Regulations and compliance are changing at breakneck speed to keep up with new types of financial crime.

This makes it essential to modernize and streamline your compliance processes.

Intelligent KYC compliance software is the most effective way to reduce fraud risks, scale onboarding, and enter new markets without worrying about non-compliance fines.

It automates workflows, delivers accurate verification, and adapts to evolving threats. This empowers businesses to grow with confidence.

Let’s unpack today’s compliance trends and explore how KYC compliance software can keep you ahead of the curve.

What's KYC compliance software?

KYC compliance software is a technological solution to streamline KYC processes. It automates workflows to help businesses meet anti-money laundering regulations and manage risk levels.

The software verifies customer identities and highlights potential risks to protect your business against financial crime and other threats.

Intelligent KYC compliance software includes features like:

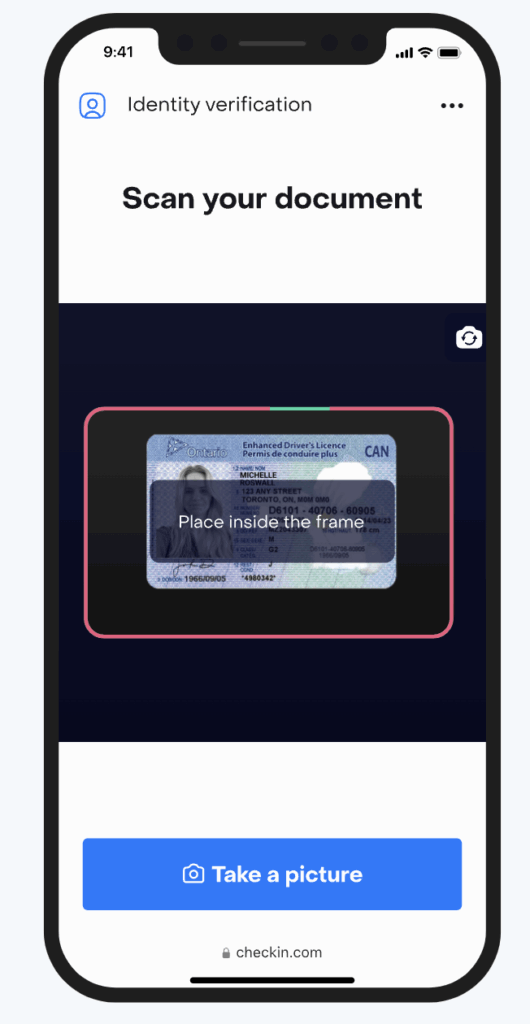

- Document verification using optical character recognition (OCR) and image analysis

- Biometric verification, like facial recognition, facial matching, and liveness detection

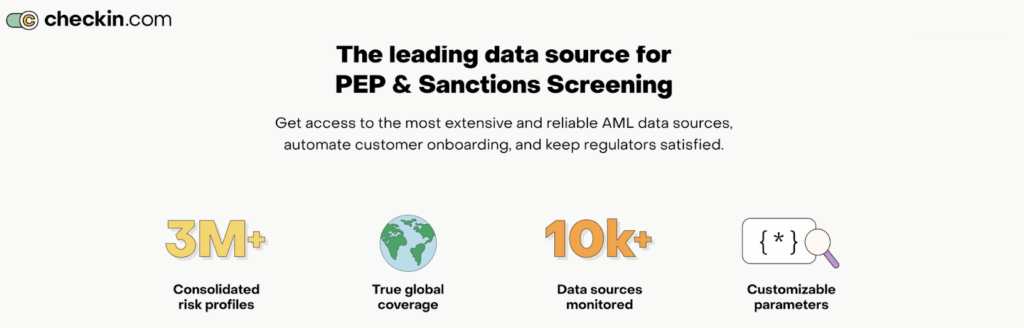

- Automatic watchlist screening to check politically exposed persons (PEPs), sanctions, and adverse media lists

- Intelligent risk scoring using AI algorithms to create and update customer risk profiles

Beyond onboarding, the software continuously monitors transactions and watchlists to flag suspicious activity and update risk profiles as circumstances change.

The AI algorithms automatically update compliance models as regulations change and new threats emerge.

In doing all of the above, KYC software ensures accurate verification and risk profiling. This keeps you compliant throughout the entire client lifecycle.

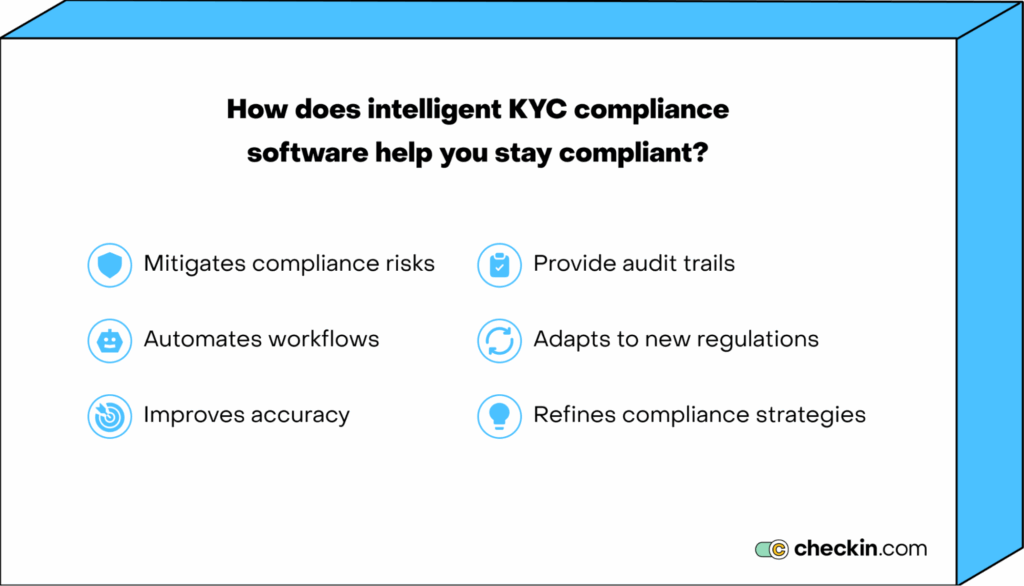

How does intelligent KYC compliance software help you stay compliant?

It’s hard to keep ahead of changing regulatory requirements when you’re doing it with manual or legacy KYC systems.

Intelligent KYC compliance software leverages AI and automation to keep you compliant in real time.

Here’s how.

Mitigates compliance risks through accurate fraud detection

Of all the risks that businesses have to manage, compliance risks ranked as the most important focus.

If your KYC processes are inadequate, you’re not compliant with anti-money laundering (AML) regulations. This can lead to huge fines and penalties and reputational damage.

This is why businesses aim to reduce risk. In fact, risk reduction is the number one reason that companies invest in risk and compliance technology.

KYC compliance software can help to reduce the risk of non-compliance by significantly improving the accuracy of fraud detection.

It uses AI-powered biometric verification and transaction monitoring to flag fraudulent activity in real time.

The tool identifies high-risk customers and fraudulent identities and prevents transactions with sanctioned entities. It accurately pinpoints suspicious patterns, like unusual transactions or payments to high-risk jurisdictions.

Machine learning (ML) algorithms constantly improve fraud detection by learning new threats.

With better fraud detection, there’s less risk of non-compliance.

Automates compliance

Manual and legacy KYC systems are inefficient, and compliance teams agree: 38% of compliance professionals worry about how inefficient their manual AML compliance processes are.

Not only are manual processes slow, but they’re also error-prone. And it’s not just that it takes a lot of time and money to fix mistakes. It’s also the cost of the mistakes in terms of financial losses and non-compliance fines.

KYC compliance software solves this issue by automating KYC processes, such as:

- Document verification

- Identity verification

- Risk assessment

- Case management

- Compliance reporting

- Ongoing monitoring

Automation speeds up KYC processes and ensures higher levels of accuracy. This reduces the risk of inaccurate data entry and incorrect decisions that result in non-compliance.

Enhances accuracy and completeness

Outdated KYC systems often rely on human subjectivity in decision-making. They also rely on manual data entry.

These two factors can lead to errors and omissions in customer information and inconsistent verification decisions.

Dynamic KYC platforms use AI-powered verification systems and automation to ensure customer profiles are complete and correct.

They reduce the risk of false positives and negatives and remove subjectivity in decision-making.

Provides clear compliance audit trails

AML regulations demand detailed record-keeping and reporting.

KYC software automatically records all KYC processes, such as customer interactions, risk assessments, and alert investigations. It keeps accurate records of all activity and generates detailed audit trails and reports on KYC activities and ongoing customer behavior.

This offers you comprehensive, easily-accessible audit trails without the labor burden while ensuring you stay compliant with record-keeping stipulations.

Adapts to evolving regulations

Regulations change. KYC processes that require manual input need human agents to update their systems with new regulations.

If you miss an update, you’re non-compliant. Regulatory ignorance isn’t an excuse.

In contrast, AI continuously adapts to keep up with changing regulations and emerging threats automatically. As soon as new regulations come into play, your AI-powered KYC compliance software integrates them and applies them.

It mitigates the risk of accidental non-compliance due to missing a regulatory change.

Refines compliance strategies

KYC software comes with analytics and reporting.

These insights paint a valuable picture of customer behavior, risk trends, compliance effectiveness, and more.

By understanding how effective your compliance programs are and how your customers behave, you can make data-driven decisions to optimize your KYC processes.

This supports the development of better AML controls and helps you adjust KYC procedures based on real-time insights.

8 compliance trends shaping KYC practices in 2025

Criminal activity is evolving rapidly. Regulations are changing just as fast in a bid to keep up. Businesses must adapt to stay compliant.

If you fail to modernize your processes, you risk non-compliance fines, reputational damage, and increased financial losses.

Here are the latest trends shaping KYC practices and what they mean for compliance professionals.

1. Evolving regulatory expectations

As of 2024, 77% of organizations predict more regulatory obligations than in previous years. You have to adapt to stay ahead of the changes.

Changes in regulations come in the wake of growing concerns about terrorist financing, complex digital financial ecosystems, and more sophisticated financial crime.

Authorities are tightening compliance frameworks to weed out non-compliance and financial crime.

For example, the U.S. Criminal Division recently introduced the Corporate Whistleblower Awards Pilot Program. It encourages workers to report internal corporate misconduct, such as money laundering, financial corruption, or fraud.

Meanwhile, the UK has recently drafted the Cryptoasset Service Providers Regulations 2025 to introduce stricter due diligence for crypto-related organizations.

These new regulatory expectations put pressure on compliance teams to keep up to date with changes.

But the constant evolution feels like a battle for compliance teams. Almost half of compliance professionals see such quick shifts as a threat to compliance.

To keep up, businesses need solutions that automatically update compliance models in real time. As regulatory frameworks change, these solutions reconfigure your workflows to reflect these updates.

For example, the FATF recently greylisted Lebanon.

If a global bank uses intelligent KYC compliance software, it will automatically recategorize Lebanese entities to a higher risk profile.

2. AI-powered risk assessment and fraud detection

AI and ML enhance fraud detection with faster, more accurate risk management.

When KYC systems rely on humans to manually review customers and transactions, it’s slow, costly, and error-prone.

Compliance software can analyze and process vast amounts of data in real time.

This makes it better at noticing fraud patterns and potential threats, and it can do it much faster.

At the onboarding stage, this means quicker, more accurate verification. And far less chance of bad actors slipping through.

But it doesn’t stop with onboarding. AI algorithms continuously monitor transactions and customer information to detect anomalies throughout the whole customer lifecycle.

This means no more need for periodic manual reviews of accounts. Your customers are in review all the time to flag fraud as soon as it happens.

3. Perpetual KYC for real-time monitoring

To stay compliant, you need to continuously monitor customers and transactions. This is hard to do using systems that require lots of manual reviews and data entry.

Perpetual KYC (pKYC) moves beyond periodic reviews.

It monitors accounts in real time and updates risk profiles every time there’s a change. This keeps your records up-to-date so you’re always compliant.

It also gives you a real-time or near-real-time picture of risk. You’re far more likely to see compliance issues before they become a problem.

Consider this.

A payment gateway uses an AI-powered pKYC solution to scan customer transactions for unusual patterns.

It notices a sudden increase in high-risk transactions. It immediately flags the customer for money laundering.

AI is quick at picking up on trends and accurately predicting what they show. This helps you spot money laundering, terrorist financing, and other financial crimes that can cause your company to become non-compliant.

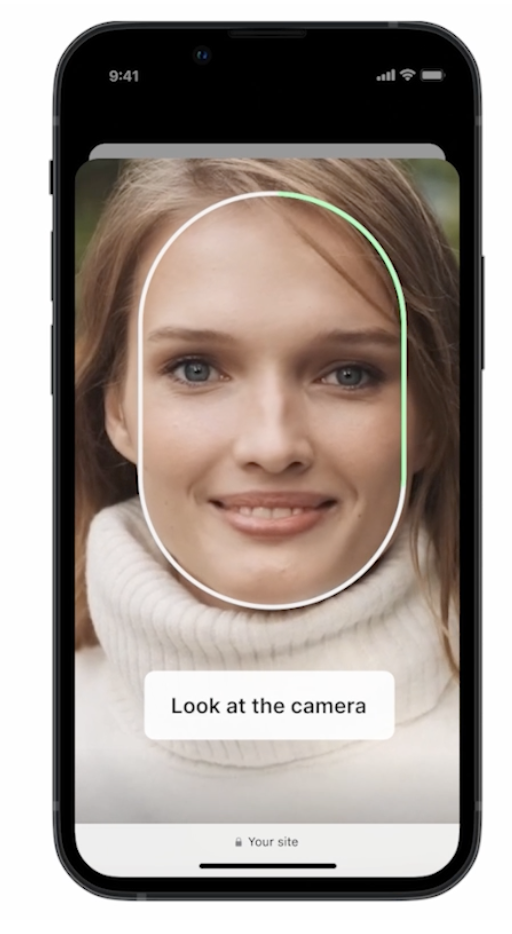

4. Biometric authentication and enhanced identity verification

Biometric authentication is fast becoming the gold standard for identity verification.

Its pinpoint accuracy stops fraudulent activity in its tracks and speeds up the whole process for genuine customers.

AI-powered biometric verifications include features like liveness directions, age assurance, and facial recognition.

These elements work together to guarantee the person onboarding is who they say they are and that they’re present during the process.

It makes it almost impossible for applicants to get verified if they try to use stolen or forged ID documents.

Take Betcity.nl, for example.

The Dutch igaming company uses Checkin.com to authenticate documents and biometrically assess applicants.

This helps significantly with identity fraud. There’s less likelihood of people laundering money through the online gaming site. It also cuts out underage gambling.

5. Integration and interoperability

Companies are starting to connect their KYC solutions to their other business systems. It removes friction in compliance workflows.

When you use disconnected compliance processes, your data is spread across multiple platforms. There’s a higher chance of data inconsistencies when you’ve got information everywhere. These mistakes can lead to non-compliance.

The best compliance tools offer API and/or SDK integration to help you connect your systems. With fluid workflows, you get a more holistic overview of customer risk. Plus, automation means there’s less chance of non-compliance due to bottlenecks.

Look for providers that offer integration support so you can connect your systems in a way that works best without disrupting your workflows.

6. Multi-jurisdictional and multilingual capabilities

If your company operates in multiple regions, you need to make sure you’re compliant with all local regulations.

Multi-jurisdictional KYC solutions use AI to automatically update your systems when local regulations change. This ensures compliance in real time, no matter where your customers are based.

To make sure your customers complete KYC properly, intelligent KYC software will also offer the interface in multiple languages and verify a wealth of global documents. This makes it easier to verify customers in different geographical locations and reduces the chances of data entry mistakes.

Not only does this keep you compliant, but it also helps you scale into new global markets.

For example, with Checkin.com’s localization features, Simple Casino was able to break into the Japanese market. The localized user interface streamlines the process for customers.

Since the software can scan 14,000 different types of documents, it can easily handle Japanese identity documents. Plus, it updates the system with Japanese regulatory requirements, so the casino is always compliant.

7. Watertight data security and privacy

In the last three years, more than half of organizations have experienced a compliance issue. Most often, these compliance issues are due to data privacy/cybersecurity breaches.

There is an increasing emphasis on data security and privacy in the wake of evolving regulations like GDPR and CCPA.

This means you need robust security measures and stringent data privacy controls to prevent non-compliance.

KYC compliance software offers security features like strong encryption, access controls, and data masking.

This minimizes the risk of data breaches that lead to non-compliance.

8. Enhanced reporting and analytics for data-driven decision-making

More than a third of compliance officers say they’re focusing on data analytics to improve compliance this year.

Luckily, KYC software comes with intelligent analytics and reporting driven by AI algorithms.

This helps you spot trends in your compliance processes to improve KYC procedures.

On top of this, automatic customer record updates and report generation make it easier to maintain correct audit trails and produce accurate compliance reports.

How to choose the right KYC compliance software to stay ahead

Cost, ease of use, and operational effectiveness as the top three buying factors that 54% organizations look at when choosing regtech5. But they’re not the only factors to think about.

Prioritize your needs

Know your compliance requirements. Your industry, region, risk appetite, and customer risk levels all dictate the type of KYC compliance software you need.

On top of that, consider your business goals. Are you trying to streamline the customer experience? Are you trying to upgrade your compliance processes? Do you need to improve KYC efficiency?

By considering both your organizational objectives and your compliance requirements, you’ll be able to find software that matches your needs.

Evaluate software features

Analyze the different features of the KYC solutions you’re comparing.

Look for:

- AI/ML capabilities

- Biometric authentication

- Data security and security

- Integration capabilities

These tools significantly improve performance and efficiency and automate the compliance process to reduce the risk of compliance fines.

Consider compliance coverage

Not all KYC software can handle global compliance requirements. Look at the number of different documents it can assess and work out whether this covers the documentation customers have in your regions.

Look for multilingual interfaces and support to improve the customer experience and lower the chance of mistakes during onboarding.

The future of compliance: Intelligent KYC compliance software

In 2025, regulation is evolving so rapidly that compliance can feel overwhelming.

The trends show a clear direction: businesses want fewer compliance headaches. And they’re using intelligent automation to do it.

Businesses need systems that:

- Streamline compliance workflows

- Verify customers with accuracy

- Detect suspicious activity

- Update regulations and threats automatically

Intelligent KYC compliance software helps you scale onboarding and enter new markets without fear of regulatory setbacks.

It simplifies the KYC processes and guarantees compliance by improving accuracy, managing evolving regulations, and cutting fraud risks.

Explore Checkin.com’s cutting-edge KYC compliance solutions today.