The KYC (Know Your Customer) verification process is an integral part of onboarding any new customer.

Failing to verify KYC checks means you’ve failed to know your customer, opening the door to everything from cyberattacks to fraud, regulatory fines, reputational damage, data breaches, and lawsuits.

At the same time, if you make the final stage in the onboarding process too difficult to complete, potential customers will go elsewhere.

KYC verification is mission-critical in the financial services sector. The United States Financial Crimes Enforcement Network (FinCEN) outlines the various levels of KYC that banks, lenders, money transfer services, and other organizations in the sector need to comply with.

KYC is enforced for good reason, with $1 of financial fraud costing the sector $4 in compensation and risk mitigation. And yet, banks and other organizations can’t afford customers to abandon onboarding at such a crucial stage in the funnel.

The question is: Can you mitigate risks, ensure KYC compliance, and make KYC as smooth and seamless as possible for every new customer?

We know you can, so in this article, we go in-depth with the KYC verification process that your organization should use to reduce operational costs and increase conversions in the last stage of the onboarding funnel.

What is the KYC verification process?

KYC is a legally mandated process that every financial institution of any kind needs to follow to ensure they’re compliant with anti-money laundering (AML) and other regulations.

It’s not just the financial sector, of course. KYC checks cover a wide range of sectors, especially if money is involved, such as iGaming, travel, and real estate, among others.

KYC is mission-critical ⏤ new customers can’t go further without doing KYC and AML checks ⏤ as part of the onboarding process for the vast majority of regulated businesses worldwide.

Even if you aren’t in a regulated sector, any business that needs to comply with data protection laws uses a form of KYC to protect themselves, customer data, and their customers.

KYC usually involves the following stages:

- Establishing and verifying the customer's details.

- Checking if they are a real person (not an AI bot or deepfake).

- Verifying the reasons they want to access your company’s services.

- Confirming they’re not on any prohibited lists through AML verifications.

KYC is essential, and yet if you make the onboarding process too complicated, you risk losing customers.

One of the most popular and vital roles KYC plays is onboarding new banking and financial customers. As of 2023, 82% of adults across the U.S. use some form of online banking services. Banking and finance ALWAYS require KYC and AML.

And yet, according to a Thomson Reuters report, onboarding takes 30 days on average for U.S. financial institutions, resulting in a high level of customer churn at this crucial stage, with 9 out of 10 never completing the onboarding and KYC flows.

Let’s look at which sectors need a KYC verification process, the benefits of having one (beyond fulfilling a compliance requirement, and how to implement KYC verification.

Which sectors need KYC verification?

In the U.S. financial services sector, FinCEN mandates that the following organizations carry out various levels of KYC and AML:

- Banks

- Money transfer services

- Insurance companies

- FinTech (financial technology companies)

- Cryptocurrency money transfer services and exchanges

- Investment firms and platforms

- Credit unions

- Every type of lender, from credit cards to mortgage providers

- Financial advisors, brokers, and anyone who provides financial advise

Of course, it’s not just FinCEN that has a say over KYC in the financial sector. The U.S. Securities and Exchange Commission (SEC), and USA PATRIOT Act in 2001 both mandate KYC compliance.

The same is true in Europe, the UK, and almost every other country in the world. KYC is everywhere, especially in the financial industry ⏤ regardless of the specific regulatory frameworks, regulators, and laws.

Beyond the financial sector, iGaming and online gambling require almost the same level of KYC and AML as most financial sector organizations.

In the travel industry, hotels, airlines, and travel insurance providers are wise to follow KYC guidelines. It’s different from financial sector KYC because usually credit checks and financial details aren’t needed.

However, identity verification (ID) is oftentimes an essential part of booking holidays and any kind of travel. It’s equally crucial from a counter-terrorism perspective, making KYC just as stringent in the travel industry.

Benefits of a robust KYC verification process

Here are the benefits of having a robust and user-friendly KYC verification process:

- KYC verification in finance, crypto, travel, and iGaming keeps your organization compliant with numerous laws in every country you operate.

- Having a robust KYC verification process proactively prevents serious problems from occurring, such as fines, reputational damage, lawsuits, and data breaches.

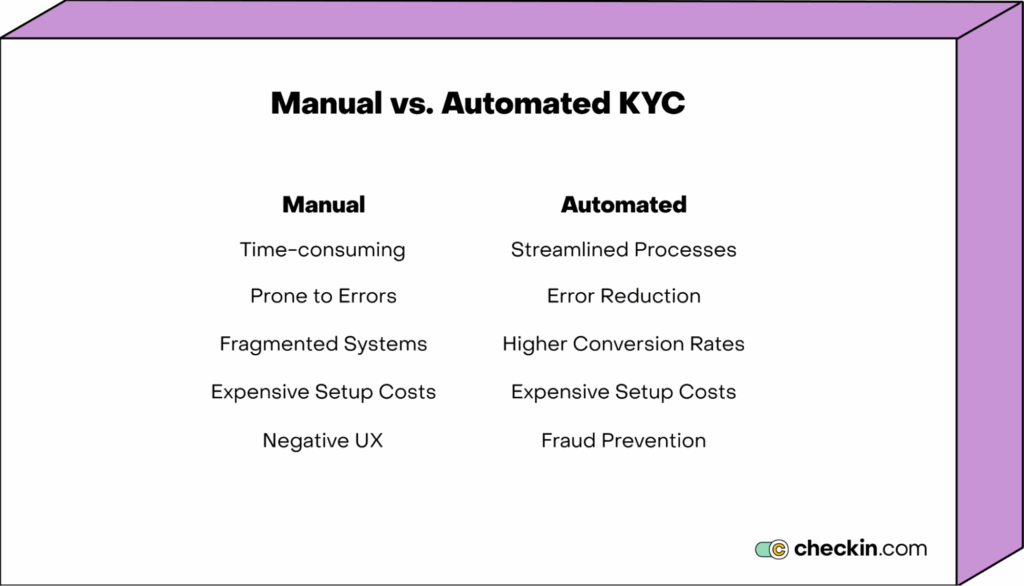

- A user-friendly and fast digital KYC verification process is more cost-efficient, less likely to result in errors and fraud, and is better for the customer experience and your organization.

- A fast, robust KYC process ensures that more customers complete onboarding than give up at the final hurdle; improving sales and marketing conversion rates.

- A positive KYC onboarding experience for the customer assures them that you are thinking about their needs, and are concerned with giving them a positive customer experience (CX), which will impact their spending patterns and brand loyalty.

Different types of KYC verification processes

Although KYC compliance is inherently digital ⏤ you’ve either passed or failed compliance ⏤ there aren’t analog shades of grey within KYC and compliance.

To ensure KYC is convenient for consumers, every organization should ensure KYC is digital, but we know there are some still sticking with time-consuming paper-based onboarding and KYC processes.

It’s worth noting that there are different types and levels of KYC verification. Ongoing compliance is also an important part of regulatory requirements.

How in-depth you need to go usually depends on the risk factors, especially in the financial sector. Here are the different levels and types of KYC verification:

- Customer Identification Procedure (CIP): Covers the basics, such as:

- Name

- Date of birth

- Proof of Address

- ID verification (identity document): Passports, driver's license, or another form of acceptable government-issued ID

- A second document is used to verify a POA, such as a bank statement or utility bill.

- Customer Acceptance Policy (CAP): Every business will have its own CAP process because this is about a customer entering into a legally binding business relationship with them. CAP is part of KYC, and usually involves ensuring a customer is onboarded effectively and offered the right products or services, while also assessing risk factors and mitigating those according to your organization's KYC, AML, and other procedures, such as a credit check.

- Customer Due Diligence (CDD): This is (or could be) an extended version of KYC if, for example, a customer is taking a loan from a bank or applying for a credit card. If the risk factor is higher than simply opening an account, then CDD usually plays a role, and this is influenced by various internal factors such as underwriting criteria.

- Enhanced Due Diligence (EDD): This is especially vital if a customer relationship is more high-risk and long-term, such as a mortgage, investments, a pension, or insurance. Generally speaking, the more money involved, the higher the risk factor, so the more extensive the due diligence and KYC checks that need to be made.

When the risk level is higher than normal, KYC might need to extend beyond the customer onboarding process and involve ongoing monitoring of higher-risk customers.

KYC is important for fighting identity theft, preventing financial fraud, and stopping money laundering or terrorist financing.

It’s equally essential for staying compliant with various regulations and laws and preventing disasters such as cyberattacks, data breaches, being fined, or losing your customer's trust.

How to implement KYC verification

Basic KYC needs to start with staff or automated software collecting and verifying the following from your customers:

- Name

- Date of birth

- Proof of Address (POA)

- ID verification: Passport, driver's license, or another form of acceptable government-issued ID

- A second document is used to verify a POA, such as a bank statement or utility bill. However, this is usually only needed in the financial or related sectors when someone is opening an account for the first time.

Now, there are going to be times or situations where the above simply isn’t enough. You need to collect and verify more from your customers, such as to make sure the image of someone showing up on an ID document like a passport matches with the person supposedly holding said passport.

In cases such as these, there are more in-depth KYC options, including:

- ID Scan: Our technology can instantly recognize 14,000+ ID documents in over 190 countries and territories. ID card data can be verified and KYC enhanced using Liveness or Face Recognition.

- Liveness: A type of biometric verification that checks the person is who they’re claiming to be, and makes it harder for fraud and deepfakes to succeed.

- Face recognition: Uses a selfie and AI facial and biometric recognition to ensure a customer matches images shown on ID documents.

Now, let’s look at how KYC is done in the travel, financial, and iGaming sectors.

KYC verification for the travel sector

Travel KYC verification usually needs to involve:

- ID verification (e.g., passport or other form of ID if it’s in-country rather than traveling internationally);

- Visa verification (making sure someone arriving in a country requiring a visa has an authentic one)

- Verify facial matches or liveness

- Proof of Address (POA).

In the travel sector, Checkin.com is trusted by dozens of high-profile brands to deliver integrated ID checks and KYC verifications.

The popular European low-cost airline, Ryanair, uses Checkin.com in their consumer-facing app, covering dozens of countries and regions they fly to so that passengers can verify their identity.

Because Checkin.com is equipped to handle 14,000+ ID documents across 190+ countries, it makes us the right match for KYC and identity verification for airlines, hotels, and other travel businesses.

KYC verification for Financial Institutions (FIs), banks, money transfer, and the crypto sector

Financial sector KYC verification usually needs to involve verifying:

- Name

- Date of birth

- Proof of Address (POA)

- ID verification: Passport, driver's license, or another form of acceptable government-issued ID

- A second document is used to verify the POA

- AML requirements and the appropriate level of due diligence depending on the relevant risk factors for that customer, account type, and financial product.

Verifying KYC and AML in the financial sector can be time-consuming and tedious. The average bank spends $48 million every year on KYC and AML processes, staff, and software. KPMG notes that larger banks spend up to $500 million, and overall the financial sector spends $25 billion on KYC and AML.

Unfortunately, if the KYC and AML process takes too long, banks lose customers, with 90% giving up and going elsewhere, according to a Thomson Reuters report.

It doesn’t have to be this way. Banks can have a robust KYC and AML process and one that’s easy to use, fast, and provides an experience that retains customers.

For example, DECTA used Checkin.com’s ID verification, document upload, back-office management, and API features. With the help of Checkin.com, DECTA was able to speed up complex ID document checks by 20%.

KYC verification for the iGaming sector

iGaming and online gambling KYC verification usually needs to involve:

- Full name

- ID verification

- Bank details

- Verify facial matches or liveness (optional but recommended)

- Proof of Address (POA).

- Self-ban registry checks

- Spending limits verifications

- Fraud prevention

- Age verification

In most cases, other checks are required depending on your registered location and the location of the players. For example, in Canada, players need a 3-year credit file check. In the Netherlands, players need a BSN number or place of birth for non-residents, and to provide an IBAN from their bank.

Your customers want a fast and smooth experience signing up, otherwise, they will lose interest and go elsewhere to have fun.

It’s equally important that your KYC verification process can be deployed whenever you want to enter a new market. Hyper-localization is crucial for this. Even in Europe or America, what works in one state or country isn’t always the same in another.

iGaming KYC also needs to be adaptable to dozens of different platforms. There is a lot to consider when designing and implementing KYC verification in the iGaming and online gambling sectors. Thankfully, the Checkin.com team has done this for dozens of iGaming brands in hundreds of countries.

Key takeaways: KYC verification process

For the vast majority of businesses in dozens of sectors worldwide, having a KYC verification process is a legally-mandated necessity, and a smart way of protecting your organization, customers, and data.

How you design and implement a KYC verification process isn’t legally mandated. There is no one way to go about this. KYC verification happens on a spectrum from a paper-based process to one that’s supported by biometrics for an easy-to-use in-app experience.

Here at Checkin.com, we recommend a KYC verification process that:

- Has a superior and fast user experience (UX)

- Is global with hyper-localization features, such as the ability to handle 14,000+ ID documents across 190+ countries

- Is fully AML-compliant, monitoring 10,000 data sources, 3 million consolidated risk profiles, and hundreds of sanctions and anti-terror lists

- Comes with Liveness and facial recognition features, making your KYC verification process even more robust and secure.

Work with Checkin.com to implement your KYC verification process. Enable instant ID scanning, face recognition, and KYC tools for secure user onboarding with global reach.