Product Update: New security package with improved deep fake detection

At Checkin.com, we’re committed to providing seamless identity solutions that prioritize security, compliance, and user experience. To continue raising the bar, we’ve recently introduced new features and significant updates to our platform. These enhancements are designed to give our clients the most robust fraud prevention, identity verification, and data protection tools available—all while keeping the user journey as smooth as ever.

Here are some of the improvements we made:

Enhanced fraud prevention features

Fraud prevention is at the core of trust in digital platforms, and we’ve enforced our capabilities to detect and stop both single-time and serial fraud with precision:

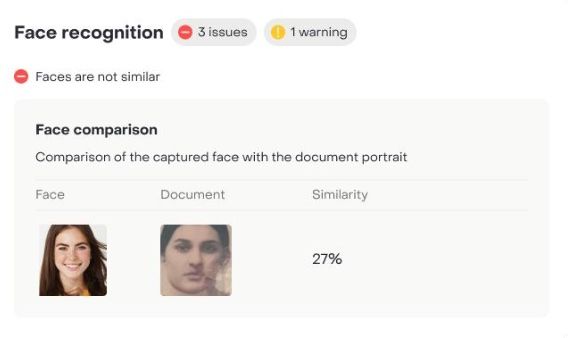

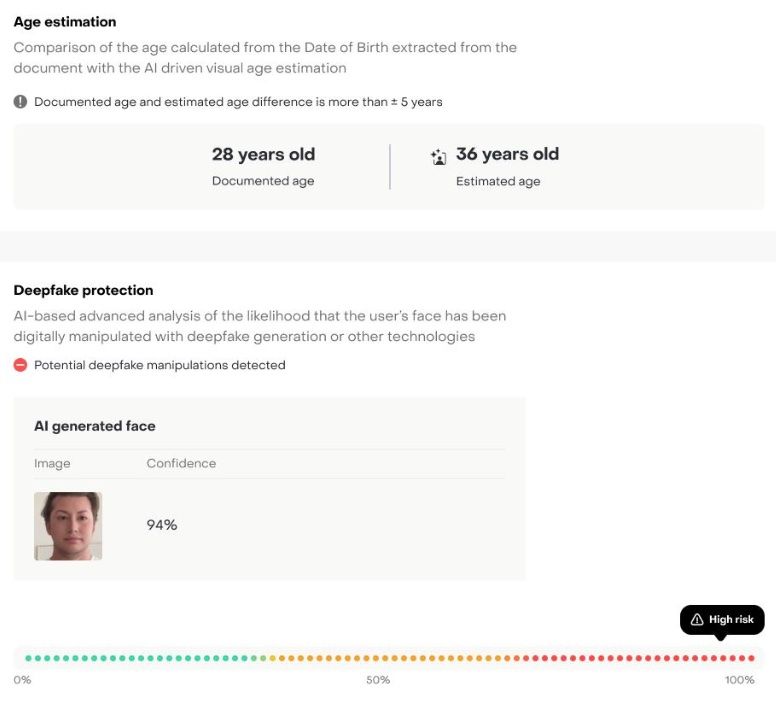

- Single-time fraud detection

Advanced image manipulation models and state of the art deepfake protection guard against attempts to spoof identity verification processes. - Serial fraud detection

With face similarity models, template recognition models, and data velocity monitoring, our system identifies repeated fraud patterns, ensuring long-term security. - Geo-location, VPN, and Proxy detection

Strengthen compliance with geographic restrictions and identify suspicious behavior through advanced location-based monitoring.

Expanded face recognition capabilities

Our updated biometric face recognition technology is more versatile and secure than ever, adding new layers of security to identity verification:

- 1-1 and 1-N matching

Accurately verify individual users against their ID documents or cross-check identities against databases and previous identifications. - Biometric authentication

Enable secure logins and transactions with reliable biometric checks. - Age estimation and Transaction confirmation

Use facial data to ensure compliance with age-restricted services and verify critical actions like withdrawals or account changes.

Improved native SDKs

Our SDKs now offer a new level of flexibility where our customers can use their own UI on top of our integration layer, helping businesses integrate Checkin.com’s solutions seamlessly into their workflows:

- UI-less integration

Developers can now embed our solutions invisibly into their existing interfaces, maintaining full control over all parts of the user experience. - Auto-capture and Passive liveness detection

Automated document capture and liveness checks reduce friction for end users while boosting security. - NFC reading

Verify IDs with embedded chips, such as passports, for unparalleled accuracy and speed.

These improvements are designed to deliver a best-in-class identity experience that prioritizes security without compromising on speed or usability. Whether you’re looking to prevent fraud, ensure regulatory compliance, or enhance user trust, these features provide the tools you need to stay ahead.

If you’d like to learn more or see these features in action, get in touch with us today.