Compliance standards are designed to protect against financial crimes such as fraud, corruption, money laundering and terrorist funding. But just about every week, fines are slapped on iGaming, FinTech, and crypto companies for not meeting regulatory requirements.

As compliance becomes more stringent, implementing the KYC verification process becomes more time-consuming and labour-intensive–especially if you want to expand to other countries.

Massive amounts of resources and manpower go into sourcing, negotiating, and signing agreements with individual KYC vendors. Once that’s completed, setting up these integrations requires an engineering team to maintain them. This leads to downtimes, errors, and lost revenue.

Finally, a product or design team has to design, test, and optimise the onboarding user experience. Failure not only leads to loss of conversions, but also compliance issues.

If you are working across multiple markets, these issues compound with each new market you expand into. KYC compliance teams need new technology and local knowhow to serve the right configuration in each market.

This is why today’s leading iGaming and FinTech brands are adopting end-to-end solutions for KYC onboarding to grow faster and expand to new markets, instead of stringing together multiple vendor KYC solutions for each market.

Beyond ID verification: end-to-end KYC onboarding

Although identity verification solutions are the best known type of KYC, you probably need a complete KYC onboarding solution to build an end-to-end process. This can include gathering and verifying emails, physical addresses, phone numbers, bank accounts, electronic IDs, and more.

Complying with regulations today typically requires a complete KYC/AML flow including:

- Fraud prevention

- ID verification and authentication: scanning documents, bank logins, biometric scans, etc.)

- Checking user information against PEP & sanctions registries

- OTP: a unique one-time password (OTP) to a customer's phone via text message, which the customer then enters into the website or app to prove their identity.

- Geolocation block

- Address enrichment

- Proof of address software: confirms a user’s place of permanent residence in accordance with KYC/AML (anti-money laundering) requirements.

- Bank statement verification: verifies the authenticity of a customer's bank statement, ensuring that it's not a fake or altered version.

Stitching together these identity solutions from different vendors is frustrating and tricky to get right. Instead, a holistic onboarding flow will give users a seamless brand experience while solving the entire KYC management from data collection to validation to the final verification.

Checkin.com is an end-to-end user onboarding solution that replaces your old fragmented solutions for signup, identity verification, and login so you can expand into new markets faster and onboard more customers.

The Checkin.com framework not only includes GetID, Checkin.com’s leading solution for scanning physical identification documents like passports and ID cards, but offers a wider range of KYC onboarding solutions compared to vendors like Onfido, Jumio, and Samsub.

We know how complex it can be to set up a registration flow in-house. Even if you have compliance officers in-house, your team might lack expertise in international KYC/AML compliance, or the knowhow to create an onboarding flow that adapts to each country’s regulations.

What’s more, localising the user experience is just as important for compliance. Asking too many questions can frustrate your users, and if they don’t know how to complete the checks, it can lead to drop-off and poor conversion rates.

This was why we built Checkin.com: the first complete solution that changes how end users sign-up, identify and login with brands and services online.

💡 Key KYC regulations You Need to Comply With

- Customer Identification Program (CIP): a mandatory requirement under the USA Patriot Act that outlines the minimum information that must be collected from a customer to verify their identity.

- Financial Action Task Force (FATF) Recommendations: a set of international standards that outlines the best practices for anti-money laundering (AML) and counter-terrorism financing (CTF) measures, including customer due diligence (CDD) procedures.

- Office of Foreign Assets Control (OFAC) Sanctions: a list of individuals, entities, and countries that are subject to economic sanctions and restrictions by the United States government. Financial institutions must screen their customers against the OFAC list as part of the KYC process.

- Customer Risk Assessment: an internal process that assesses the level of risk associated with a customer based on factors such as their industry, geographic location, transaction history, and other relevant factors.

- Enhanced Due Diligence (EDD): a more rigorous level of due diligence that is required for high-risk customers, such as politically exposed persons (PEPs), to ensure that they are not involved in money laundering, terrorist financing, or other illegal activities.

Optimising data collection uplifts signups by 18%

If you are not optimising your onboarding process to improve customer experience, you are losing out on substantial revenues.

We all have experienced the overwhelm of filling out long and tedious forms with gray text boxes, even if you know all the information by heart. It was this experience that inspired our founder, Krisoffer, to build the Checkin.com framework.

Instead of an endless form that creates cognitive overload and creates drop-offs, the Checkin.com data collection user flow makes customer onboarding process easy by collecting customer data one question at a time, each one localised for country-specific data sources.

You may also like: The Cost of Compliance: KYC Outsourcing vs. In-house Solutions

For example, our framework has a mobile phone number module with global support. Once collected, it always takes all the necessary information such as international formatting and country code. However, the best user experience in many countries is to accept numbers in a local format and then transform the data into an international format in the background.

These little details matter, because a holistic flow that just works out of the box not only saves time from building forms internally, but more importantly, we see as many as 18% more customers when our clients use the Checkin.com framework. There is no other B2B solution on the market that offers a holistic signup flow on the front end for data collection.

How is Checkin.com different from other KYC solutions in the market?

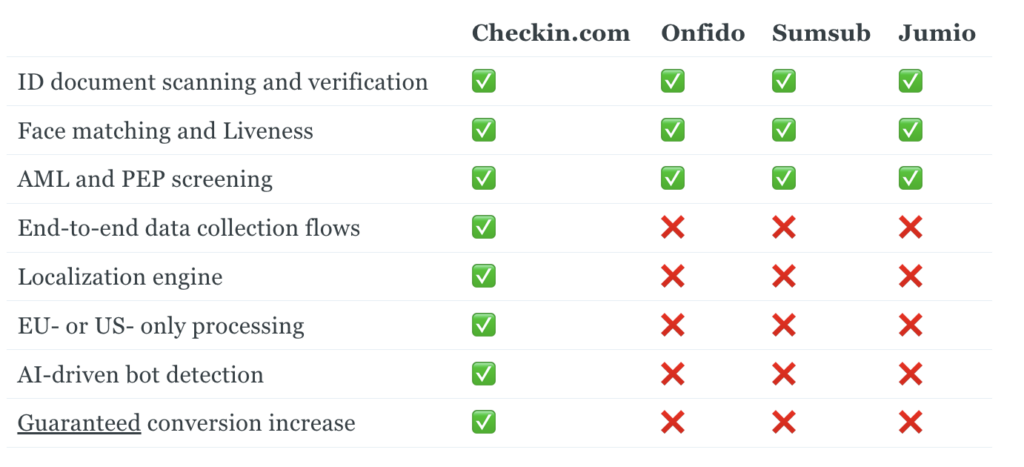

Although KYC solutions like Onfido, Jumio, and Sumsub verify identity by scanning physical documents, you will need an entire optimised workflow to successfully convert customers and comply with regulations from country to country.

Checkin.com is designed to be an A-Z customer onboarding tech stack to improve conversion and user experience at scale across countries. It handles everything from AML/KYC checks to ID scanning to SMS verification in your target market with completely localised flows.

With Checkin.com, you will have 100% control over branding and UX. The solution is fully white-labelled to integrate seamlessly inside your app platform or website. Every aspect of the checkin flow is 100% customizable and easily adjusted through our powerful backoffice so you can deliver a seamless experience for your customers.

The cherry on the cake? We guarantee increased conversions for using the Checkin.com framework when you A/B test it with your existing solution. Our customers see an average of +18% uplift in conversions.

Here’s a quick comparison between Checkin.com and other KYC solutions in the market:

In short, if you’d just like an ID scanning software, other solution providers in the market are suitable for you, but if you want a completely done-for-you client onboarding flow ready to activate with just a click of a mouse, then opt for Checkin.com.

Expand to new markets faster and get conversions with Checkin.com

Navigating complex regulations in different markets is confusing for global businesses. Checkin.com can not only help you become 100% compliant with any local regulation, but also optimise for higher completion rates with fully localised workflows.

Complying with KYC regulations can be time-consuming and labour intensive and current fragmented KYC solutions are not enough. An end-to-end framework like Checkin.com takes away the hassle of sourcing, negotiating, and putting together different solutions and optimises signup flows for higher conversions.

Book a call with our team to get the perfect client onboarding KYC workflow for your business and your target market.