Cryptocurrencies bring a new sense of financial freedom. But they also bring risks.

Their pseudonymous, decentralized nature increases financial accessibility.

But it also makes crypto a magnet for misuse.

Virtual Asset Service Providers (VASPs) face serious threats like identity fraud, terrorist financing, and sanctions evasion. These issues compromise trust and compliance.

This is why Know Your Customer (KYC) is so important.

Intelligent KYC solutions that use AI and biometrics bring unparalleled accuracy. They’re fast, scalable, and adaptable.

In this article, we’ll explore the importance of adopting cutting-edge KYC solutions to combat the specific risks VASPs face. We’ll look at the benefits of intelligent KYC software and how you can pick the solution that’s right for you.

What is KYC in crypto?

KYC does what it says on the tin. It helps you to “know your customer”.

As The Joint Money Laundering Steering Group explains it, KYC includes:

- Identifying users

- Understanding their purpose

- Assessing risks

The KYC process is a legal requirement for VASPs.

It ensures AML compliance by verifying user identities and managing risk to protect against fraudulent activity and financial crime.

Identity friction and risk management are a big step toward preventing illegal crypto activities like money laundering, terrorist financing, and tax evasion.

What are the KYC crypto requirements for VASPs?

For VASPs, KYC isn’t optional — it’s a legal requirement.

VASPs must meet strict compliance requirements to protect against financial crimes and fraudulent activities.

Let’s break down the key steps.

Customer Due Diligence (CDD)

When crypto customers sign up, cryptocurrency exchanges conduct due diligence to verify the user and create an accurate risk profile.

First, you verify the customer’s identity using official documents.

Next, you try to understand where funds originate from to prevent the risk of fraud and illicit cryptocurrency transactions.

Then, you create customer risk profiles to identify low- and high-risk customers.

You assess customers against risk factors, such as whether they’re based in high-risk jurisdictions or listed in adverse media reports. This process also involves PEP (politically exposed persons) and sanctions list screening.

Lots of VASPs now use identity verification (IDV) technology to automate this process for accuracy and speed.

As a recent MONEYVAL report puts it, “The use of technology when identifying and assessing risks in this sector appears to be a good practice.”

Enhanced Due Diligence (EDD)

When CDD flags high-risk customers, they get passed up for EDD.

This involves deeper background checks and more stringent document verification.

There’s extra screening across an individual’s whole financial history to look for suspicious activity.

Ongoing Customer Due Diligence (CDD)

KYC doesn’t stop at onboarding. Ongoing monitoring makes sure your customers remain safe and keeps you compliant as their circumstances change.

This involves continuous transaction monitoring to check for suspicious activity, like large transactions.

Your system should also continue to screen customers against sanctions lists and watchlists to keep risk profiles updated.

Record-keeping and reporting

VASPs must keep accurate records of customer data and activity for at least five years.

It’s a proactive way to identify suspicious behavior.

If something seems amiss, you need to file Suspicious Activity Reports (SARs) and cooperate with authorities to catch illegitimate users.

Compliance with regulations

Regulations change and it’s up to VASPs to stay compliant.

You need to meet all AML requirements in the jurisdictions you operate in.

For example, in the US, you need to comply with:

- FATF recommendations (an inter-governmental body that develops AML policy)

- The Digital Asset Anti-Money Laundering Act of 2022

- The U.S. Bank Secrecy Act (BSA)

Why is KYC so important for VASPs?

It’s not just that fraud is increasing for financial institutions. The crypto industry is particularly vulnerable as fraudsters evolve their tactics.

This is why VASPs need to take KYC so seriously.

Criminals are getting smarter

Criminals use Anonymity‑Enhancing technologies (AEC) to bypass onboarding systems and hide illegal activity.

These tools obscure the origin and movement of funds, so authorities can’t trace them.

Take Lazarus Group, for example.

This Democratic People's Republic of Korea (DPRK)‑sponsored cyber group stole $620 million from a blockchain project. They used AEC to launder the illicit funds until the money became untraceable.

Without robust KYC processes, VASPs are sitting ducks for clever fraudsters.

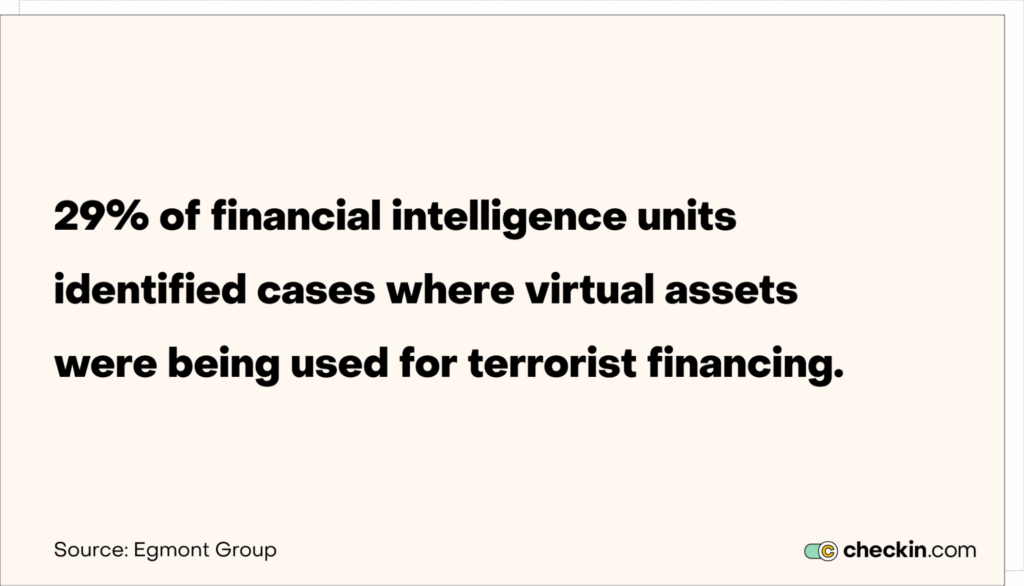

VASPS act as ideal channels for terrorist funding

Almost 30% of financial intelligence units (FIUs) say they’ve dealt with cases of virtual assets funding terrorist activity.

As a report by FIU cooperative, Egmont Group explains, “Most of the time, donors or supporters were identified as sending funds to individual or group addresses linked to terrorist organizations present in conflict zones.”

In other cases, bad actors use crypto assets to fund right-wing organizations and radical religious groups.

With strong KYC practices, you screen users to identify these potential risks before they manifest.

Exchanges are vulnerable to sanctions evasions

Cryptocurrencies are decentralized and borderless.

This makes it easier for sanctioned entities to move funds undetected.

These individuals or groups use VASPs that operate in jurisdictions with weak AML enforcement. It’s harder for authorities to track and freeze assets when criminals move money through VASPs instead of conventional financial services.

Effective KYC flags users tied to sanctioned regions or entities. This helps you mitigate the risk of sanctions evasion.

There’s tax evasion risks

Cryptocurrencies can be used to hide funds from tax authorities.

It’s not just criminals smuggling illicit funds from illegal activities. Your average Joe might hide income to pay less tax.

Pseudonymous addresses and cross-border transactions make it tough to track income or capital gains. Plus, the complexity of crypto activity, such as staking and mining, makes it hard to report income accurately.

With smarter ID verification, it’s simpler to track a person’s transactions and identify bad actors.

What are the benefits of an intelligent KYC solution?

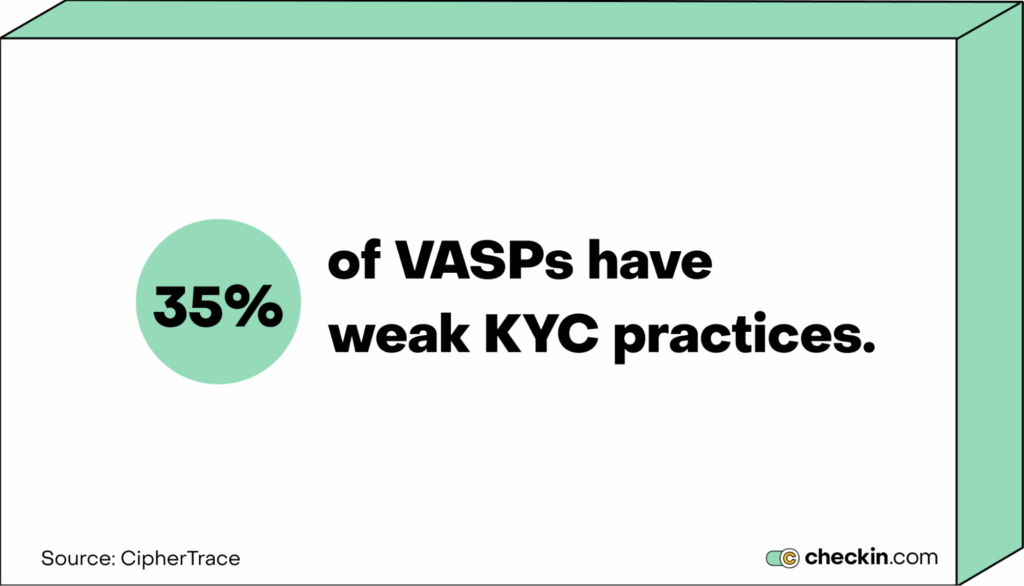

While KYC is mandatory for VASPs, 35% have weak KYC practices.

Legacy systems and disjointed KYC checks leave VASPs open to fraud, compliance issues, and reputational damage.

Here’s why you need an intelligent KYC system to improve and automate this process.

1. Proactive risk scoring

Legacy solutions are often subjective or they use static, rule-based models for risk scoring.

These systems don’t automatically update with new threats. And because of their rigidity, they often fail to spot high-risk customers.

AI-powered KYC software is far better at identifying risky behavior.

They can analyze a vast range of data points in real-time, to assign a dynamic risk score.

The algorithms update automatically to incorporate emerging threats and adjust risk profiles to reflect this.

This way, you stay ahead of changing compliance requirements and you catch risky actors before you lose money.

2. Automated anomaly detection

Rule-based systems aren’t as sensitive to nuance as intelligent KYC solutions. They often miss subtle anomalies in large datasets that indicate fraud.

An AI-driven KYC tool can detect all kinds of unusual patterns.

It would notice sudden increases in transaction volume or unexpected sources of funds. Plus, its algorithms evolve so they get better at spotting risks as they learn.

3. Due diligence automation

Legacy solutions often involve lots of manual tasks like data entry. It’s slow, error-prone, and costly.

Modern KYC tools automate verification tasks. They extract data, verify identities, screen against PEP and sanctions lists, and monitor transactions. All without human participation.

Not only is the technology extremely accurate. The entire process is much more efficient and far less costly.

4. Continuous monitoring and adaptation

Old systems need constant manual updates.

AI-based KYC systems evolve automatically. They adapt to managing emerging threats and incorporate new regulations.

Your risk profiles stay up-to-date and you’re always compliant.

5. Fewer false positives and negatives

Legacy solutions are rigid. They will flag anything they don’t recognize.

This can generate a high number of false positives where legitimate customers are tagged as risky.

This is frustrating for customers as extra checks take time. It also wastes resources on unnecessary investigations.

AI KYC is far more precise. It can analyze a wealth of data points for more accurate customer context.

This means fewer escalations and less operational friction.

6. Smoother customer onboarding

50% of customers who drop out at the onboarding stage say it’s because of poor experience.

Conventional KYC practices are often cumbersome and data entry-heavy.

AI-powered KYC uses intelligent automation to simplify onboarding tasks. It uses biometric verification and optical character recognition (OCR) to automate the process.

This improves the onboarding experience so you reduce dropout rates.

7. Data-driven decision making

Old systems lack insightful reporting. This limits their ability to identify areas for improvement.

In contrast, AI solutions track customer behavior, emerging threats, and compliance trends in real time.

This helps you figure out ways to improve KYC processes to remain compliant, lower risk, and understand customers.

8. Scalability and agility

Conventional KYC practices are often labor-heavy and disjointed. They’re tough to scale without hiring more staff.

AI automation can handle lots of verifications at once. It scales to manage increasing customer volumes, and it evolves to manage new risks and regulations.

Now you can handle more customers without extra labor costs.

9. Enhanced regulatory compliance

It’s hard to keep pace with the regulatory landscape if you have to do this manually.

If you don’t update your systems in time, you risk non-compliance fines and legal penalties.

AI KYC systems self-evolve, updating with each regulatory change. This way, you’re always compliant, no matter your jurisdiction.

10. Competitive advantage

Faster, more accurate KYC gives you the edge.

Not only do you cut back on the cost of a big compliance team. You also offer your customers the most convenient user experience. This builds your reputation as you show you’re the most customer-focused brand.

When your KYC processes are easy, you can onboard faster than your competition. This allows you to scale quickly and increase your market share.

How to pick the right crypto KYC solution for your VASP

It’s not just about switching from manual KYC to a tech solution. It’s about finding the right intelligent crypto KYC system to work with your business needs.

Here’s some key features to consider.

1. Compliance coverage

Your solution must meet all AML laws, sanctions regulations, and local legal stipulations.

For example, Checkin.com keeps companies compliant across 190+ countries.

Make sure the tool you choose updates its compliance models automatically so you stay compliant without manual updates.

2. AI and machine learning capabilities

AI improves speed and accuracy, as well as offering intelligent risk scoring and anomaly detection.

And the best thing? It learns as it goes.

With an AI-driven KYC solution, you stay ahead of all crypto threats and regulations, while automating workflows to accelerate verification.

3. User-friendliness

Make it easy for your customers to complete KYC and for your staff to keep track.

Test tools to understand how user-friendly they are.

.

Look for an easy-to-use interface with clear instructions, as well as training documentation, to get your staff up and running immediately.

Ideally, you want solutions that offer a localized KYC experience so customers can complete the process in their native language.

4. Data security and privacy

Data security and privacy compliance are as important as following AML regulations.

Without tight enough security, you risk breaches. This can result in a huge hit to your reputation, not to mention the sky-high non-compliance fines.

Look for advanced data encryption, strong security measures, and compliance with relevant data privacy regulations.

5. Scalability and performance

As your business evolves, you need a KYC solution that can keep up with growing volumes of customers.

Search for reviews that talk about the performance of the tool. KYC solutions should be able to handle large volumes of data and transactions without slowing down.

Also look for scalable pricing plans that offer add-on features to improve your operations as you grow.

6. Integration capabilities

The best KYC solutions fit into your existing tech stack.

Consider tools that connect with your CRM, transaction monitoring software, and document management systems.

And remember, you don’t have to go it alone. Top KYC solutions offer integration support, helping you to create streamlined workflows for more holistic KYC processes.

7. Customizable branding

White-label solutions allow you to customize the interface with your branding.

It adds a professional touch to solidify your brand identity.

8. Reporting and analytics

Analytics help you make data-driven decisions on how to improve your compliance performance. They help you see patterns in customer behavior and monitor risk trends.

Reporting capabilities help you visualize this information and simplify regulatory reporting.

Make sure your tool has a user-friendly analytics dashboard that brings information together in an understandable way.

8. Hidden obligations

Watch the small print.

Find out if your chosen solution has hidden fees and obligations. Some companies charge extra for setup, integration, and support. Others lock you into long contracts.

The best solutions don’t charge extra or force you to stay. They simply offer the best services for a transparent price.

Keep your crypto compliant

The crypto landscape faces unique challenges. Intelligent KYC solutions are the first step to tackling these issues.

Legacy systems simply won’t cut it anymore. They don’t have the capacity to handle sophisticated fraud tactics, regulatory pressure, and the need for a seamless experience.

Intelligent KYC crypto solutions do.

These tools deliver advanced fraud prevention, dynamic risk assessment, and automated compliance. This means better security, smooth onboarding, and consistent compliance with changing regulations.

Interested in learning about how Checkin’s KYC solution protects VASPs? Book a call with our experts today.