We hope you're having a great start of the new decade! The whole Regily Team is super excited to make 2020 into the great year we're certain it's going to be.

Let us help you enter new markets 🌍

A lot has happened during the previous year. 500% more registrations has gone through the Regily framework during the last month compared to beginning of last year (that's a huge amount of data!).

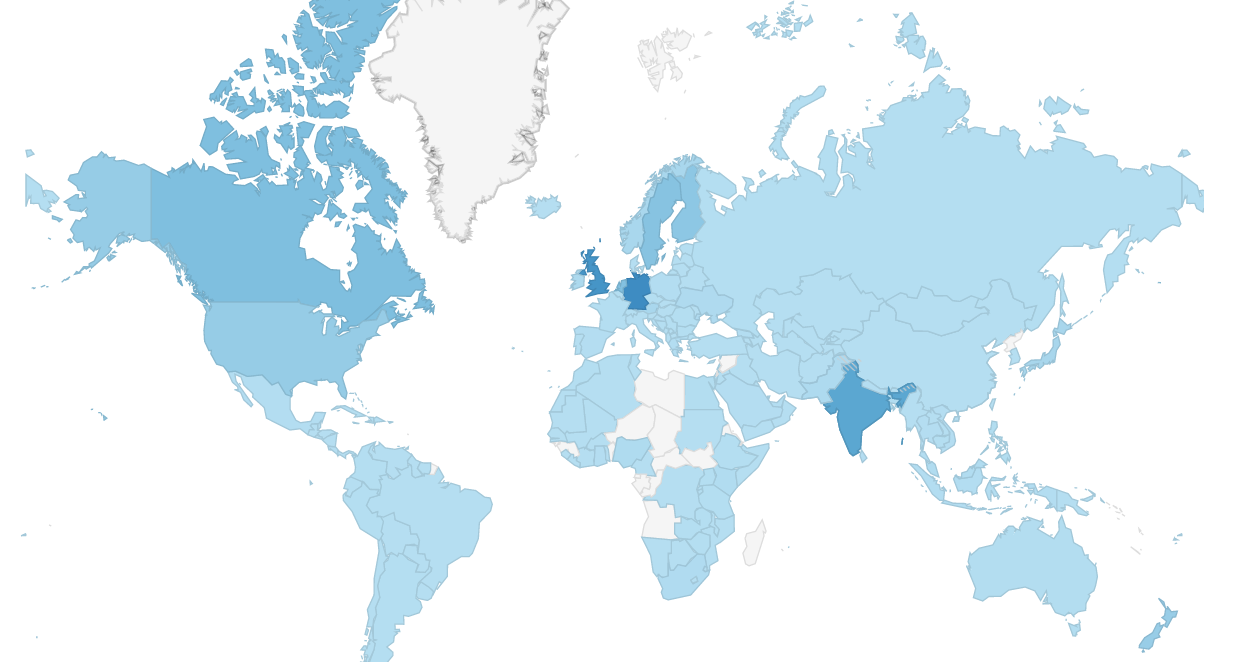

The framework supports over 30 languages, is handling traffic from over 150 countries and has 84 edge locations for faster load time across the world. In other words, we're a 100% worldwide service that ensures the best sign up conversion for all your markets regardless of where on the globe that is.

As the framework localizes to each new market, it's very easy for you as a partner to grow with us. Localizing to a new market means that the best local data sources for lookups are being used, localized AB testing helps to ensure that the information is fetched in the best possible way according to the local population, and the local language is of course supported (among many other things). Once it's live, the framework leverages the data it receives in that market in order to optimize the flow further.

So, thinking about entering a new market, but are not sure how? Let us help.

Increase conversion on affiliate traffic with Remote

We've talked about this before, but we think it deserves a highlight. Like all online players, many of you get your traffic from affiliate sites. This is why we've built Regily Remote, enabling your registration flow on an external page. This means we can increase signup conversion on affiliate traffic by register them to your service already on the external page, leading to users already being signed up once entering your site. Besides this, all special adjustments you have on your registration flow will be applied on the affiliate traffic as well. Regily Remote is very easy to set up and will radically increase conversion on affiliate traffic - two aspects we know you like. Let us know if you want to get started, more information about Remote can be found here: https://regily.com/remote/

- Radically increased affiliate conversion

- Keep full control over registration flow and data

- Fully compliant in all jurisdictions

- Additional services follows

Product updates 💡

Even though there has been a record in amount of red days in the Swedish calendar, we've managed to be very productive during Christmas and New Years! One of the many perks of being a remote company is that we're spread out all over the world and don't have the same public holidays, hence production never ends.

Update on the second generation technical platform

As written in previous update, last year we started taking traffic on the second generation technical platform: Flowbrain.

This means that we're already now personalizing the flows on an even more granular level for some of the traffic running through the framework. We've seen an increase in conversion on this traffic, and we'll continue to ramp up the percentage over time until all traffic runs through Flowbrain.

The new platform allows for multiple UX systems and broader creativity. There is really no stop in how many UX systems that will be available in the new platform, and we have already built several dozen. One of newest ones are called "the Card interphase". This module allows the user to enter their information by swiping cards, which is a more playful and interactive way of collecting data.

Age verification with iDIN in Netherlands

The Gaming Authority (KSA) decided that age verifications will be needed in the Netherlands from January 1st 2020, and the framework now supports this kind of verification. It is soon possible for all partners to enable an age verification check through the online service iDIN.

iDIN is a service offered by banks which allows users to use their bank's secure and reliable login methods to carry out a verification. The verification can either be done in regards to age, or be more extensive and then also include name and address.

The iDIN check can easily be added and removed to the flow, and can be used by any partner using the framework. Let us know if you're interested.

User tests in regulated markets

As you know by now, all flows are 100% data-driven. However, sometimes we would like to get a human user perspective, especially when we want to understand how locals think and act in different markets. So, we've recently conducted user tests in regulated markets, and here are the key takeaways:

Localized experiences give better conversion rates.

With the help of user tests we ensure that all the translations, formats and examples are correct: Phone number, date of birth, address, full Name, identity numbers and many more.

People can have really long names

In contrast to for example Sweden, in Spain most children get both their mother's and father's surnames. In order to get high data accuracy, the way to collect names should be split into “First Name, Last Name and Second Last Name”.

Fun fact - Pablo Picasso’s (the painter) full name is: Pablo Diego José Francisco de Paula Juan Nepomuceno María de los Remedios Cipriano de la Santísima Trinidad Ruiz y Picasso.

Postcode structure is very clear and locals seems to always remember it.

In this case our data enrichment gateway is able to automatically identify user’s city and province. However, street names normally consist of house, floor, apartment numbers etc and can have many different formats. Hence, we've set up a few alternative modules to get it tested on live traffic and for systems to optimize based on data.

Hope you enjoyed the read, feel free to reach out if you have any questions, feedback or input - we're always happy to help!