Players are ditching online casinos with slow, clunky KYC processes.

Outdated, paperwork-heavy KYC verification systems frustrate new sign-ups and drive loyal players away. This doesn’t just damage your brand’s reputation: It harms your bottom line.

But how do you improve onboarding to streamline the player experience while still staying compliant with strict gambling regulations in all your operational locations?

Intelligent KYC software.

AI-powered KYC solutions speed up onboarding and keep players engaged. This means fewer dropouts and faster gameplay.

Let’s explore how smoother KYC can improve onboarding to give you a competitive edge. Let’s dive into the world of fast, frictionless KYC to attract more players and reduce churn.

What's KYC for casinos and why's it important?

Know Your Customer (KYC) is a mandatory requirement for casinos. It’s the process of verifying the identity of players before they can deposit or withdraw funds.

It serves three main purposes.

Firstly, it keeps casinos compliant with Anti-Money Laundering (AML) laws. These compliance regulations protect casinos against financial crimes like money laundering and terrorist financing.

Secondly, it helps casinos create risk profiles to assess how risky players are. It identifies potential fraud or problematic gambling habits.

KYC identity verification also helps casinos confirm player age. This prevents underage gambling.

Regulatory bodies like the Financial Action Task Force (FATF) and Basel Committee on Banking Supervision require casinos to make a conscious effort to put stringent KYC measures in place.

Casinos need to:

- Verify customer identities

- Monitor high-risk individuals

- Implement enhanced due diligence (EDD) for high-risk customers

If casinos fail to comply, they face legal penalties, revoked licenses, and hefty fines.

To comply with these regulatory requirements, the KYC process for casinos typically involves:

- Identity verification using government-issued ID

- Proof of address to confirm play location

- Age verification to prevent underage gambling

- Risk profiling to identify high-risk players or locations

- Ongoing monitoring to flag suspicious transactions

It’s important to understand that AML regulations vary by location. Casinos must comply with AML regulations across all jurisdictions in which they operate.

For example, in the U.S., the Bank Secrecy Act (BSA) and Patriot Act require financial institutions to track transactions and report suspicious activity.

But casinos that also operate in the EU need to follow the EU’s Anti-Money Laundering Directive (AMLD) as well.

These regulations don’t just protect casinos against fraud and money laundering. They also protect players.

KYC ensures players benefit from a secure gaming environment that offers fair games, prevents fraud, and protects financial transactions.

How does KYC software fit in?

Traditional KYC processes rely on manual checks and disjointed systems. They’re slow, prone to errors, and frustrating for players.

Genuine players are often subject to long wait times and false positives that require deeper investigation. Plus, human error and subjectivity increase the chance of fraud slipping through.

KYC software cuts out these inefficiencies through automation and AI processing:

- Optical Character Recognition (OCR) extracts and verifies data from ID documents.

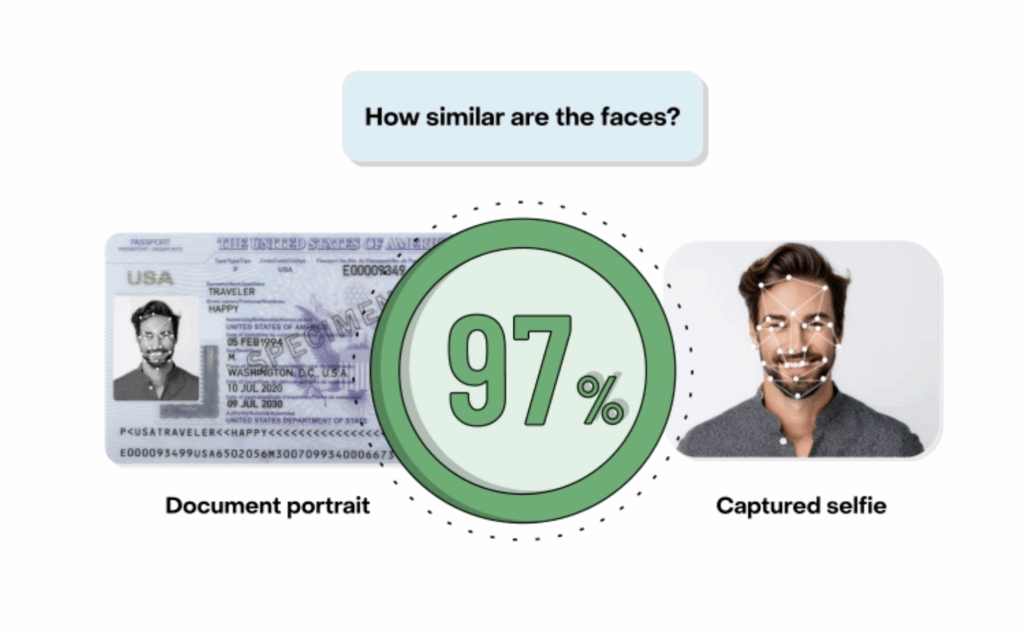

- Face matching matches an applicant’s live image to their ID.

- Facial recognition compares a person’s face to government databases to verify their identity.

- Liveness detection prevents deepfakes and spoofing to make sure the player is present alongside their proof of identity.

- Bot recognition identifies bots trying to open accounts.

- Automated watchlist checks scan global watchlists for politically-exposed persons (PEPs), adverse media coverage, and sanctions

Intelligent KYC solutions also use AI-powered features to continuously monitor player activity. Instead of periodic manual reviews, KYC software tracks player activity and updates risk profiles on an ongoing basis.

It flags suspicious transactions, high-risk behaviors, and changes in circumstances (such as an address change). In doing this, it spots fraudulent and suspicious behavior instantly.

KYC software streamlines the process. It improves security, reduces fraud, and speeds up onboarding. It offers a smoother player experience while keeping casinos compliant with KYC and protected from financial crime.

What are the problems with outdated KYC in casinos?

Players drop out of casino onboarding when the KYC process is slow, complicated, or disjointed. It’s also hard to scale and tough to stay compliant.

Here’s why manual KYC processes hold casinos back.

Slow onboarding

Traditional KYC methods require players to upload documents manually. Human agents review these documents one by one.

This process is slow, causing delays that frustrate new users. This leads to player drop-out.

Manual reviews are also problematic after onboarding. Manual re-verification disrupts gameplay. Players often abandon casinos with outdated processes. Customers instead opt for establishments with faster KYC and re-verification.

Prone to mistakes that give way to fraud

Human verification is subjective. Decision-making is inconsistent and prone to false positives and negatives.

Legitimate players get tied up in unnecessary enhanced due diligence (EDD).

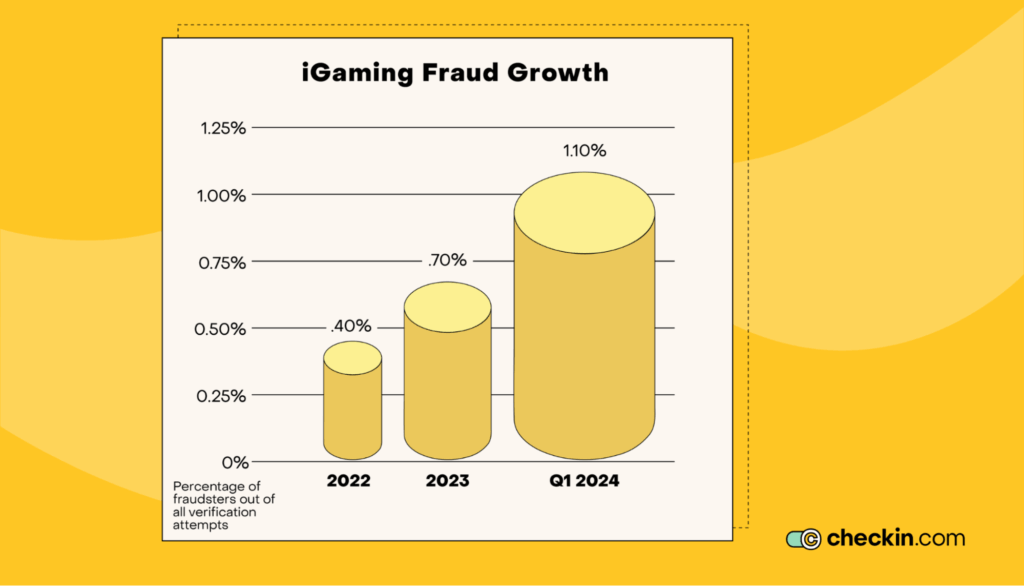

Worse still, malicious actors slip through the net. And fraudulent activities are both increasing and getting smarter.

Between 2022 and 2024, iGaming fraud increased 64% year-over-year. In fact, 8.7% of all online gaming and gambling attempted account creations are fraudulent.

Bad actors use fake or stolen IDs, synthetic identities, and deepfakes to circumvent KYC. It’s hard for human reviewers to spot these forgeries.

Bonus fraud is also an issue.

Bonus abuse is a huge problem for casinos, accounting for almost 70% of fraud in the online gambling industry.

Some casinos offer generous bonuses for new players. Customers create multiple accounts using fake details to exploit these promotions.

It’s not easy for human reviewers to notice duplicate accounts, so these fraudulent players get away with harvesting bonuses.

Withdrawal delays

Even after passing onboarding, customers may experience bottlenecks when it comes to withdrawals.

Some casinos require KYC at the onboarding stage. Others wait until customers want to withdraw funds. This delay can surprise and frustrate customers.

In other circumstances, casinos require re-verification at withdrawal. Customers want instant withdrawals and don’t appreciate the extra steps.

Manual document verification takes a long time — sometimes a few days. This can significantly delay withdrawals. If a document gets flagged, customers must submit extra proof of identity, which further delays payouts.

As a result, customers submit complaints, request refunds, and switch to different gaming providers. All these issues hurt your reputation and affect your profit margins.

Overloaded customer support

Slow onboarding and false positives put a huge burden on support teams. If there are lots of complaints about the KYC process, support teams spend their time focused on dealing with these bottlenecks.

This results in high operational costs to fund large teams of support agents.

Equally, agents are busy dealing with KYC complaints rather than focusing on support requests that help loyal players.

Tough to scale

It’s hard to scale manual review processes. Human agents can only deal with one verification at a time.

The more people that onboard, the longer the wait times as staff workloads back up. Alternatively, casinos have to hire bigger compliance teams to prevent delays due to an increasing volume of applications.

Hard to stay compliant

Regulations change constantly.

Outdated systems require manual updates to stay compliant. It’s easy to miss new regulations that come into play, so casinos accidentally fall out of compliance.

This puts casinos at risk of reputational damage, fines, and legal penalties.

Take Gamsys, for example.

After failing to meet compliance thresholds, the gaming company was fined $7.6 million.

How does KYC casino software improve player experience to increase customers and reduce churn?

Outdated KYC slows players down and leads to abandonment. Smooth verification keeps players engaged and ensures compliance.

Here’s how KYC casino software streamlines the experience for players.

1. Faster, smoother onboarding experience

For most players, automated KYC takes a couple of minutes. Players can begin playing immediately after signing up.

Players no longer have to wait days for manual verification, thanks to biometric authentication, automated document verification, and AI-powered risk profiling.

Players simply upload their ID, take a selfie, and let the system do the rest.

A smooth onboarding process reduces drop-offs. In a competitive market, online casino sites that make onboarding easier gain an edge over those with disjointed, outdated verification processes.

2. More accurate KYC

Outdated systems often create unnecessary obstacles where false positives demand extra documentation and longer wait times.

Automated KYC software is better at assessing documentation and catching forged IDs and suspicious applicants.

This means fewer false positives, so legitimate players pass through without friction. It also automatically flags bad actors straight away.

This minimizes human intervention and reduces extra reviews, lowering operational costs. It catches fraud, cutting down financial losses from financial crime.

There are also lower abandonment rates as the process is straightforward for genuine customers.

3. Perpetual KYC doesn’t interrupt gameplay

To stay compliant, casinos must continue to monitor player behavior as they play online casino games and reverify suspicious accounts.

The problem is that manual reviews and re-verification disrupt gameplay.

Automated KYC solutions work in the background. They continuously track financial and gambling activity to flag suspicious behavior. This is known as perpetual KYC (pKYC).

If re-verification is required, biometric authentication takes seconds. You stay compliant, and genuine players don’t get annoyed.

Plus, manual reviews are reactive. They’re triggered by a human noticing suspicious activity.

AI-driven ongoing monitoring is proactive. It analyzes player behavior in real time so it can catch inconsistencies early. This prevents financial crime before it escalates, rather than reacting to problems once the damage has been done.

4. Increased trust in security

Intelligent KYC solutions offer enhanced privacy and security features to protect personal and financial details. They use strong encryption, AI-driven fraud detection, and robust data storage to secure transactions and personal details.

A secure, compliant environment encourages player trust. It strengthens your brand's reputation, giving you a competitive edge over less secure online casino sites.

5. Easier access to customer support

When you automate verification, players are subject to fewer delays. This decreases the number of KYC-related support tickets.

The result? Reduced burden on customer support so they can focus on more complex issues.

There are also fewer bad reviews about poor customer service as support teams. A decreased backlog means support agents can respond quickly.

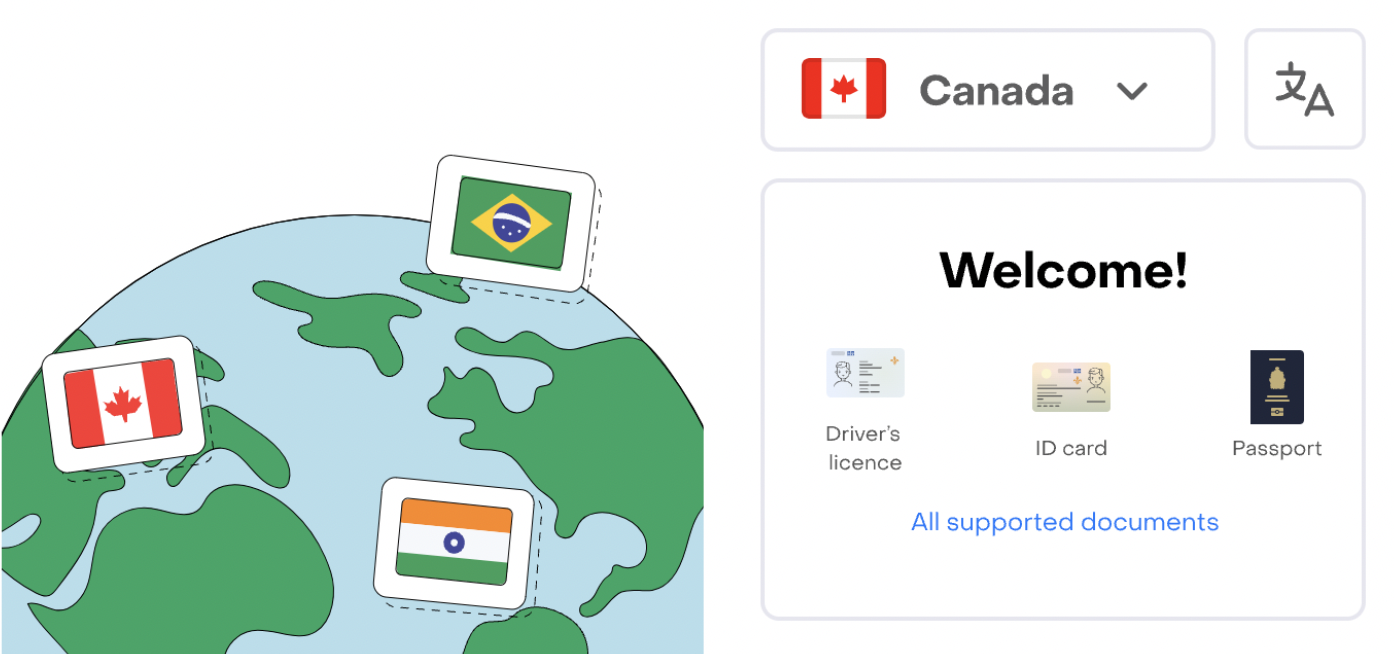

6. Global access to gaming

Outdated KYC mechanisms struggle to verify foreign documents, while players make mistakes when completing KYC in a non-native language.

AI-powered KYC solutions can process lots of foreign documents and offer interfaces in multiple languages.

For example, Checkin.com offers its localized KYC interface in 80+ languages and can process more than 14,000 document types.

This helps casinos expand their market reach to increase their customer base while remaining compliant across all jurisdictions they operate in.

7. Personalized gaming experiences

KYC data doesn’t just help improve your compliance processes. By connecting to CRM systems and marketing tools, data on player behavior can help tailor the online casino experience.

This information helps online gambling platforms offer attractive bonuses, promotions, and game recommendations that are relevant to each player.

This boosts retention and improves player engagement through a more customized, immersive experience.

8. Fewer withdrawal delays

Smooth KYC doesn’t just benefit onboarding. It also speeds up the withdrawal process.

Some gaming sites let you play online casino games without completing KYC. But they’ll require customers to complete verification when they come to withdraw funds.

It can be very frustrating when customers don’t realize they have to complete these steps before they can have their money — especially if the process is slow and cumbersome.

AI-powered verification enables lightning-fast withdrawals. Verification happens quickly, and players can access their winnings almost immediately.

Faster, hassle-free withdrawals enhance the whole casino experience, making it more likely that customers will return.

9. Less bonus abuse and multi-account fraud

Bonus fraud is very problematic for casinos. It’s the most common type of fraud, and it’s hard to spot.

Advanced KYC software stops bonus fraud in its tracks. It can detect duplicate identities, suspicious transactions, and bot activity.

By analyzing behavioral patterns, AI-driven fraud prevention tools flag customers who attempt to open more than one account.

This makes a significant difference to a casino’s bottom line since it's such a prevalent form of fraud. These funds can be redistributed to offer better promotions for genuine players rather than offsetting financial losses from fraud.

10. Stronger compliance without sacrificing UX

It’s hard to balance regulatory compliance with a seamless gaming experience. One often affects the other.

Strict KYC procedures feel intrusive, but weak compliance measures can cause damage to the business.

Intelligent KYC solutions offer an adaptive approach. Layering security based on risk levels, AI algorithms assess each player individually, so only high-risk customers have to go through EDD processes. Low-risk players sail through verification uninterrupted, with the whole process taking no more than a few minutes.

This way, casinos stay compliant without pushing customers away with invasive measures.

KYC casino software: Top features to look for

The right KYC software streamlines onboarding for the online gaming industry. It should help prevent fraud and ensure compliance at all times.

But not all KYC solutions offer the same cutting-edge technology.

Here are the standout features to look for when comparing KYC tools.

1. Automatic data capture and biometric verification

Seamless verification reduces the likelihood that players will drop out of onboarding.

OCR, biometric authentication, liveness detection, and automatic watchlist checks verify most players in minutes — without human intervention.

This speeds up onboarding and improves accuracy for a frictionless KYC experience.

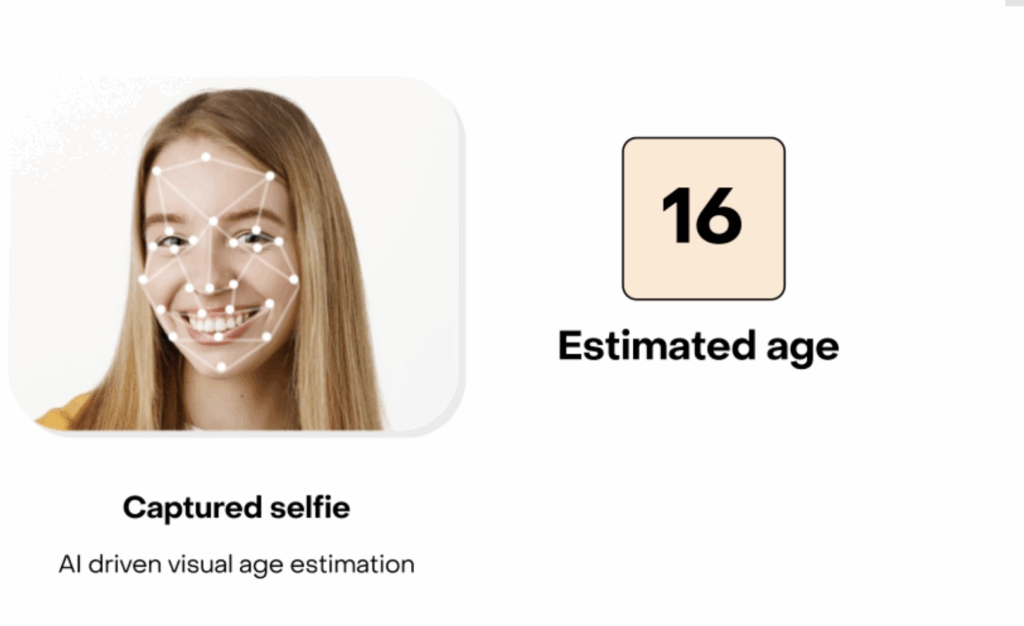

2. Age assurance technology

Gambling operators are subject to strict age restrictions. Breaching this ethical and legal requirement can result in huge fines and license revocation.

Biometric age assurance compares selfies and ID images to each other and to databases of known age-related facial features.

In doing this, it verifies ages and weeds out underage players.

This ensures compliance, protects minors from inappropriate gaming, and promotes responsible gambling.

3. AI-powered fraud prevention

AI can detect and prevent fraud more quickly and accurately than humans. This protects against bots, account takeovers, and identity theft.

AI-powered fraud prevention uses biometric verification and automated watchlist scanning to flag any illegal activities, PEPs, or high-risk individuals with sanctions and adverse media coverage.

AI risk profiling helps identify high-risk players and pass them along for EDD processes.

It also keeps risk profiles updated, changing the risk status if suspicious activity occurs later in the accounts.

AI also gets better at assessing risk and recognizing threats. As new threats emerge, AI updates its algorithms to keep it ahead of bad actors and new types of fraud.

4. Localized, easy-to-use interface

Pick a solution with a user-friendly interface that offers KYC in a wide variety of languages and supports an impressive array of local document types.

This way, your solution aligns with regional regulations and improves accessibility by meeting cultural norms. As a result, you’ll see fewer applicant mistakes and a lower drop-off rate.

Plus, it’s easier to offer your services in new jurisdictions.

For example, by using Checkin.com’s KYC solution, online casino platform Simple Casino could offer its interface in Japanese, which made it easier for them to break into the Japanese market.

5. Automatic multi-jurisdictional compliance

KYC regulations are different across regions. They also change frequently.

AI-powered KYC solutions automatically update compliance models to match new AML, data privacy, and Counter-Terrorist Financing (CTF) regulations as they come into play.

This means you’re always compliant without having to update your system with new laws.

Automated screening and real-time updates reduce the risk of fines and ensure frictionless compliance across all the locations you operate in.

For example, Checkin.com’s AML screening automatically checks over 3 million PEP profiles to flag PEPs and close associates. The AI algorithms automatically update regulations and change risk statuses to align with new laws.

6. API integration and integration support

Solutions with flexible APIs allow your chosen KYC software to integrate with casino management systems, marketing tools, and transaction monitoring platforms.

For example, Checkin.com offers direct API/SDK integration along with dedicated integration support. You can either use the AML/PEP screening as a standalone or part of your end-to-end customer onboarding workflows.

7. Case management and KYC progress tracking

Efficient management of cases helps to streamline KYC by providing end-to-end visibility into each customer’s account.

You need a centralized dashboard to track verification progress and see real-time updates on customer status.

This improves transparency and makes it easier for the customer support team to offer help.

It also simplifies audits by keeping records accessible and organized.

8. White-label solutions and customizability

Branding gives a professional look and feel to your brand, improving customer trust.

White-label KYC solutions allow you to customize your branding so that the verification interface matches your brand identity.

This offers customers a familiar user experience to increase confidence and provide an extra layer of professionalism.

9. Analytics and reporting

Strong KYC software comes with advanced analytics and reporting functionality. These tools automatically track and analyze customer behavior, delivering detailed insights into verification trends, fraud patterns, and risk profiles.

You can also securely share this data with other systems by integrating the software. This way, you can tailor marketing messaging and refine player engagement strategies.

Checkin.com: KYC casinos need to scale your customer base

Successful online casinos offer secure, user-friendly onboarding. If your KYC processes are slow and outdated, you’ll lose customers before they even start to play.

Casinos that invest in AI-powered KYC solutions automate onboarding and ongoing monitoring.

A seamless gaming experience attracts more players, reduces churn, and cuts out regulatory risks.

Ready to improve player verification and compliance? Check out Checkin.com’s KYC solutions to improve player onboarding and simplify regulatory compliance. Talk to our experts today.