Too many financial services still rely on manual ID checks. These clunky processes frustrate users, waste resources, and leave cracks for fraudulent users to slip through.

The result? High overheads and low return on investment. Essentially, your ID verification solutions are costing you time, money, and customers.

That’s why intelligent ID verification (IDV) is a must-have. These tools use AI, biometrics, and automation to simplify KYC, boost security, and improve the customer experience.

Let's explore how smart IDV solutions help financial services reduce risk, lower costs, and scale efficiently to unlock serious ROI.

Why do financial services need ID verification?

Identity verification (IDV) plays a critical role in the financial industry.

Whenever a customer opens a new account, moves money, or requests a change, financial service providers need to know they’re dealing with the right person.

This means verifying the customer’s identity. To do this, you must compare a customer’s data and identity documents against trusted databases and the person themselves.

This process protects financial businesses.

It helps prevent identity theft and fraudulent applications, while reducing the risk of financial crimes like terrorist financing and money laundering. It’s also a mandatory requirement to comply with anti-money laundering (AML) regulations and other legal requirements.

Beyond that, robust identity verification solutions improve the customer experience.

People trust financial institutions that offer secure services. It shows the company prioritizes their safety and interests.

For banks, fintechs, and credit unions, strong identity verification technology offers the answer. It helps you meet regulatory requirements while securing long-term customer trust.

What’s the problem with conventional ID verification solutions?

Traditional identity verification processes rely on manual checks. They’re slow and error-prone, making them vulnerable to fraud.

Since legacy ID verification systems can’t keep up with evolving fraud and increasing regulatory demands, they’re costly for businesses.

Here are the real issues with conventional ID verification processes.

Labor-heavy

Manual ID checks take time as staff need to collect, review, and verify documents by hand, one at a time.

In fact, for almost all institutions, Know Your Customer (KYC) identity verification processes can take between one and six months, with 30% saying it takes them at least 4 months.

The result?

Long delays in the customer onboarding process and slow financial transactions. This friction leads customers to drop out and switch providers, leading to lost revenue.

Error-prone

Manual identity checks are riddled with human error. Typos, missed red flags, incorrect risk assessments — all these issues cost time and money.

But it’s not just the costs of remedying mistakes.

Errors can lead to compliance failures, which can result in huge fines.

Equally, incorrect judgments meaning risky applicants slip through the net (false negatives) while legitimate customers are denied approval (false positives).

This results in financial losses from fraudulent activity. On top of that, there’s the added cost of unnecessary investigations and lost revenue from genuine customers who can’t access your services.

Expensive and inefficient

Old-school identity verification is expensive.

Manual reviews require large teams, endless training, and constant system updates.

When costs range from $1,000 to $3,000 per customer, traditional IDV processes sap your budget quickly.

Worse still, manual IDV processes don’t scale well. As customer volumes increase, you need to hire more staff to cover the workload. This puts you at a serious competitive disadvantage compared to financial institutions using intelligent IDV automations.

Vulnerable to fraudulent activity

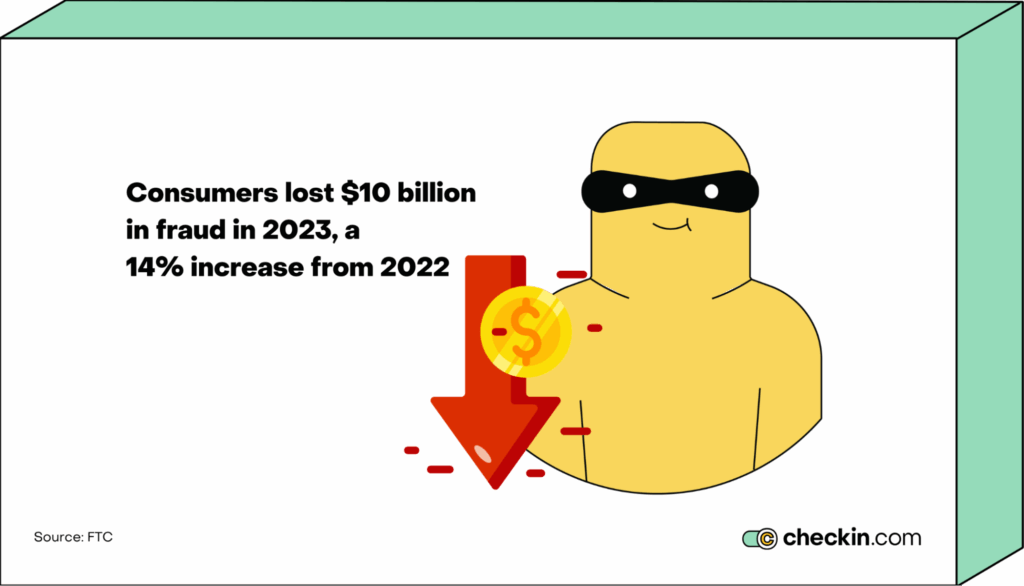

Fraudulent actors are getting smarter and more prevalent.

Artificial intelligence (AI) has advanced fraud tactics — deepfakes, synthetic identities, and ID theft now run rife. As a result, 43% of financial institutions have reported a rise in fraud attempts.

And it costs consumers a lot of money. In 2023 alone, consumers lost $10 billion to fraud — a 14% increase from the year before.

The problem is that outdated IDV methods can’t detect modern threats well enough. Manual reviewers are too slow and fraud tactics are too clever, so they fly under the radar.

Lack of objectivity in decision-making

Manual reviews are steeped in personal judgment.

While one agent might approve a document, another would reject it.

These inconsistent decisions don’t just frustrate legitimate customers. They also increase fraud risks.

How do intelligent ID verification solutions reduce friction and power ROI?

Slow, costly, error-prone processes reduce your bottom line.

Intelligent IDV tools offer the solution. It combines biometric verification, AI, and automation to improve accuracy, streamline processes, and keep you compliant.

Here’s how AI-driven identity verification solutions can help you unlock serious ROI.

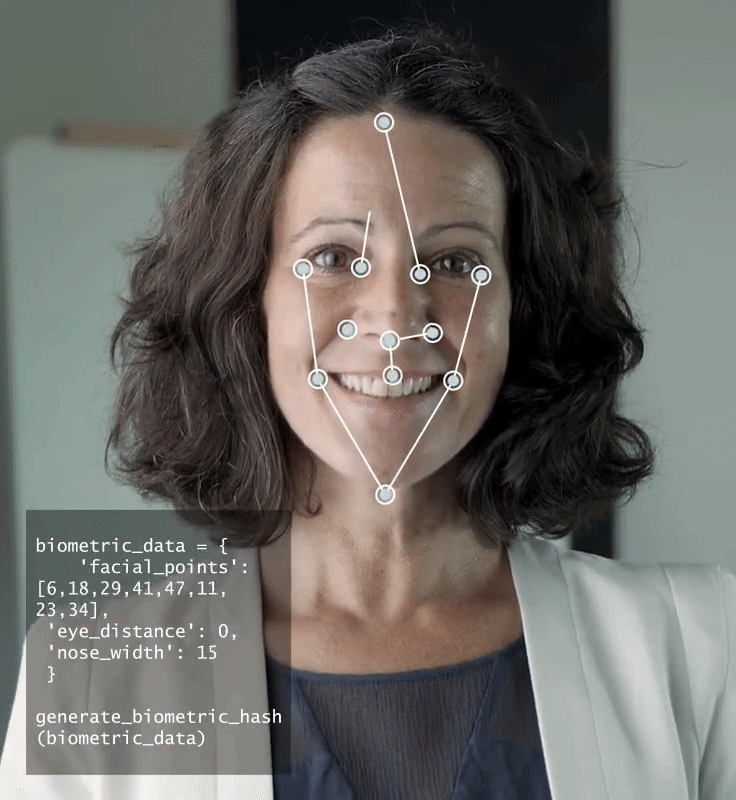

Highly accurate verification minimizes costs and fraud

AI-driven IDV tools offer the advantage of accuracy.

Machine learning models are trained on vast global datasets of diverse faces and international documents. This enables these systems to spot fraudulent activity and forged documents faster than any human.

Combining facial biometrics, advanced document authentication techniques, and liveness detection, IDV technology can weed out synthetic identity fraud, bot activity, fake ID documents, and suspicious behavior as soon as it arises.

Earlier fraud detection to prevents you from onboarding high-risk customers and identity thieves. This protects you against the cost of fraud losses and compliance fines.

It also improves the experience for genuine customers, as there are fewer manual reviews driven by false positives. Customers are more likely to complete IDV processes, leading to higher conversion rates.

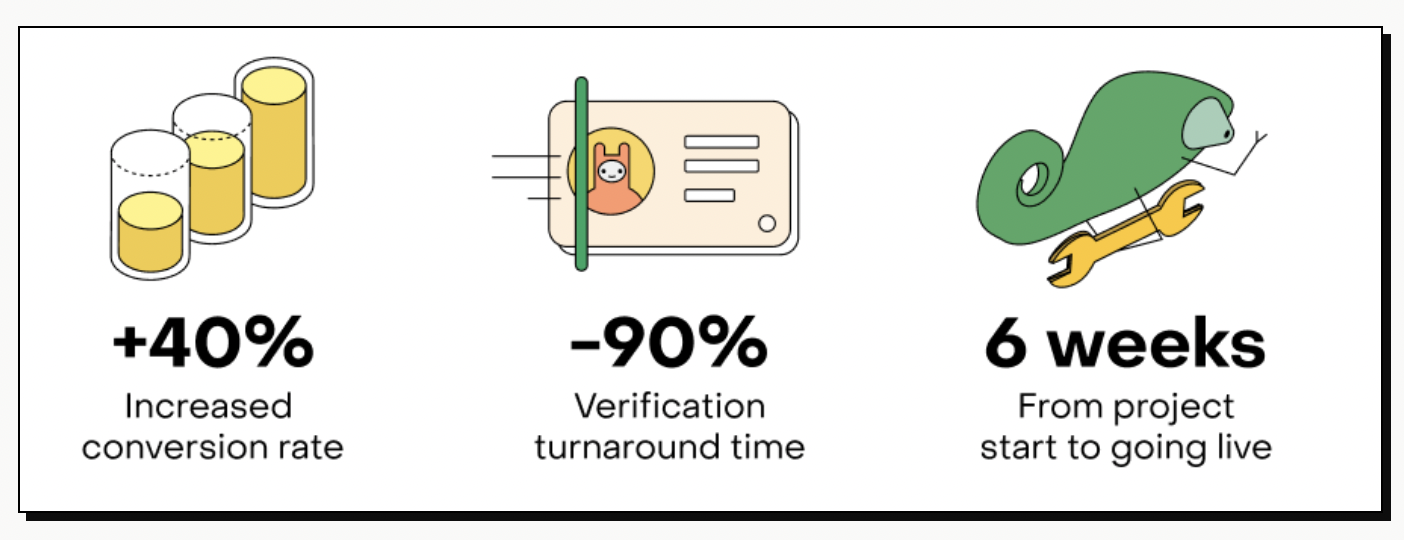

Quicker onboarding drives faster revenue generation

You know the old saying: time is money, especially in the financial sector.

Conventional IDV processes slow down every step of the customer journey where you need to confirm identity. This means a slower customer onboarding process and delayed loan applications and account changes.

AI-powered tools intelligently automate the process. You’ll see higher onboarding success rates as verification takes seconds instead of days or months.

Take Checkin.com, for example. It takes customers less than five seconds to complete the ID submission process and biometric checks.

As a result, users start transacting faster, shortening the sales cycle and driving more revenue.

Automation lowers operational expenses

When your IDV processes are manual, you have to pay a lot of staff. You need large teams to check individual applications, conduct manual reviews, and fix mistakes.

AI automates the most critical tasks, including:

- Document authentication

- Biometric verification

- Liveness checks

- Database cross-referencing

- Customer risk assessment

With less manual effort, financial institutions lower their overheads. There’s less human error, and you’re able to scale without adding headcount.

Now staff can focus on complex cases and higher-risk customers — a far more efficient use of an agent’s time and salary.

Fewer fraud-related losses protect assets

Fraud doesn’t just hurt your reputation. It attacks your bottom line.

Fraudulent applications and criminal activity cost billions of dollars each year, showing that outdated IDV processes don’t cut it.

Intelligent verification tools stop fraud in its tracks, before it causes financial damage.

With the support of biometric authentication, deepfake detection, and automated AML/PEP checks, tools like Checkin.com block suspicious activity before it breaches the system.

Plus, AI algorithms use continuous learning models to adjust to evolving fraud threats. This is especially important in fast-moving sectors like cryptocurrency, where new financial crime tactics arise quickly.

Scalable operations handle high volumes without staff increases

To grow your profit, you need to expand your customer base.

But manual IDV processes struggle to scale. You either hire more people, or your current team has to work harder to cover more ground (often leading to more mistakes).

Intelligent IDV solutions handle spikes in demand without the need for more staff.

These solutions scale without compromising speed or accuracy, all while keeping you compliant.

Enhanced customer experience increases retention and conversion

If your digital onboarding solution is slow or confusing, customers won’t stick around.

But when the user experience feels seamless, customers complete the process.

Smart IDV systems improve the digital identity verification process by offering:

- Clean, intuitive interfaces

- Localized language support (Checkin.com supports 80+ languages)

- Adaptive input formats based on device and region

- Lightning-fast response times

This frictionless experience boosts customer trust. In response, you see higher conversion rates and greater customer loyalty.

Global compliance helps you avoid costly fines

Financial institutions are bound by strict legislation. Following the Anti-Money Laundering Directive, KYC rules, and data privacy laws isn’t an option, it’s mandatory.

To stay compliant, you need secure, transparent identity checks that follow the regulations in every country you operate in.

Intelligent solutions like Checkin.com automate this process. Machine learning algorithms update the systems in real time as global regulatory requirements change.

Plus, it offers multi-region hosting, sanctions screening, automated audit trails, and real-time reporting to help you stay compliant and avoid hefty penalties.

Just look at its client, Decta, for example.

The global payment processer remains compliant while serving over 2,000 clients monthly across 32 countries.

Real-time data analysis optimizes processes and improves efficiency

It’s not just the front-of-house that’s a bonus. Smart IDV solutions act as a back-office powerhouse.

Tools like Checkin.com come with advanced analytics and reporting systems that offer real-time insights to improve your processes and prove compliance.

With granular insights, you can improve ROI by:

- Spotting inefficiencies

- Improving identity verification approval rates

- Adapting to fraud trends

- Simplifying audits

How can financial services use IDV solutions to improve ROI?

Upgrading your IDV processes doesn’t just stop fraud. It brings value to the entire customer journey.

From onboarding to account recovery, AI-driven IDV tools lead to lower costs, faster processing, and higher levels of customer trust.

Here’s how.

Streamline customer onboarding and KYC

First impressions are everything.

If you don’t nail the customer onboarding process, you risk losing potential customers before they’re signed up.

Slow, clunky identity checks are a one way ticket to customer drop-outs.

AI-powered document verification and facial recognition help speed up the process, while maintaining high levels of security.

By swapping manual checks for intelligent AI-powered automation, you can meet KYC/AML obligations while offering a smooth customer experience.

For example, when Admirals switched to Checkin.com, the financial solutions provider cut verification time by 90% and increased conversion by 40%.

Verify high-value transactions

High-value transactions are a hotbed of risk. Approve the wrong transaction and customer funds are in the hands of fraudulent actors.

To combat this risk, you can use IDV tools to confirm the identity of customers before moving money. This reduces the chances of money laundering, illicit activities, and internal fraud.

This is an especially helpful application for crypto exchanges, bank-to-bank transfers, and investment platforms, where you face strict regulatory requirements and the risk of fraud is high.

Safeguard password resets and account recovery

Weak account recovery processes are a goldmine for fraud actors.

Impersonation fraud happens when bad actors pretend to be another person to access their accounts. Weak reset flows make it easy for impostors to hijack financial accounts.

Instead, you can roll out an intelligent IDV solution that requires users to re-authenticate themselves before resetting their credentials. Using biometric verification and smart document authentication, you add an extra layer of protection against account hijacking.

Secure document signing and e-signatures

Loan agreements, investment deals, financial disclosures. All these official documents need to be signed and verified.

But you don’t want an intruder signing a document meant for another customer.

Smart IDV verifies users before they sign. By adding authentication solutions to this process, you reduce the risk of forged or invalid signatures.

Checkin.com is a good example of this: It offers signature comparison tools to flag mismatches in real time. This prevents fake sign-offs, protecting customer assets while supporting legal requirements.

Prevent fake and duplicate accounts

Fraudulent users exploit bonus schemes or test fake IDs across multiple signups. Without the right tools, these attacks slip through, leading to fake or duplicate accounts.

IDV solutions with deepfake detection block fake IDs. They detect AI-generated spoofs immediately, preventing the creation of fake accounts.

But flagging duplicate accounts is a little harder.

Here’s the problem.

Most systems store raw biometric data. This poses privacy risks.

If hackers breach your system, they have sensitive customer data at their fingertips. This is problematic for customers and leads to non-compliance.

Checkin.com takes a smarter approach.

It’s the only IDV provider that stores biometric vectors instead of raw images.

Vectors can’t be reverse-engineered. Even if a hacker gets into your system, they can’t recreate the data’s original form. But these vectors are powerful enough to flag repeat fraud attempts and duplicate IDs instantly.

That means strong protection against duplicate signups, without sacrificing user privacy.

Final thoughts

Smart ID verification doesn’t just keep you compliant. It facilitates growth.

Faster onboarding, smarter fraud prevention, and better user experiences, all power higher ROI. With modern ID solutions, financial services operate more smoothly and efficiently, cutting costs and driving profitability.

Remember, though. Accuracy, speed, and adaptability are key to long-term ROI.

If you're looking for a solution built for today’s financial landscape and tomorrow’s regulations, Checkin.com offers the most advanced IDV solution on the market.

Book a demo now to see how it fits your compliance and CX strategy.