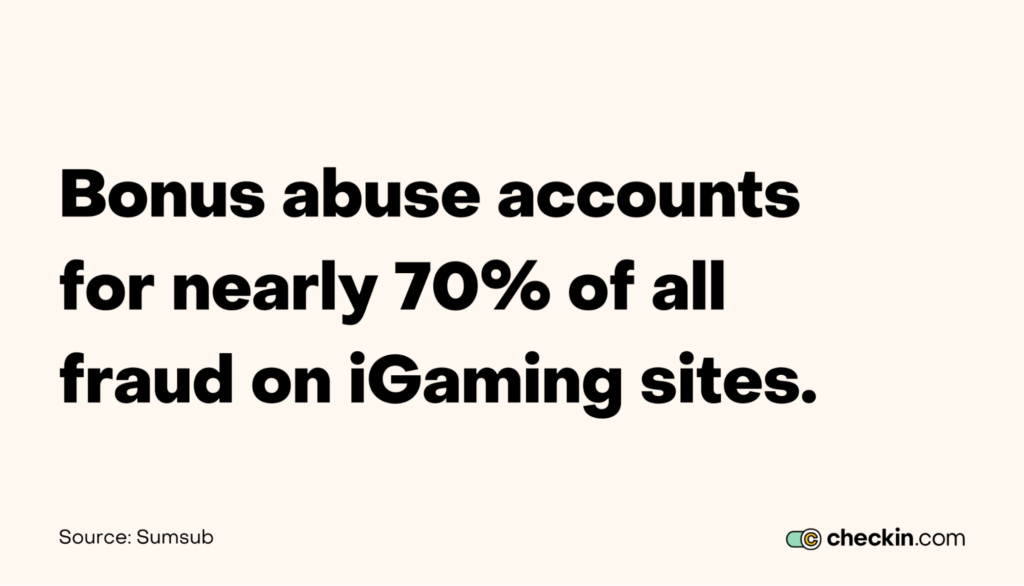

- Bonus abuse: Customers create multiple accounts to take advantage of new customer promotions. This accounts for almost 70% of all online gaming fraud.

Illegal gambling is rife

Despite the accessibility of online gaming platforms, illegal gambling is widespread.

In fact, illegal gambling providers generate an estimated $44.2 billion in revenue. This is almost 75% of the revenue generated by legal commercial casino gambling.

Lots of gamblers choose these organizations because casinos without verification let people play without assessing risk. Other customers use these gaming companies because legitimate sites don’t accept their local ID documents.

While this often means faster onboarding, customers that use these services are vulnerable to fraud and financial crime.

Non-compliance can ruin your business

Non-compliance is risky business.

Regulators don’t accept excuses, and they come down hard on those that don’t follow the rules.

If you’re found to be non-compliant with AML, CFT, or data privacy laws, you face huge fines and legal penalties that can financially cripple your business. At the very least, compliance breaches significantly damage your reputation.

Take MGM Grand and The Cosmopolitan, for example.

These prominent Las Vegas casinos were recently fined $7.45 million due to an illicit sports betting scheme that violated AML regulations.

What are the latest trends in KYC gambling processes?

Luckily, compliance technology is advancing rapidly enough to keep up with changing regulations and evolving fraud tactics.

From biometric authentication to AI-powered risk profiling, here are the KYC trends keeping gambling providers compliant.

1. Biometric verification and advanced document verification

Traditional identity verification relies on manual reviews. These processes are slow, error-prone, and vulnerable to forgery. It’s easy for malicious actors to manipulate ID documents with AI or use stolen information to build false identities.

To negate this risk, online gaming companies are using biometric verification and advanced document authentication systems.

These include:

- Optical Character Recognition (OCR) to automatically extract relevant data from ID documents

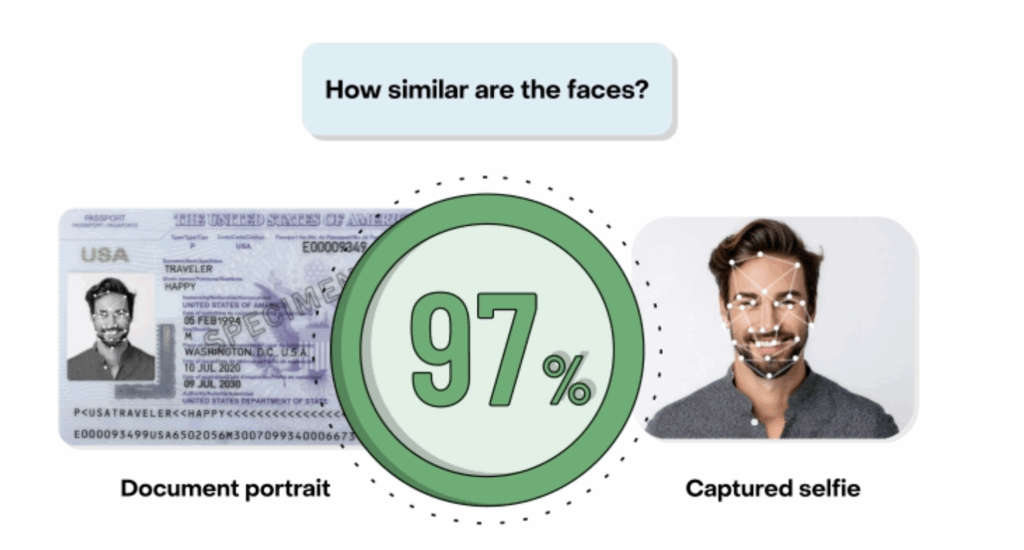

- Facial matching technology to match a user’s face to their ID document

- Facial recognition to verify users against data in official databases

- Liveness detection to confirm the person who’s onboarding is present and not using AI-generated face spoofs

These mechanisms are far more accurate than traditional manual document reviews. They identify bad actors and risky customers quicker.

This speeds up onboarding for genuine customers, reducing false positives and negatives. Not only does it lower operational costs associated with manual labor. It also cuts back the costs of unnecessary investigations due to false positives.

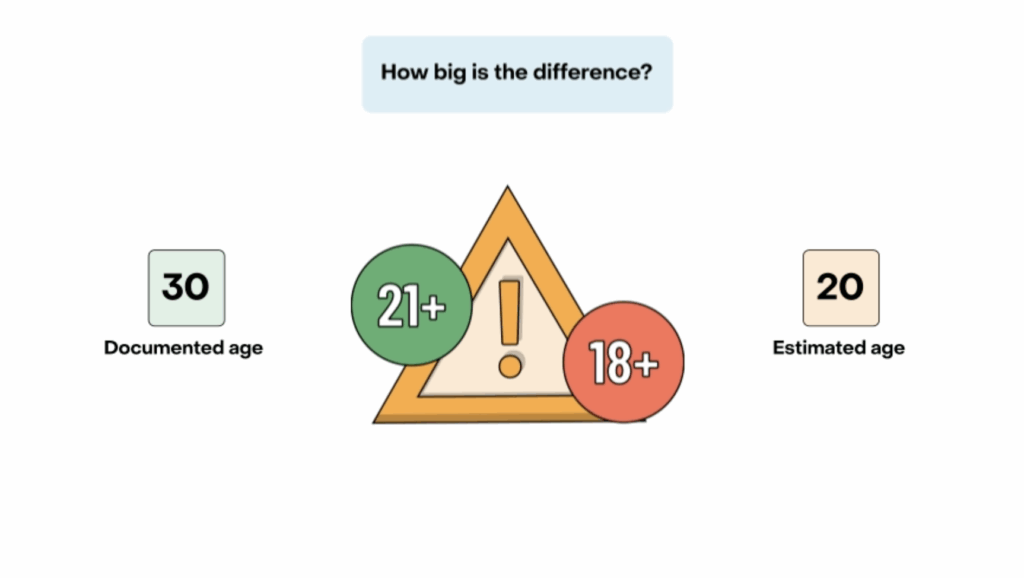

2. Age assurance technology

Lots of gambling sites still rely on basic age verification techniques like self-declaration. It’s easy to lie about your age, making these tactics mostly worthless.

New age assurance technology verifies age using AI-driven face matching.

It analyzes facial features in the document photo and from a live selfie. It compares these images to databases of known age-related facial features to estimate the age.

This helps casinos stay compliant with age restrictions and protects minors from underage gambling.

3. AI-powered risk profiling

Gambling platforms are hotbeds for money laundering, fraud, and financial crime.

Legacy KYC systems are vulnerable since it’s easy to miss subtle patterns of suspicious activity.

AI-driven risk profiling is far more sensitive. It can scan massive amounts of data and detect suspicious behavior quickly.

Looking at betting patterns, watchlists, and transaction history, AI systems can build accurate risk profiles and update them automatically if circumstances change.

What’s more, AI continuously learns automatically. It updates itself as new threats emerge, keeping casinos one step ahead of evolving fraud and problematic gambling.

4. Perpetual KYC for ongoing monitoring

A one-off KYC check isn’t enough to keep fraud at bay. Risk profiles change over time as new threats emerge and customers' circumstances alter.

Plus, fraud doesn’t always happen at the onboarding stage. Malicious actors that create synthetic identities might wait months or even years to use these identities for illicit activity.

Perpetual KYC (pKYC) ensures true ongoing monitoring of player accounts.

Before pKYC, humans conducted periodic manual reviews. This left long gaps where fraud could go undetected.

AI systems continuously monitor player accounts to track suspicious transactions or betting behaviors. They also notice account changes that might signal something suspicious, such as a change of address to a high-risk jurisdiction.

By automatically monitoring accounts at all times, casinos stay compliant. Systems catch illegal activity as it happens — without disrupting the player experience.

5. Localized experiences

Gambling is a global industry. But lots of gambling platforms struggle to verify foreign players.

This is often because they lack the means to process international IDs. In other cases, non-native speakers find it tough to understand the steps they need to follow during onboarding.

Intelligent KYC solutions offer localized experiences. The gambling apps support multiple languages and the KYC process can verify a range of foreign documents.

For example, Checkin.com supports 14,000 different document types and over 80 languages.

Online casinos and gaming providers can now verify players worldwide.

And because these KYC systems update local regulations automatically, gambling sites can verify global players without worrying about compliance.

This improves the player experience and reduces friction in onboarding. It also makes it easier for online gaming businesses to expand into new markets.

Take Simple Casino, for example.

By offering its KYC processes in Japanese, onboarding became more accessible and user-friendly for Japanese users. This helped the online casino expand into Japan without friction.

6. Automatic compliance

Gambling regulations change frequently.

Manual KYC systems require manual updates to make sure those reviewing understand the new legal requirements. Unfortunately, it’s easy to miss new legal updates, especially if you operate across lots of locations.

Instead, AI-powered KYC software automatically updates compliance models when regulations change. This keeps gambling platforms compliant in real time.

How does KYC gambling software help you stay ahead of your competition?

KYC gambling software doesn’t just keep you compliant. It also improves efficiency and prevents fraud without interrupting gameplay.

Here’s how the right KYC solution gives you a competitive edge.

1. Streamlined verification

Modern KYC software automates ID verification and risk profiling.

It’s faster, reduces false positives, and cuts down on the need for lengthy manual reviews.

Most players can verify their ID in minutes in the language they understand best.

Faster sign-ups and fewer unnecessary investigations mean lower drop-out rates. Quicker, more accurate checks allow you to catch bad actors without fraud slipping through the net.

2. Improved player experience

It’s not just slow onboarding that frustrates players. Reverification and manual account reviews disrupt gameplay.

Instead, streamlined verification and pKYC mean players can verify their identity in seconds. Plus, the system continues to monitor their accounts without interrupting gaming.

This gives you a competitive advantage. Players are far more likely to opt for a gaming platform that offers a smooth KYC experience over one that’s slow or disruptive.

3. Highly accurate fraud and suspicious activity detection

Manual fraud detection is slow and lacks accuracy. Financial losses can pile up before anyone notices suspicious behavior.

AI-powered fraud detection spots bad actors immediately. It identifies suspicious patterns in real time and flags potentially damaging behavior before it escalates.

This cuts out underage gambling, identity fraud, money laundering, and more.

This allows you to offer a fair, secure gaming environment. With fewer fraud-related chargebacks, compliance issues, and unnecessary investigations, your platform becomes far more attractive than your less secure competitors.

4. Multi-jurisdictional compliance

Gambling regulations vary from place to place.

KYC software keeps you compliant automatically. It can process documents from different regions and update compliance models as local rules change.

With localized interfaces and foreign document verification, international players can enjoy smooth onboarding.

For casinos and gaming sites, you stay compliant in every jurisdiction, making it easier to expand into new markets.

Hero Gaming did this with Checkin.com. By implementing Checkin.com’s KYC solution, the gaming company could scale operations and move into new jurisdictions while offering localized sign-up experiences.

5. Lower operational costs

Manual KYC processes require big compliance teams. As you scale, you need more and more people to review the increasing volume of documents and transactions.

AI-powered KYC reduces the need for more compliance officers. It can process lots of applications at once, scaling to accommodate a growing number of users. This gives you scalability without added labor costs.

What’s more, AI verification is far more accurate. This means fewer false positives that lead to expensive enhanced due diligence (EDD) investigations.

6. Better insights for improvement and personalization

KYC software comes with built-in analytics and reporting. This is helpful for creating reports for compliance.

However, it also gives you insights into player behavior that can be used for personalizing the gaming experience.

Gaming platforms can use this data to tailor marketing and promotions, as well as game recommendations. This helps you retain players and optimize the experience.

KYC gambling: Improve compliance, impress customers, stay competitive

KYC gambling processes are vital for online gaming sites to stay compliant.

Since everyone needs to follow the rules, why not use this opportunity to give yourself a competitive edge?

Players want a secure site with fast onboarding. This is where KYC software helps you improve the user experience without compromising compliance.

Advanced KYC software enhances security and streamlines verification so players can onboard quickly in a safe gambling environment.

Using AI-powered verification and risk profiling, you combat fraud and underage gambling while staying compliant with regulations across all your operating locations.

Want to scale your gambling operations without KYC causing a headache for your customers? Explore Checkin.com’s advanced KYC solutions today.