Fraudsters are getting more sophisticated, making it harder for organizations to spot forged IDs and identity fraud.

ID document verification helps solve this. It’s fast, accurate, and scalable.

Modern, AI-driven verification tools can capture, authenticate, and verify ID documents without requiring manual checks.

In this guide, we’ll explore what ID document verification is. We’ll look at how it works, why it’s beneficial, and where you can apply it to enhance security and improve customer experiences.

What is document verification and how does it work?

Digital document verification is a core feature in many AI-powered identity verification systems. It does two primary things.

First, it checks the authenticity of identity documents. Algorithms inspect for inconsistencies, signs of tampering, or structural anomalies that suggest fraud.

Second, it extracts data from the ID using optical character recognition (OCR) and other image processing methods, eliminating the need for manual data entry.

It does these two jobs through image recognition and analysis, and optical character recognition (OCR).

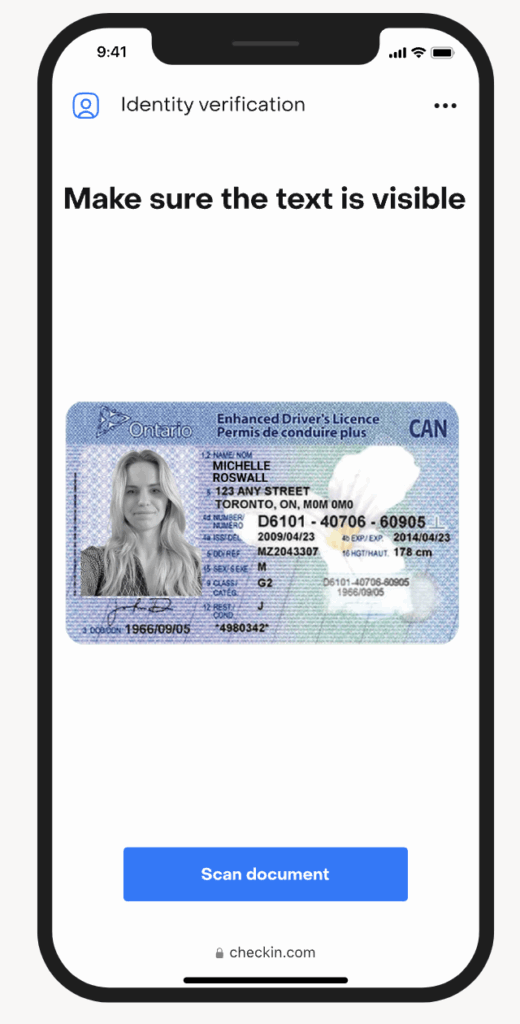

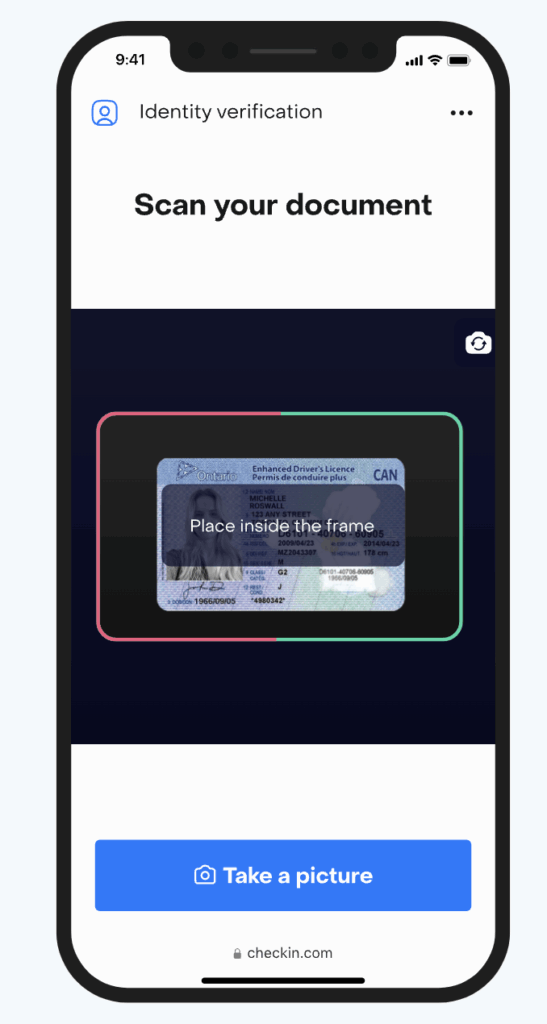

Here’s the step-by-step process:

- Image capture: The user photographs their ID using their device’s camera.

- Image analysis: The system checks if the image is sharp, complete, and usable.

- OCR and data extraction: Text fields (like name, birth date, ID number) are read automatically.

- Forgery detection: The document is analyzed for visual or metadata signs of manipulation.

- Data validation: The extracted data is compared against trusted sources to confirm both the document and the user.

In doing these steps, ID document verification technology offers accurate, scalable verification that protects against fraud while keeping businesses compliant.

Why is ID document verification so important?

Fraud is rising fast.

Almost 50% of financial institutions report increases in fraud attempts, with forged or manipulated ID documents playing a major role.

Enterprises experience, on average, 18 identity fraud cases per year, costing upwards of $280,000.

This is where ID verification solutions win out

Accurate data capture spots tampering and forgery, while self-evolving algorithms update in real time with the latest fraud threats.

The system is always ahead of new fraud tactics, and consistent rules mean subjectivity doesn’t compromise verification.

The benefits of automated ID verification

1. Faster, automated verification

Advanced software automates verification with accurate, typo-free data capture and automated image analysis. It’s fast, and it cuts out transcription mistakes and subjective decision-making.

Take Admirals as an example.

Using Checkin.com’s automated ID verification tools, the financial services company has reduced processing time by 90%.

This results in quicker onboarding and faster fraud identification.

2. Prevents fraud at the source

Fraud is a growing concern for businesses. Robust ID document checks are the first defense against fraud attempts.

This is why 65% of businesses are using digital document verification to tackle the issue.

AI-driven authentication software can spot subtle signs of tampering or forgery in identification cards and other document types. This ensures the authenticity of identification documents, minimizing financial losses and boosting security.

3. Improves user experience

Poor experience is to blame for 50% of customer dropouts during onboarding.

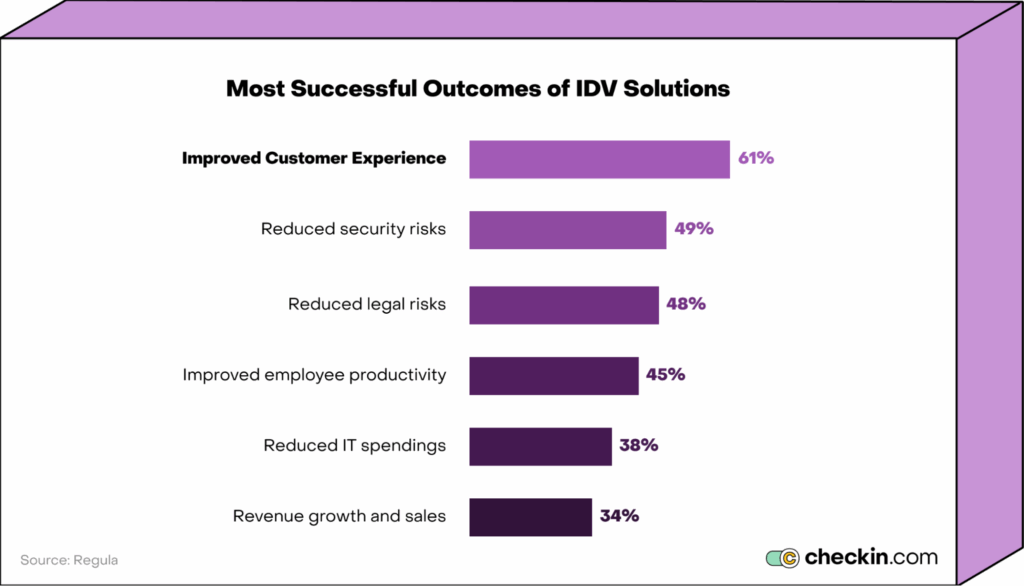

This is why 41% of companies have turned to IDV solutions to improve customer satisfaction, with 61% saying it’s achieved this goal.

Automated document verification offers a smoother, faster experience. It’s user-friendly, convenient, and speedy.

Instead of cumbersome paperwork and long wait times, customers can complete the verification directly from their device in a matter of minutes.

4. Cuts operational costs

It takes lots of agents a great deal of time to manually authenticate and verify documents.

Significant money can be saved by automating this process. In fact, 38% of organizations say ID verification technology has reduced IT spending.

There’s no longer a need for a large workforce and the associated costs of this. Automated document checks offers a scalable solution that processes growing volumes of customers without increasing overheads.

5. It’s scalable

It becomes difficult to manage rising user volumes and transactions if you’re doing this manually or with legacy, disjointed systems.

Busy staff and clunky systems equal mistakes. So you’ll spend lots of time correcting errors, which leads to delays.

ID document verification software scales seamlessly.

It handles increasing verification requests without compromising accuracy. This way, you can onboard more users and grow your operations without sacrificing efficiency, effectiveness, or security.

6. Reduces legal risks

You have to comply with regulatory requirements or you face hefty fines and reputational damage.

This is why organizations need solutions that reduce the legal risks of not following privacy laws, Know Your Customer (KYC)/Anti-Money Laundering (AML) regulations, and changing mandates.

For 2024 and beyond, 48% of organizations say IDV solutions reduce legal risks.

This is because high-quality IDV software has self-evolving algorithms that automatically update their compliance models. As regulations change, the system automatically updates and applies these new rules.

4 use cases of ID scanning in action

There are lots of areas of your business that can benefit from confirming a person’s identity.

Here are some examples.

1. Lightning-fast onboarding

Smart ID document verification is so easy, most customers get through the signup process in minutes.

Imagine if new customers could register by simply scanning a driver’s license and taking a selfie.

Smart data capture features pull out the necessary information without the customer needing to type it manually.

Because it uses facial recognition to cross-reference databases, there’s no need to submit paperwork in person.

It’s quick, convenient, and accurate.

2. Hassle-free financial transactions

Document checks can add an extra layer of security to your transactions.

If you re-verify customers at the point of transaction, you can block fraud attempts.

Let’s say a customer tries to make a bank transfer of more than $10,000. Their banking app would prompt them to scan a government-issued ID.

This helps you confirm that the real account holder is transferring the money.

3. Simplified age verification

If your business offers age-restricted services, you’ll need software with age verification capable of reading and verifying ID documents as well as confirming the actual document holder is present.

This keeps underage users from accessing inappropriate content, services, or goods. It also ensures you stay compliant with age-related regulations.

As an example, let’s look at social media platforms.

Several US states have passed laws about social media age restrictions. To comply with these, social networks need to verify the user’s age at the onboarding stage.

The ID scanner authenticates and verifies the user’s ID so they can open an account.

But, the platform should also re-verify the user’s age as they use the platform.

It could prompt the user for random scans of their face using their webcam or device camera. It would compare this live image to the original onboarding documents to make sure it’s the same person.

The best IDV solutions use age assurance technology to do this.

Facial recognition analyzes the live image and compares it to databases of known age-related features. It estimates the user’s age based on factors like wrinkles, skin texture, and face shape.

It compares this estimated age to the image and data on the original ID.

This catches fake IDs and stops adults from opening accounts for minors.

4. Secure account recovery

If customers lose their account information, ID verification makes it easier for them to log back in without compromising security.

Imagine a user requests a password reset for their online shopping account.

You need to make sure it’s the legitimate account owner or you risk account hijacking.

The system simply prompts the user to scan their government-issued ID, and they regain access immediately.

Can’t decide between ID scanning software? 8 important questions to help you choose

ID scanning software comes in all shapes and sizes. The tool that works for you will match your business needs, budget, and goals.

Here are a few questions to ask to help you find a solution that works for you.

Is it accurate and reliable?

The accuracy of your software matters. Otherwise, you risk false positives and negatives, as well as compliance issues.

Your ID scanner should consistently scan and verify information with very few mistakes.

Look for reviews and independent audits that confirm high success rates and low error rates.

Can it process a wide range of documents?

If you can process a wide range of identity documents, you offer a better user experience. This is especially important if you operate across countries.

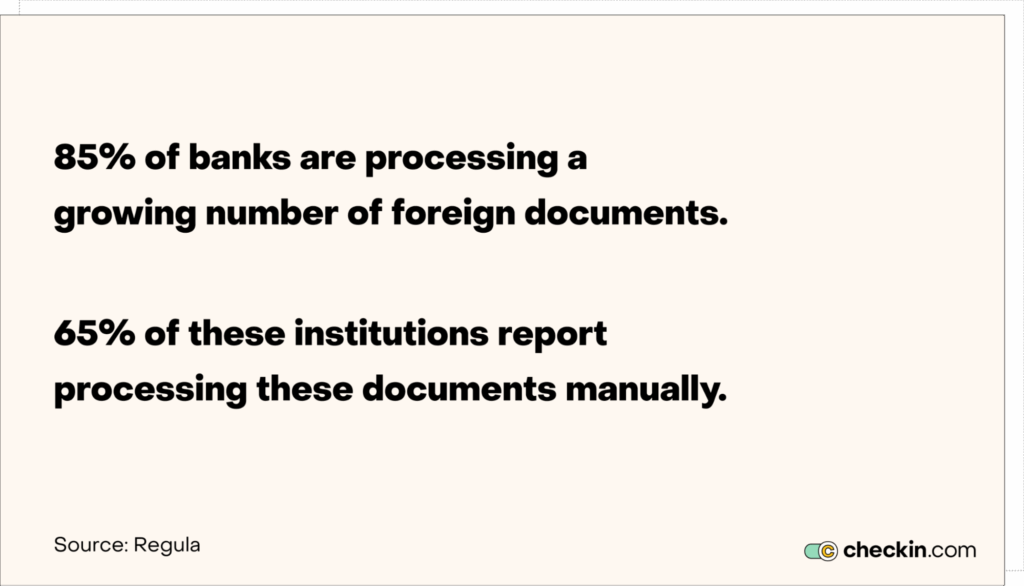

85% of banks say they’re processing a growing number of foreign documents. 62% of them report that they’re still doing this manually.

If you want to scale internationally, look for an ID scanner that can verify documents from the global markets you operate in.

For example, Checkin.com can scan and verify over 15,000 document types from 190+ countries.

How secure is it?

You don’t just need to comply with AML and KYC regulations. You also need to follow relevant data privacy legislation, like the GDPR and CCPA.

Look for tools with strong encryption and secure data storage. Make sure it has transparent data handling practices so customer data is secure in transit and at rest.

Is it user-friendly for diverse customers?

A simple interface with clear instructions makes it easy for customers to use your ID scanner.

Make sure your solution is intuitive and guides your customers through the experience.

Bonus points if it supports various languages. This allows users to access verification in their native language.

Not only does this make it easier for them to use, it also allows you to branch out into new markets.

For example, Checkin.com users can choose from 80+ languages. This allowed Simple Casino to offer onboarding in Japanese, helping it to reach a new audience.

Does it comply with the right regulations?

Non-compliance leads to hefty fines, legal issues, and reputational damage.

Make sure your tool has compliance models that cover all the areas you operate in. It’s no good following US regulations if you’re operating in Dubai.

Equally, look for solutions that update automatically. The best IDV tools use AI algorithms that evolve as regulations change, so you’re always compliant with the latest mandates.

How well does it integrate with your tech stack?

Consider the tools you already use. Will the ID verification integrate easily with your existing systems?

Look for a solution that connects with all relevant existing tools, as well as offering integration support. This way, you’ll have expert help setting up seamless workflows so nothing feels disjointed.

Can you offer a branded experience?

Consider solutions that offer branded experiences during the verification process.

A white-label solution allows you to customize the ID checks with your organization’s branding. This gives the experience a cleaner, more professional feel.

Is there small print in the contract?

Don’t immediately plump for the cheapest option. There might be a catch.

Read the contract carefully to understand whether there are hidden fees or conditions.

Look for:

- Setup fees

- Integration costs

- Lock-up periods

- Support costs

Streamline identity verification with ID scanning

ID scanning brings speed, accuracy, and fraud prevention to the identity verification process.

Not only does this improve the customer experience. It also improves compliance.

But it’s not just a tool for onboarding. Document verification can help in all areas of your business, from age verification to account recovery.

Explore Checkin.com’s solutions to understand how you can enhance your verification processes to secure your business’ future. Contact our experts today to learn more.