Case study: Admirals

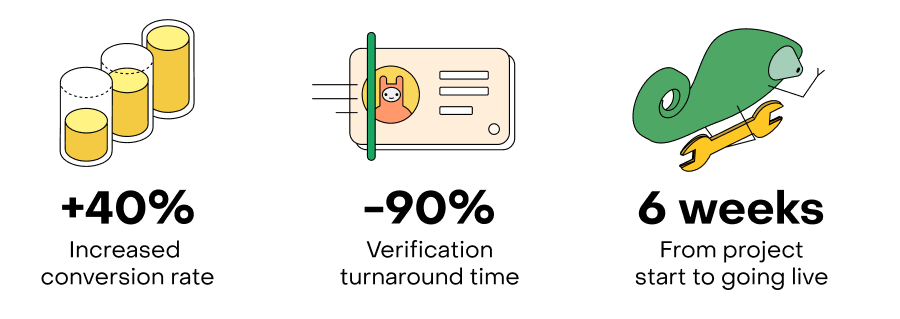

Learn how the leading financial services company has implemented automatic customer identity verification and reduced the registration time down to 6 minutes.

“...While even more important we have been able to open up new countries as a result of our ability to successfully verify clients from countries where previously we did not have such an option.”

– Andreas Ioannou, Head of Global Compliance at Admirals

Case and History

Admirals is the leading provider of financial solutions for the European securities market. The company serves over 30 thousand people a month from more than 130 countries.

The company seeks to ensure the convenience and safety of work for its customers. On the other hand, it is obliged to guarantee reliability and compliance with financial regulators’ requirements.

The customer verification process, using the help of KYC officers, used to take a long time to complete. In many cases, clients had to wait for several days to get the registration results. Also, due to constantly changing regulatory requirements and the company’s global presence, the compliance staff had to be continuously trained. These factors created a weak link in the company’s onboarding process.

Process and Results

Admirals has set itself to automate the customer verification system and find a solution that would be friendly to the end-users yet provide professional customer data checks. The main goal was the speed and quality of data processing and the ability to enter the markets of other countries faster. Checkin.com has helped Admirals to solve this problem efficiently. Thanks to AI and unique technical solutions, the global identity verification process has become much more manageable. In most cases, KYC officer’s participation is no longer required. Moreover, Admirals is now able to attract customers from countries that were previously out of their reach.

The company can see the verification results inside the backoffice dashboard in real-time. The customer’s profile data is divided into more than 20 components that make the results clear and comprehensive. It also enables the compliance team to respond immediately if a violation or an error occurs. All data can be downloaded as a full-fledged report.

It’s important to note that Admirals could easily integrate the Checkin.com solution into its system interface both on the web and mobile applications. As a result, the entire KYC process has become significantly faster and more professional, regardless of the customer’s location, device, or ID document type.

KYC features used

Methods of integration